Rogers 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

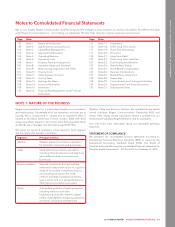

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Multiple deliverable arrangements

We offer some products and services as part of multiple deliverable

arrangements. We record these as follows:

• Divide the products and services into separate units of accounting,

as long as the delivered elements have stand-alone value to

customers and we can determine the fair value of any undelivered

elements objectively and reliably; then

• Measure and allocate the arrangement consideration among the

accounting units based on their relative fair values and recognize

revenue when the relevant criteria are met for each unit.

• When an amount allocated to a delivered item is contingent upon

the delivery of additional items or meeting specified performance

conditions, the amount allocated to the delivered item is limited to

the non-contingent amount.

Unearned revenue

We record payments we receive in advance of providing goods and

services as unearned revenue. Advance payments include subscriber

deposits, cable installation fees and amounts subscribers pay for

services and subscriptions that will be provided in future periods.

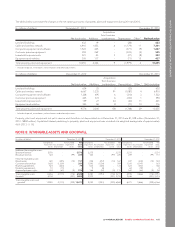

PROPERTY, PLANT AND EQUIPMENT

Depreciation

We depreciate property, plant and equipment over its estimated

useful life by charging depreciation expense to the Consolidated

Statements of Income as follows:

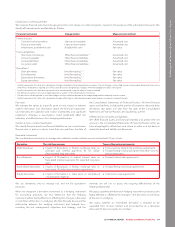

Asset Basis

Estimated

useful life

Buildings Diminishing balance 5 to 40 years

Cable and wireless network Straight-line 3 to 30 years

Computer equipment and

software Straight-line 4 to 10 years

Customer premise

equipment Straight-line 3 to 5 years

Leasehold improvements Straight-line Over shorter of

estimated useful

life or lease term

Equipment and vehicles Diminishing balance 3 to 20 years

Components of an item of property, plant and equipment may have

different useful lives. We make significant estimates when determining

depreciation methods, depreciation rates and asset useful lives, which

requires taking into account company-specific factors and industry

trends. We monitor and review our depreciation methods,

depreciation rates and asset useful lives at least once a year and

change them if they are different from our previous estimates. We

recognize the effect of changes in estimates in net income

prospectively.

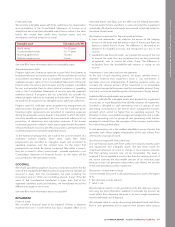

Recognition and measurement

We measure property, plant and equipment upon initial recognition at

cost, and record amortization when the asset is ready for its intended

use. Upon commencement of depreciation, the asset is carried at cost

less accumulated depreciation and accumulated impairment losses.

Cost includes expenditures that are directly attributable to the

acquisition of the asset. The cost of self-constructed assets also

includes:

• the cost of materials and direct labour;

• costs directly associated with bringing the assets to a working

condition for their intended use;

• costs of dismantling and removing the items and restoring the site

where they are located (see Provisions, below); and

• borrowing costs on qualifying assets.

We use estimates to determine certain costs that are directly

attributable to self-constructed assets. These estimates primarily

include certain internal and external direct labour associated with the

acquisition, construction, development or betterment of our network.

They also include interest costs, which we capitalize to certain property,

plant and equipment during construction and development.

We use significant estimates to determine the estimated useful lives of

property, plant and equipment, considering industry trends such as

technological advancements, our past experience, our expected use

and our review of asset lives.

We incur costs related to subscriber acquisition and retention.

• We capitalize cable installation costs that relate to the cable network

and depreciate them over the expected life of the cable customer.

• We defer direct incremental installation costs related to reconnect

cable customers and amortize them as the related reconnect

installation revenues are recorded.

• We expense all other costs as incurred.

We calculate gains and losses on the disposal of property, plant and

equipment by comparing the proceeds from the disposal with the

item’s carrying amount, and recognize the gain or loss in other income

in the Consolidated Statements of Income.

We capitalize development expenditures if they meet the criteria for

recognition as an asset, and amortize them over their expected useful

lives once they are available for use. We expense research

expenditures and maintenance and training costs as incurred.

See note 7 for more information about our property, plant and

equipment.

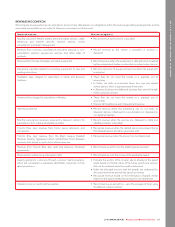

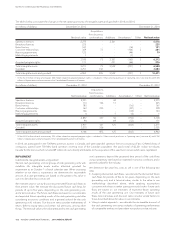

INTANGIBLE ASSETS

Amortization

We measure intangible assets that we acquire in business

combinations at fair value upon initial recognition and record

amortization when the asset is ready for its intended use. Upon the

commencement of amortization, the asset is carried at cost less

accumulated amortization and impairment losses. Intangible assets are

tested for impairment as required (see Impairment,below).

Indefinite useful lives

We do not amortize intangible assets with indefinite lives (spectrum

and broadcast licences) because there is no foreseeable limit to the

period that these assets are expected to generate net cash inflows for

us. We use judgement to determine the indefinite life of these assets,

analyzing all relevant factors, including the expected usage of the

asset, the typical life cycle of the asset and anticipated changes in the

market demand for the products and services that the asset helps

generate. After review of the competitive, legal, regulatory and other

factors, it is our view that these factors do not limit the useful lives of

our spectrum and broadcast licences.

96 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT