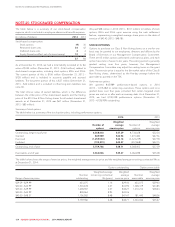

Rogers 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

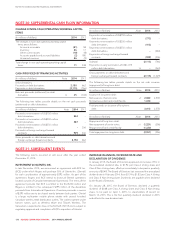

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

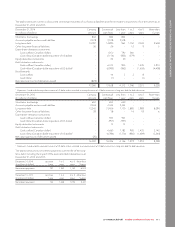

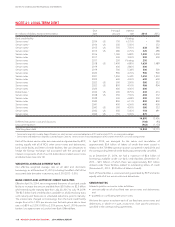

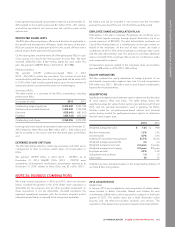

The table below sets out the estimated present value of accrued plan

benefits and the estimated market value of the net assets available to

provide these benefits for our funded plans as at December 31, 2014

and December 31, 2013.

(In millions of dollars) 2014 2013

Plan assets, at fair value 1,285 1,037

Accrued benefit obligations 1,592 1,209

Deficiency of plan assets over accrued benefit

obligations (307) (172)

Effect of asset ceiling limit (7) (9)

Net deferred pension liability (314) (181)

Consists of:

Deferred pension asset 78

Deferred pension liability (321) (189)

Net deferred pension liability (314) (181)

The table below shows our pension fund assets for 2014 and 2013.

(In millions of dollars) 2014 2013

Plan assets, January 1 1,037 833

Interest income 57 40

Remeasurements, return on plan assets recognized

in other comprehensive income and equity 94 65

Contributions by employees 30 26

Contributions by employer 106 101

Benefits paid (37) (26)

Administrative expenses paid from plan assets (2) (2)

Plan assets, December 31 1,285 1,037

The table below shows the accrued benefit obligations arising from

funded obligations for the years ended December 31, 2014 and 2013.

(In millions of dollars) 2014 2013

Accrued benefit obligations, January 1 1,209 1,167

Service cost 70 71

Interest cost 61 52

Benefits paid (37) (26)

Contributions by employees 30 26

Remeasurements, recognized in other

comprehensive income and equity 259 (81)

Accrued benefit obligations, December 31 1,592 1,209

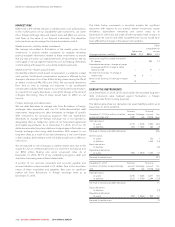

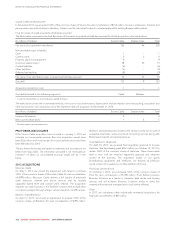

The table below shows the effect of the asset ceiling for the years

ended December 31, 2014 and 2013.

(In millions of dollars) 2014 2013

Asset ceiling, January 1 (9) –

Interest expense (1) –

Remeasurements, change in asset ceiling (excluding

interest expense) 3(9)

Asset ceiling, December 31 (7) (9)

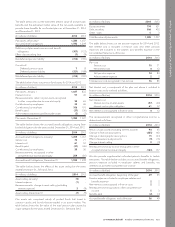

Plan assets are comprised mainly of pooled funds that invest in

common stocks and bonds that are traded in an active market. The

table below shows the fair value of the total pension plan assets by

major category for the years ended December 31, 2014 and 2013.

(In millions of dollars) 2014 2013

Equity securities 774 631

Debt securities 506 403

Other – cash 53

Total fair value of plan assets 1,285 1,037

The table below shows our net pension expense for 2014 and 2013.

Net interest cost is included in finance costs and other pension

expenses are included in the salaries and benefits expense in the

Consolidated Statements of Income.

(In millions of dollars) 2014 2013

Plan cost:

Service cost 70 71

Net interest cost 412

Net pension expense 74 83

Administrative expense 22

Total pension cost recognized in net income 76 85

Net interest cost, a component of the plan cost above is included in

finance costs and is outlined as follows.

(In millions of dollars) 2014 2013

Net interest cost:

Interest income on plan assets (57) (40)

Interest cost on plan obligation 61 52

Netinterestcostrecognizedinfinancecosts 412

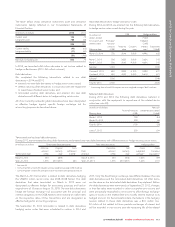

The remeasurement recognized in other comprehensive income, is

determined as follows.

(In millions of dollars) 2014 2013

Return on plan assets (excluding interest income) 94 65

Change in financial assumptions (265) 140

Change in demographic assumptions 15 (43)

Effect of experience adjustments (9) (16)

Change in asset ceiling 2(9)

Remeasurement (loss) income recognized in other

comprehensive income and equity (163) 137

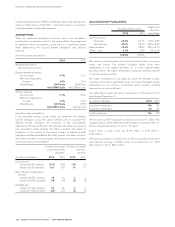

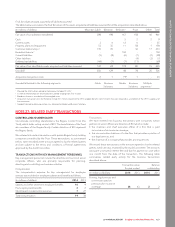

We also provide supplemental unfunded pension benefits to certain

executives. The table below includes our accrued benefit obligations,

pension expense included in employee salaries and benefits, net

interest cost and other comprehensive income.

(In millions of dollars) 2014 2013

Accrued benefit obligation, beginning of the year 49 45

Pension expense included in employee salaries and

benefits expense 22

Netinterestcostrecognizedinfinancecosts 22

Remeasurement recognized in other comprehensive

income 53

Benefits paid (2) (3)

Accrued benefit obligation, end of the year 56 49

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 121