Rogers 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

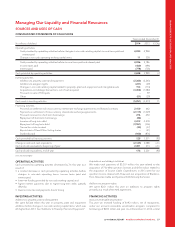

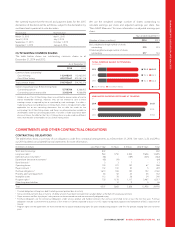

As outlined in the table below, the total cost to Rogers of these payments in 2014 was approximately $1,140 million.

(In millions of dollars)

Income

taxes

Non-recoverable

sales taxes Payroll taxes

Regulatory and

spectrum fees 1

Property and

business taxes

Total taxes and

other payments

Total payments 460 8 132 496 44 1,140

1Includes an allocation of $264.5 million relating to the $1.0 billion and $3.3 billion we paid for the acquisition of spectrum licences in 2008 and 2014, respectively.

We also collected on behalf of the government approximately $1,667

million in sales taxes on our products and services and $545 million in

employee payroll taxes.

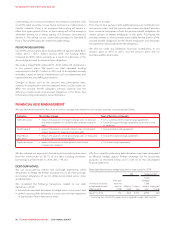

RISK MANAGEMENT

We are committed to continually strengthening our risk management

capabilities to protect and enhance shareholder value. The purpose of

risk management is not to eliminate risk but to optimize trade-offs

between risk and return to maximize value to the organization.

RISK GOVERNANCE

The Board has overall responsibility for risk governance and oversees

management in identifying the principal risks we face in our business

and implementing appropriate risk assessment processes to manage

these risks. It delegates certain risk oversight and management duties

to the Audit Committee.

The Audit Committee discusses risk policies with management and the

Board, and assists the Board in overseeing our compliance with legal

and regulatory requirements.

The Audit Committee also reviews:

• the adequacy of the internal controls that have been adopted to

safeguardassetsfromlossandunauthorized use, to prevent, deter

and detect fraud and to ensure the accuracy of the financial records;

• the processes for identifying, assessing and managing risks;

• our exposure to major risks and trends and management’s

implementation of risk policies and actions to monitor and control

these exposures;

• our business continuity and disaster recovery plans;

• any special audit steps adopted due to material weaknesses or

significant deficiencies that may be identified; and

• other risk management matters from time to time as determined by

the Audit Committee or directed by the Board.

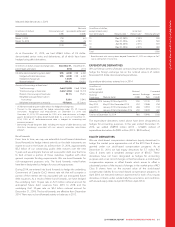

ENTERPRISE RISK MANAGEMENT

Our Enterprise Risk Management program uses the “3 Lines of

Defence” framework to identify, assess, manage, monitor and

communicate risks. The Executive Leadership Team with its associated

business units and departments is the first line of defence. The

Executive Leadership Team with the business units and departments

identify and assess key risks and define controls and action plans to

minimize these risks to enhance our ability to meet our business

objectives. This group owns the risks. Management within the business

units and departments is responsible for maintaining effective controls

on a day-to-day basis to reduce risks to an acceptable level.

Enterprise Risk Management is the second line of defence. As part of

their role, Enterprise Risk Management supports the Executive

Leadership Team to identify the organization’s risk appetite, identify

emerging risks, and monitor the adequacy and effectiveness of the

controls to reduce risks to an acceptable level. At the business unit

level, Enterprise Risk Management works with the business to provide

governance and oversight in managing the key risks and associated

controls to mitigate these risks.

Enterprise Risk Management carries out an annual strategic risk

assessment to identify our principal risks and their potential impact on

our ability to achieve our business objectives. This assessment includes

reviewing risk reports, audit reports and industry benchmarks, and

interviewing key risk owners. Enterprise Risk Management reports the

results of the annual strategic risk assessment to the Executive

Leadership Team and the Audit Committee. Enterprise Risk

Management also conducts a formal management survey every two

years to get management feedback on the key risks facing the

organization and identify emerging risks. These risks are prioritized

using standard risk assessment criteria.

Internal Audit is the third line of defence. Internal Audit evaluates the

design and operational effectiveness of the governance program,

internal controls and Risk management. Risks, controls and mitigation

plans identified through this process are incorporated into the annual

Internal Audit plan. Annually, Internal Audit also facilitates and monitors

management’s completion of the financial fraud risk assessment to

identify areas of potential fraud in our financial statements and to

ensure these controls are designed and operating effectively.

The Executive Leadership Team and the Audit Committee are

responsible for approving our enterprise risk policies. Our Enterprise

Risk Management methodology and policies rely on the expertise of

our management and employees to identify risks and opportunities,

and implement risk mitigation strategies as required.

RISKS AND UNCERTAINTIES AFFECTING OUR

BUSINESS

This section describes the principal risks and uncertainties that could

have a material adverse effect on our business and financial results.

Any discussion about risks should be read in conjunction with “About

Forward-Looking Information”.

GENERAL RISKS

ECONOMIC CONDITIONS

Our businesses are affected by general economic conditions and

consumer confidence and spending. Recessions, declines in economic

activity and economic uncertainty can erode consumer and business

confidence and reduce discretionary spending. Any of these factors

can negatively affect us through reduced advertising, lower demand

for our products and services, decreased revenue and profitability, and

higher churn and bad debt expense. A significant portion of our

broadcasting, publishing and digital revenues come from the sale of

advertising.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 67