Rogers 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

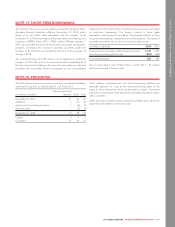

NOTE 25: STOCK-BASED COMPENSATION

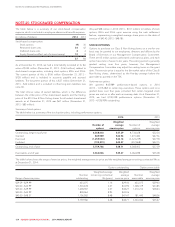

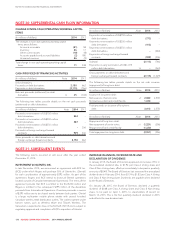

The table below is a summary of our stock-based compensation

expense, which is included in employee salaries and benefits expense:

(In millions of dollars) 2014 2013

Stock-based compensation:

Stock options (9) 30

Restricted share units 34 42

Deferred share units 24

Equity Derivative effect, net of interest receipt 10 8

37 84

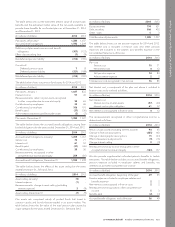

As at December 31, 2014, we had a total liability recorded at its fair

value of $144 million (December 31, 2013 – $164 million), related to

stock-based compensation, including stock options, RSUs and DSUs.

The current portion of this is $106 million (December 31, 2013 –

$128 million) and is included in accounts payable and accrued

liabilities. The long-term portion of this is $37 million (December 31,

2013 – $36 million) and is included in other long-term liabilities (see

note 22).

The total intrinsic value of vested liabilities, which is the difference

between the strike price of the share-based awards and the trading

price of the RCI Class B Non-Voting shares for all vested share-based

awards as at December 31, 2014 was $67 million (December 31,

2013 – $85 million).

We paid $48 million in 2014 (2013 – $101 million) to holders of stock

options, RSUs and DSUs upon exercise using the cash settlement

feature, representing a weighted average share price on the date of

exercise of $43.42 (2013 – $48.18).

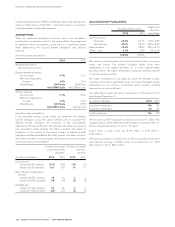

STOCK OPTIONS

Options to purchase our Class B Non-Voting shares on a one-for-one

basis may be granted to our employees, directors and officers by the

Board of Directors or our Management Compensation Committee.

There are 65 million options authorized under various plans, and each

option has a term of seven to ten years. The vesting period is generally

graded vesting over four years, however, the Management

Compensation Committee may adjust the vesting terms on the grant

date. The exercise price is equal to the fair market value of the Class B

Non-Voting shares, determined as the five-day average before the

grant date as quoted on the TSX.

Performance options

We granted 845,989 performance-based options in 2014

(2013 – 1,415,482) to certain key executives. These options vest on a

graded basis over four years provided that certain targeted stock

prices are met on or after each anniversary date. As at December 31,

2014, we had 4,740,308 performance options (December 31,

2013 – 4,728,959) outstanding.

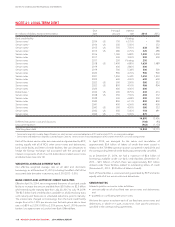

Summary of stock options

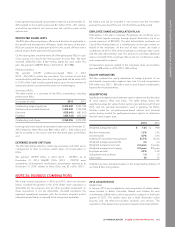

The table below is a summary of the stock option plans, including performance options:

2014 2013

Number of

options

Weighted

average

exercise price

Number of

options

Weighted

average

exercise price

Outstanding, beginning of year 6,368,403 $37.39 8,734,028 $32.34

Granted 845,989 $42.94 1,415,482 $47.56

Exercised (1,259,533) $34.14 (3,323,239) $27.78

Forfeited (195,073) $43.37 (457,868) $42.15

Outstanding, end of year 5,759,786 $38.71 6,368,403 $37.39

Exercisable, end of year 3,363,046 $35.47 4,066,698 $35.08

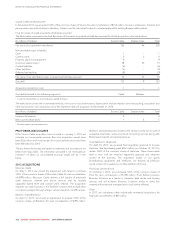

The table below shows the range of exercise prices, the weighted average exercise price and the weighted average remaining contractual life as

at December 31, 2014:

Options outstanding Options exercisable

Range of exercise prices

Number

outstanding

Weighted average

remaining contractual

life (years)

Weighted

average

exercise price

Number

exercisable

Weighted

average

exercise price

$29.39 – $29.99 623,075 1.16 $29.40 623,075 $29.40

$30.00 – $34.99 1,503,278 2.47 $33.90 1,348,319 $33.85

$35.00 – $39.99 1,638,787 2.47 $38.27 1,210,212 $38.43

$40.00 – $44.99 838,064 8.95 $43.06 – –

$45.00 – $48.57 1,156,582 8.48 $47.47 181,440 $48.56

5,759,786 4.48 $38.71 3,363,046 $35.47

124 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT