Rogers 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

of $842 million was outstanding under the program, which was

committed to fund up to a maximum of $900 million as at

December 31, 2014. Effective January 1, 2015, the amended terms of

the accounts receivable securitization program increased the

maximum potential proceeds under the program to $1.05 billion and

extended the term of the program to January 1, 2018.

We continue to service and retain substantially all of the risks and

rewards relating to the accounts receivables we sold, and therefore,

the receivables remain recognized on our consolidated statements of

financial position and the funding received is recorded as short-term

borrowings. The buyer’s interest in these trade receivables ranks ahead

of our interest. The program restricts us from using the receivables as

collateral for any other purpose. The buyer of our trade receivables has

no claim on any of our other assets.

Senior note issuances

On March 10, 2014, we issued $1.25 billion and US$750 million ($832

million) of senior notes for total net proceeds of approximately $2.1

billion after deducting the original issue discount, agents’ fees and

other related expenses. See “Financial Risk Management” for related

hedging information. The notes issued consisted of the following:

• $250 million floating rate senior notes due 2017;

• $400 million 2.8% senior notes due 2019;

• $600 million 4.0% senior notes due 2024; and

• US$750 million 5.0% notes due 2044.

The $1.25 billion of senior notes issued was pursuant to a public

offering in Canada and US$750 million of senior notes issued was

pursuant to a separate public offering in the US.

On March 7, 2013 we issued US$1 billion of senior notes for total net

proceeds of approximately US$985 million ($1,015 million). The notes

issued consisted of the following:

• US$500 million of 3.0% senior notes due in 2023; and

• US$500 million of 4.5% senior notes due in 2043.

On October 2, 2013, we issued US$1.5 billion of senior notes for total

net proceeds of approximately US$1,481 million ($1,528 million). The

notes issued consisted of the following:

• US$850 million of 4.1% senior notes due in 2023; and

• US$650 million of 5.45% senior notes due in 2043.

All the notes issued are unsecured and guaranteed by RCP, ranking

equally with all of our other senior unsecured notes and debentures,

bank credit and letter of credit facilities.

Debt payments and related derivative settlements

During 2014, we:

• repaid or repurchased US$750 million ($834 million) 6.375% senior

notes due 2014 and US$350 million ($387 million) 5.50% senior

notes due 2014; and

• terminated the related US$1.1 billion of debt derivatives at maturity.

During 2013, we:

• repaid or repurchased all of the US$350 million ($356 million) 6.25%

senior notes due in June 2013 and terminated the related US$350

million debt derivatives at maturity; and

• paid $263 million to terminate US$1,075 million of debt derivatives.

At the same time, we entered into new debt derivatives with a

notional principal of US$1,075 million,withthesametermsasthose

terminated simultaneously, with the exception of the fixed Canadian

notional principal.

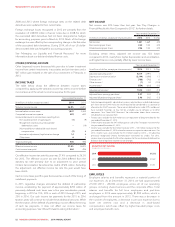

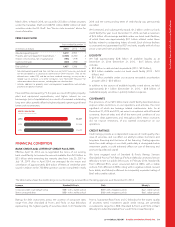

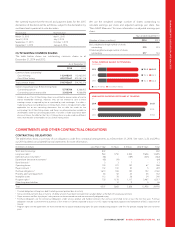

Weighted average cost of borrowings

Our borrowings had a weighted average cost of 5.20% as at

December 31, 2014 (December 31, 2013 – 5.54%) and a weighted

average term to maturity of 10.8 years (December 31, 2013 – 10.3

years). This comparative favourable decline in our 2014 weighted

average interest rate and increased weighted average term to maturity

reflects the combined effects of:

• utilization of our securitization program;

• the public debt issuances completed in March and October 2013

and March 2014, at historically low interest rates for Rogers and

long-term maturities ranging up to 30 years; and

• the scheduled repayments and repurchases of relatively more

expensive debt made in June 2013 and March 2014.

(%)

WEIGHTED AVERAGE COST OF BORROWINGS

2014

2013

2012

5.2%

5.5%

6.1%

RATIO OF ADJUSTED NET DEBT TO ADJUSTED OPERATING PROFIT

2014

2013

2012

2.9

2.4

2.3

Normal course issuer bid share purchases

In February 2014, we renewed our normal course issuer bid (NCIB) for

our Class B Non-Voting shares for another year. The 2014 NCIB gave

us the right to buy up to an aggregate $500 million or 35,780,234

Class B Non-Voting shares of RCI, whichever is less, at any time

between February 25, 2014 and February 24, 2015. We did not

purchase any shares for cancellation in 2014 and we do not currently

intend to renew our NCIB beyond the February 24, 2015 expiry.

In 2013, 546,674 Class B Non-Voting shares were purchased through

the facilities of the TSX for cancellation under the NCIB for a purchase

price of $22 million.

Dividends

In 2014, we declared and paid dividends on each of our outstanding

Class A Voting and Class B Non-Voting shares. We paid $930 million in

cash dividends, an increase of $54 million from 2013. See “Dividend

and Share Information”.

Shelf prospectuses

We have two shelf prospectuses that qualify the offering of debt

securities from time to time. One shelf prospectus qualifies the public

offering of up to $4 billion of our debt securities in each of the

provinces of Canada (Canadian Shelf) and the other shelf prospectus

(together with a corresponding registration statement filed with the US

Securities and Exchange Commission) qualifies the public offering of

up to US$4 billion of our debt securities in the United States and

Ontario (US Shelf). Both the Canadian Shelf and the US Shelf expire in

58 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT