Rogers 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

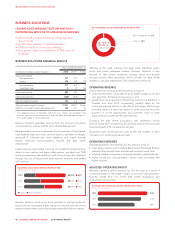

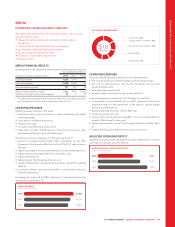

BUSINESS SOLUTIONS

LEADING-EDGE WIRELINE TELECOM AND DATA

NETWORKING SERVICES TO CANADIAN BUSINESSES

• sells to small, medium and large enterprises and

governments

• sells to other carriers on a wholesale basis

• 7,800 on-net fibre connected buildings

• fibre passes close to an additional 23,000 near-net

buildings.

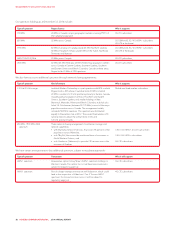

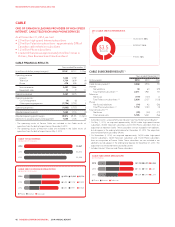

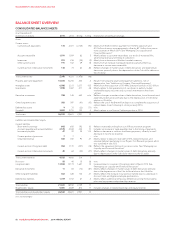

BUSINESS SOLUTIONS FINANCIAL RESULTS

Years ended December 31

(In millions of dollars, except margins) 2014 2013 1%Chg

Operating revenue

Next generation 271 213 27

Legacy 106 149 (29)

Service revenue 377 362 4

Equipment sales 512 (58)

Operating revenue 382 374 2

Operating expenses (260) (268) (3)

Adjusted operating profit 122 106 15

Adjusted operating profit margin 31.9% 28.3% 3.6 pts

Additions to property, plant, and equipment 146 107 36

1The operating results of Blackiron and Pivot Data Centres are included in the

Business Solutions results of operations from the dates of acquisition on April 17,

2013 and October 1, 2013, respectively.

Business Solutions generates revenue from the provision of wireline

communications services and the sales of related equipment.

Next generation revenue is generated by the provision of high-speed,

high-reliability data and voice communications, provided on Rogers’

advanced IP, Ethernet and cloud platforms, and mainly through

Rogers’ extensive communications network and data centre

infrastructure.

Legacy revenue is generated mainly by circuit-switched local and long-

distance voice services and legacy data services, provided over TDM

and prior generation data platforms, with client access often delivered

through the use of leased third-party network elements and tariffed

ILEC services.

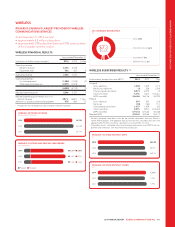

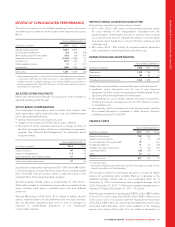

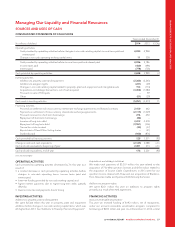

(IN MILLIONS OF DOLLARS)

BUSINESS SOLUTIONS SERVICE REVENUE MIX

2014

2013

2012

$106 $271

$149 $213

$183 $162

Next GenerationLegacy

Business Solutions continues to focus primarily on next generation IP-

based services, leveraging higher margin on-net and near-net service

revenue opportunities, and using existing network facilities to expand

$377

MILLION

(%)

2014 BUSINESS SOLUTIONS SERVICE REVENUE MIX

NEXT GENERATION 72%

LEGACY 28%

offeringstothesmall,mediumandlargesizedenterprise,public

sector and carrier wholesale markets. Business Solutions is also

focused on data centre colocation, hosting, cloud, and disaster

recovery services. Next generation, which includes our data centre

operations, this year represented 72% of total service revenue.

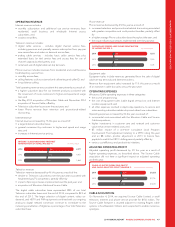

OPERATING REVENUE

Service revenue increased by 4% this year as a result of:

• continuing execution of our plan to grow higher margin on-net and

next generation IP-based services revenue; and

• growth from the acquisitions of Pivot Data Centres and Blackiron in

October and April 2013, respectively; partially offset by the

continued planned decline in the off-net and legacy off-net voice

and data services, a trend we expect to continue as we focus the

business on on-net opportunities and customers move to more

advanced and cost effective IP-based services.

Excluding the data centre acquisitions, next generation service

revenue would have increased by 6% and total service revenue would

have decreased by 9% compared to last year.

Equipment sales decreased this year as the first quarter of 2013

included a non-recurring equipment sale.

OPERATING EXPENSES

Operating expenses decreased by 3% this year as a result of:

• lower legacy service costs including fewer leased third-party facilities

related to the planned lower volumes and customer levels; and

• ongoing initiatives to improve costs and productivity; partially offset by

• higher on-net and next generation service costs associated with

higher volumes.

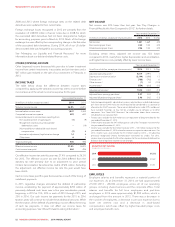

ADJUSTED OPERATING PROFIT

Adjusted operating profit increased by 15% this year as a result of

continued growth in the higher margin on-net and next generation

business mostly from our recent data centre acquisitions and

productivity improvements.

(IN MILLIONS OF DOLLARS)

BUSINESS SOLUTIONS ADJUSTED OPERATING PROFIT

2014

2013

2012

$122

$106

$89

48 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT