Rogers 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

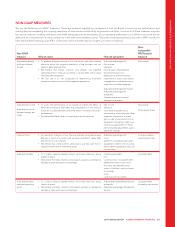

Other Information

ACCOUNTING POLICIES

CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Management makes judgements, estimates and assumptions that

affect how accounting policies are applied and the amounts we report

in assets, liabilities, revenue and expenses and our related disclosure

about contingent assets and liabilities. Significant changes in our

assumptions, including those related to our future business plans and

cash flows, could materially change the amounts we record. Actual

results could be different from these estimates.

These estimates are critical to our business operations and

understanding our results of operations. We may need to use

additional judgement because of the sensitivity of the methods and

assumptions used in determining the asset, liability, revenue and

expense amounts.

ESTIMATES

FAIR VALUE

We use considerable judgement in estimating the fair value of tangible

and intangible assets acquired and liabilities assumed in an acquisition,

using the best available information including information from

financial markets. This may include discounted cash flow analyses

which utilize key assumptions such as discount rates, attrition rates, and

terminal growth rates to estimate future earnings. Actual results may

differ from these estimates.

USEFUL LIVES

We depreciate the cost of property, plant and equipment over their

estimated useful lives by considering industry trends and company-

specific factors, including changing technologies and expectations for

the in-service period of certain assets at the time. We reassess our

estimates of useful lives annually or when circumstances change to

ensure they match the anticipated life of the technology from a

revenue-producing perspective. If technological change happens

more quickly, or in a different way than anticipated, we might have to

reduce the estimated life of property, plant and equipment, which

could result in a higher depreciation expense in future periods or an

impairment charge to write down the value. We will change our

depreciation methods, depreciation rates or asset useful lives if they

are different from our previous estimates. We recognize the effect of

these changes in net income prospectively.

CAPITALIZING DIRECT LABOUR, OVERHEAD AND

INTEREST

Certain direct labour and overhead and interest costs associated with

the acquisition, construction, development or improvement of our

networks are capitalized to property, plant and equipment. The

capitalized amounts are calculated based on estimated costs of

projects that are capital in nature, and are generally based on a

per-hour rate. In addition, interest costs are capitalized during

development and construction of certain property, plant and

equipment. Capitalized amounts increase the cost of the asset and

result in a higher depreciation expense in future periods.

IMPAIRMENT OF ASSETS

Indefinite-life intangible assets (including goodwill and spectrum and/

or broadcast licences) are assessed for impairment on an annual basis

or more often if events or circumstances warrant and definite-life assets

(including property, plant and equipment and other intangible assets)

are assessed for impairment if events or circumstances warrant. The

recoverable amount of a cash generating unit involves significant

estimates of future cash flows, periods of use and applicable discount

rates. The allocation of goodwill to cash generating units (or groups of

cash generating units) involves judgement and is made to cash

generating units (or groups of cash generating units) that are expected

to benefit from the synergies of the business combination from which

the goodwill arose. If key estimates differ unfavourably in the future, we

could experience impairment charges that could decrease net income.

We did not record an impairment charge in 2014 or 2013 since the

recoverable amounts of the cash generating units exceeded their

carrying values.

FINANCIAL INSTRUMENTS

The fair values of our derivatives are recorded using an estimated

credit-adjusted mark-to-market valuation. If the derivatives are in an

asset position (i.e. the counterparty owes Rogers), the credit spread for

the bank counterparty is added to the risk-free discount rate to

determine the estimated credit-adjusted value. If the derivatives are in

a liability position (i.e. Rogers owes the counterparty), our credit spread

is added to the risk-free discount rate. The estimated credit-adjusted

value of derivatives is affected by changes in credit spreads between

us and our counterparties.

For all derivative instruments where hedge accounting is applied, we

are required to ensure that the hedging relationships meet hedge

effectiveness criteria both retrospectively and prospectively. Hedge

effectiveness testing requires the use of both judgements and

estimates.

PENSION BENEFITS

When we account for defined benefit pension plans, assumptions are

made in determining the valuation of benefit obligations. Assumptions

and estimates include the discount rate, the rate of increase in

compensation and the mortality rate. Changes to these primary

assumptions and estimates would affect the pension expense, pension

asset and liability and other comprehensive income. Changes in

economic conditions including financial markets and interest rates may

also have an impact on our pension plan because there is no assurance

that the plan will be able to earn the assumed rate of return. Market-

driven changes may also result in changes in the discount rates and

other variables that would require us to make contributions in the

future that differ significantly from the current contributions and

assumptions incorporated into the actuarial valuation process.

78 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT