Rogers 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

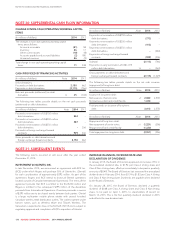

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

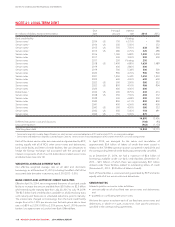

SUBSIDIARIES, ASSOCIATES AND JOINT ARRANGEMENTS

We have the following significant subsidiaries:

• Rogers Communications Partnership

• Rogers Media Inc.

We have 100% ownership interest in these subsidiaries. Our

subsidiaries are incorporated in Canada and have the same reporting

period for annual financial statements reporting.

When necessary, adjustments are made to conform the accounting

policies of the subsidiaries to those of Rogers. There are no significant

restrictions on the ability of subsidiaries, joint arrangements and associates

totransferfundstoRogersascashdividendsortorepayloansor

advances.

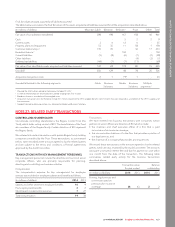

We carried out the following business transactions with our associates

and joint arrangements. Transactions between us and our subsidiaries

have been eliminated on consolidation and are not disclosed in this

note.

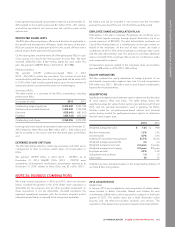

(In millions of dollars) 2014 2013

Revenues 15 3

Purchases 88 83

Sales to and purchases from our associates and joint arrangements are

made at terms equivalent to those that prevail in arm’s length

transactions. Outstanding balances at year-end are unsecured and

interest-free, and settled in cash. The outstanding balances with these

related parties relating to similar business transactions as at

December 31, 2014 was $15 million and included in accounts payable

and accrued liabilities (December 31, 2013 – $14 million payable).

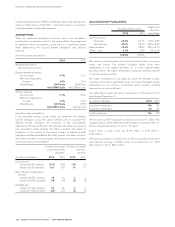

NOTE 28: GUARANTEES

We had the following guarantees as at December 31, 2014 and 2013

as part of our normal course of business:

BUSINESS SALE AND BUSINESS COMBINATION

AGREEMENTS

As part of transactions involving business dispositions, sales of assets

or other business combinations, we may be required to pay

counterparties for costs and losses incurred as a result of breaches of

representations and warranties, intellectual property right

infringement, loss or damages to property, environmental liabilities,

changes in laws and regulations (including tax legislation), litigation

against the counterparties, contingent liabilities of a disposed business

or reassessments of previous tax filings of the corporation that carries

on the business.

SALES OF SERVICES

As part of transactions involving sales of services, we may be required

to make payments to counterparties as a result of breaches of

representations and warranties, changes in laws and regulations

(including tax legislation) or litigation against the counterparties.

PURCHASES AND DEVELOPMENT OF ASSETS

As part of transactions involving purchases and development of assets,

we may be required to pay counterparties for costs and losses incurred

as a result of breaches of representations and warranties, loss or

damages to property, changes in laws and regulations (including tax

legislation) or litigation against the counterparties.

INDEMNIFICATIONS

We indemnify our directors, officers and employees against claims

reasonably incurred and resulting from the performance of their

services to Rogers. We have liability insurance for our directors and

officers and those of our subsidiaries.

We are unable to make a reasonable estimate of the maximum

potential amount we would be required to pay to counterparties. The

amount also depends on the outcome of future events and conditions

which cannot be predicted. No amount has been accrued in the

Consolidated Statements of Financial Position relating to these types of

indemnifications or guarantees as at December 31, 2014 or 2013.

Historically, we have not made any significant payments under these

indemnifications or guarantees.

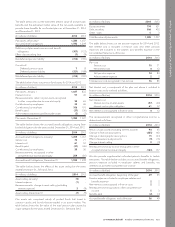

NOTE 29: COMMITMENTS AND CONTINGENT LIABILITIES

COMMITMENTS

The table below shows the future minimum payments under operating leases as at December 31, 2014:

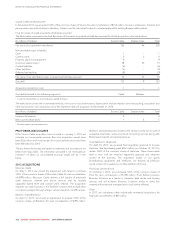

(In millions of dollars)

Less Than

1 Year 1-3 Years 4-5 Years

After

5Years Total

Operating leases 150 221 120 67 558

Player contracts 1132 100 52 5 289

Purchase obligations 21,610 308 140 102 2,160

Program rights 3735 1,178 1,117 3,487 6,517

Total commitments 2,627 1,807 1,429 3,661 9,524

1Player contracts are Blue Jays players’ salary contracts we have entered into and are contractually obligated to pay.

2Purchase obligations are the contractual obligations under service, product and handset contracts that we have committed to for at least the next fiveyears.Purchase

obligations include commitment to purchase 50% joint ownership of Glentel Inc., expected to occur in 2015, subject to regulatory approval and completion of BCE lnc.’s

acquisition of Glentel lnc. (see note 31).

3Program rights are the agreements we have entered into to acquire broadcasting rights for sports broadcasting programs and films for periods ranging from one to twelve

years.

128 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT