Rogers 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

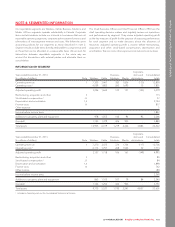

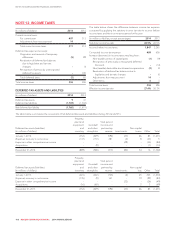

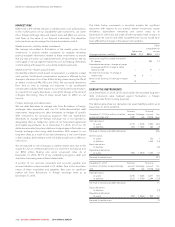

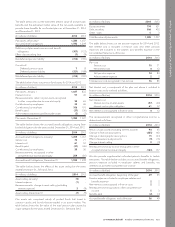

The table below shows derivative instruments asset and derivative

instruments liability reflected in our Consolidated Statements of

Financial Position.

(In millions of dollars) 2014 2013

Current asset 136 73

Long-term asset 788 148

924 221

Current liability (40) (63)

Long-term liability (11) (83)

(51) (146)

Net mark-to-market asset 873 75

In 2014, we recorded a $2 million decrease to net income related to

hedge ineffectiveness (2013 – $4 million increase).

Debt derivatives

We completed the following transactions related to our debt

derivatives in 2014 and 2013:

• entered into new debt derivatives to hedge senior notes issued;

• settled maturing debt derivatives in conjunction with the repayment

or repurchase of related senior notes; and

• terminated existing debt derivatives and entered into new debt

derivatives with different terms to hedge existing senior notes.

All of our currently outstanding debt derivatives have been designated

as effective hedges against specific foreign exchange risk for

accounting purposes as described above.

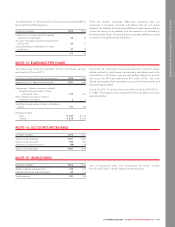

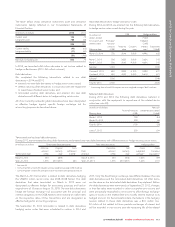

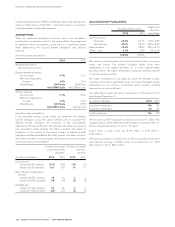

New debt derivatives to hedge new senior notes

During 2014 and 2013, we entered into the following debt derivatives

to hedge senior notes issued during the year.

(In millions of

dollars, except

for coupon and

interest rates)

Effective date

US$ Hedging effect

Principal/

notional

amount

(US$)

Maturity

date

Coupon

rate

Fixed

hedged

Cdn$

interest

rate 1

Equivalent

(Cdn$)

March 10, 2014 750 2044 5.00% 4.99% 832

March 7, 2013 500 2023 3.00% 3.62% 515

March 7, 2013 500 2043 4.50% 4.60% 515

Subtotal 1,000 1,030

October 2, 2013 850 2023 4.10% 4.59% 877

October 2, 2013 650 2043 5.45% 5.61% 671

Subtotal 1,500 1,548

Total for 2013 2,500 2,578

1Converting from a fixed US$ coupon rate to a weighted average Cdn$ fixed rate.

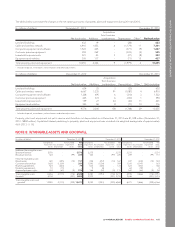

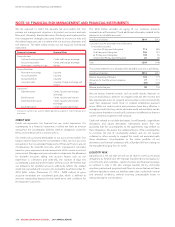

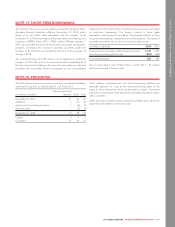

Matured debt derivatives

During 2014 and 2013, the following debt derivatives matured in

conjunction with the repayment or repurchase of the related senior

notes (see note 30).

(In millions of dollars)

Maturity date

Notional Amount

(US$)

Net cash

settlement (proceeds)

(Cdn$)

March 1, 2014 750 (61)

March 15, 2014 350 26

Total for 2014 1,100 (35)

June 17, 2013 350 104

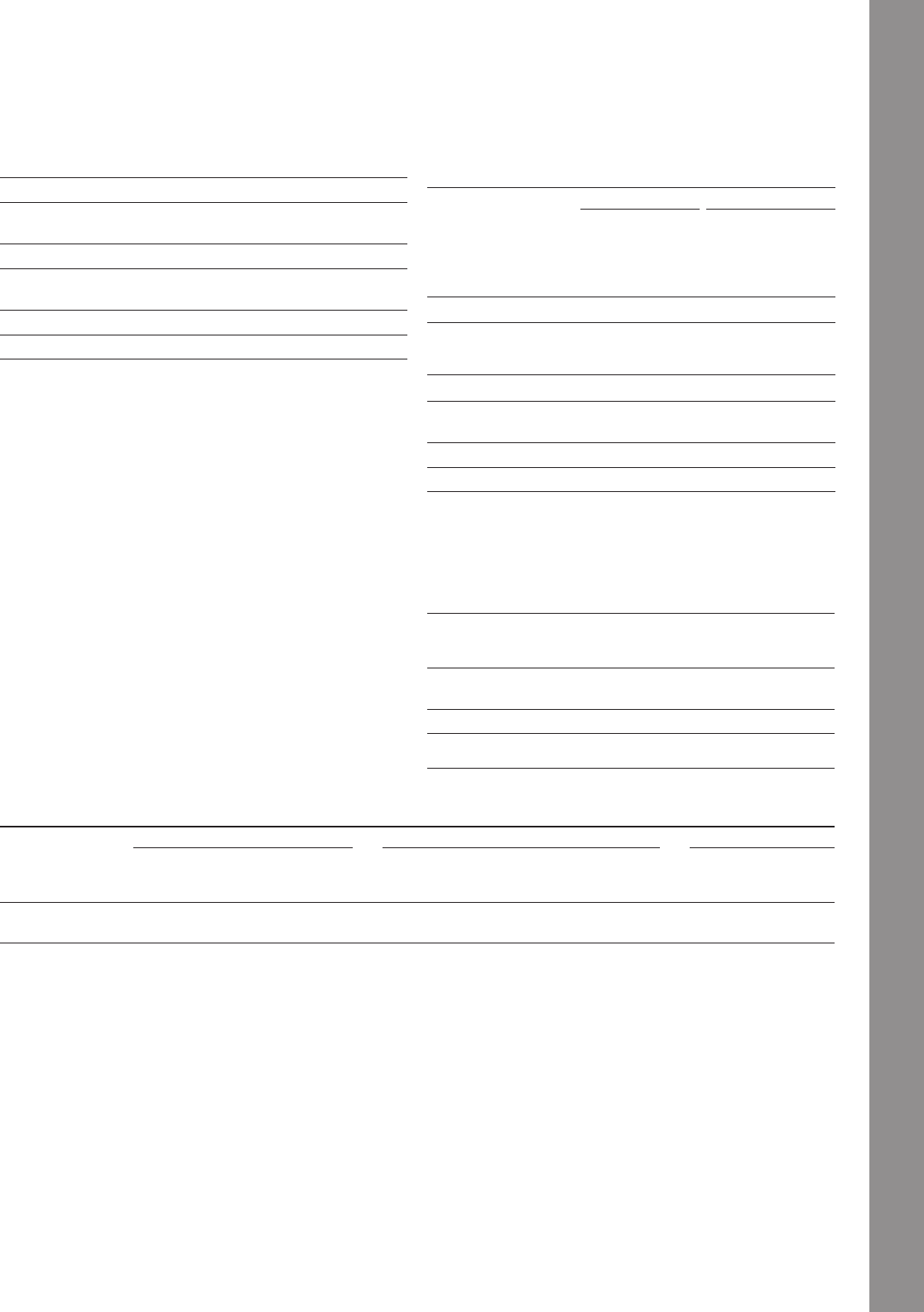

Terminated and replaced debt derivatives

During 2013, we terminated existing debt derivatives and entered into new debt derivatives with different terms to hedge existing senior notes.

(In millions of dollars) Terminated debt derivatives New debt derivatives Hedging effect

Termination date

Notional

amount

(US$)

Original

maturity

date

Cash

settlement

(Cdn$) 1

Date

entered

Derivative

amount

(US$)

Net

maturity

date

Fixed

weighted

average 2

Fixed

Canadian

equivalent 3

March 6, 2013 350 2018 – March 6, 2013 350 2038 7.62% 359

Sept. 27, 2013 1,075 2014-2015 263 Sept. 27, 2013 1,075 2014-2015 7.42% 1,110

1Seenote30

2Converting from a fixed US$ coupon rate to a weighted average Cdn$ fixed rate

3Converting from a fixed US$ principal amount to a fixed Cdn$ principal amount.

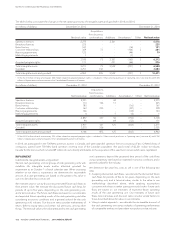

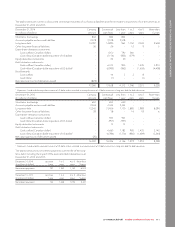

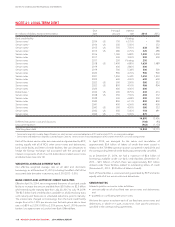

The March 6, 2013 termination is related to debt derivatives hedging

the US$350 million senior notes due 2038 (2038 Notes). The debt

derivatives that were terminated on March 6, 2013 were not

designated as effective hedges for accounting purposes and had an

original term of 10 years to August 15, 2018. The new debt derivatives

hedge the foreign exchange risk associated with the principal and

interest obligations on the 2038 Notes to their maturity at market rates

ontherespectivedatesofthetransactionsandaredesignatedas

effective hedges for accounting purposes.

The September 27, 2013 termination is related to debt derivatives

hedging senior notes that were scheduled to mature in 2014 and

2015. Only the fixed foreign exchange rate differed between the new

debt derivatives and the terminated debt derivatives. All other terms

are the same as the terminated debt derivatives they replaced. Before

the debt derivatives were terminated on September 27, 2013, changes

in their fair value were recorded in other comprehensive income and

were periodically reclassified to net income to offset foreign exchange

gains or losses on the related debt or to modify interest expense to its

hedged amount. On the termination date, the balance in the hedging

reserve related to these debt derivatives was a $10 million loss.

$1 million of this related to future periodic exchanges of interest and

will be recorded in net income over the remaining life of the related

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 113