Rogers 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OPERATING REVENUE

Internet revenue includes:

• monthly subscription and additional use service revenues from

residential, small business and wholesale Internet access

subscribers; and

• modem rental fees.

Television revenue includes:

• digital cable services – includes digital channel service fees,

including premium and specialty service subscription fees, pay per

view service fees and video on demand service fees;

• analog cable services – includes basic cable service fees plus

extended basic (or tier) service fees and access fees for use of

channel capacity by third parties; and

• rental and sale of digital cable set-top terminals.

Phone revenue includes revenues from residential and small business

local telephony service from:

• monthly service fees;

• calling features such as voicemail and call waiting and caller ID; and

• long-distance calling.

Total operating revenue was consistent this year primarily as a result of:

• a higher subscriber base for our Internet products combined with

the movement of more customers to higher-end speed and usage

tiers; and

• the May 2013 acquisition of Mountain Cable and November 2014

acquisition of Source Cable; offset by

• Television subscriber losses over the past year; and

• lower Phone revenue from retention and promotional-related

discounting.

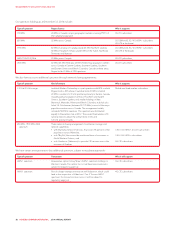

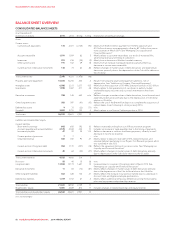

Internet revenue

Internet revenue increased by 7% this year as a result of:

• a larger Internet subscriber base;

• general movement by customers to higher-end speed and usage

tiers; and

• increases in Internet service pricing.

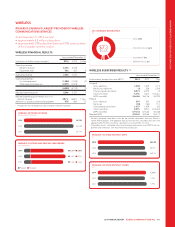

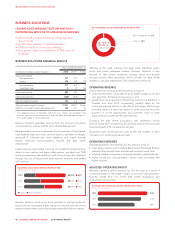

2014

2013

2012

2,011

1,961

1,864

49%

49%

49%

(IN THOUSANDS)

INTERNET SUBSCRIBERS AND INTERNET

PENETRATION OF HOMES PASSED %

Television revenue

Television revenue decreased by 4% this year as a result of the:

• decline in Television subscribers over the past year associated with

heightened pay TV competition; partially offset by

• impact of pricing increases implemented over the past year; and

• acquisitions of Mountain Cable and Source Cable.

The digital cable subscriber base represented 88% of our total

Television subscriber base as at the end of 2014, compared to 84% at

the end of 2013. The larger selection of digital content, video on-

demand, and HDTV and PVR equipment combined with our ongoing

analog to digital network conversion continue to contribute to the

increasing penetration of digital as a percentage of our total Television

subscriber base.

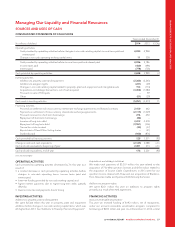

Phone revenue

Phone revenue decreased by 4% this year as a result of:

• increased retention and promotional-related discounting associated

with greater competition and multi-product bundles; partially offset

by

• a higher average Phone subscriber base throughout the year; and

• the impact of pricing increases implemented over the past year.

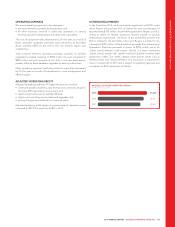

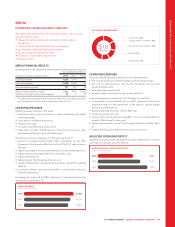

2014

2013

2012

1,150

1,153

1,074

28%

29%

28%

(IN THOUSANDS)

PHONE SUBSCRIBERS AND PHONE PENETRATION

OF HOMES PASSED %

Equipment sales

Equipment sales include revenues generated from the sale of digital

cable set-top terminals and Internet modems.

Revenuefromequipmentsalesincreasedby11%thisyearasaresult

of an increase in cable box sales versus the prior year.

OPERATING EXPENSES

We assess Cable operating expenses in three categories:

• the cost of programming;

• the cost of equipment sales (cable digital set-top box and Internet

modem equipment); and

• all other expenses involved in day-to-day operations, to service and

retain existing subscriber relationships and attract new subscribers.

Operating expenses increased by 3% this year as a result of:

• incremental costs associated with the Mountain Cable and Source

Cable acquisitions;

• higher investments in customer careandnetworkandcustomer

value enhancement related costs; and

• $5 million impact of a one-time cumulative Local Program

Improvement Fund adjustment relating to a CRTC ruling this year

and an $8 million positive adjustment in 2013 to licence fees

payable to match the CRTC’s billing period; partially offset by

• various cost efficiency and productivity initiatives.

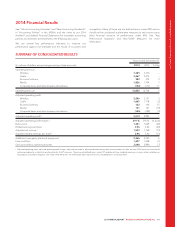

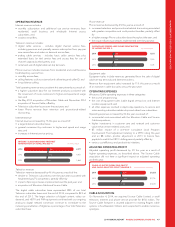

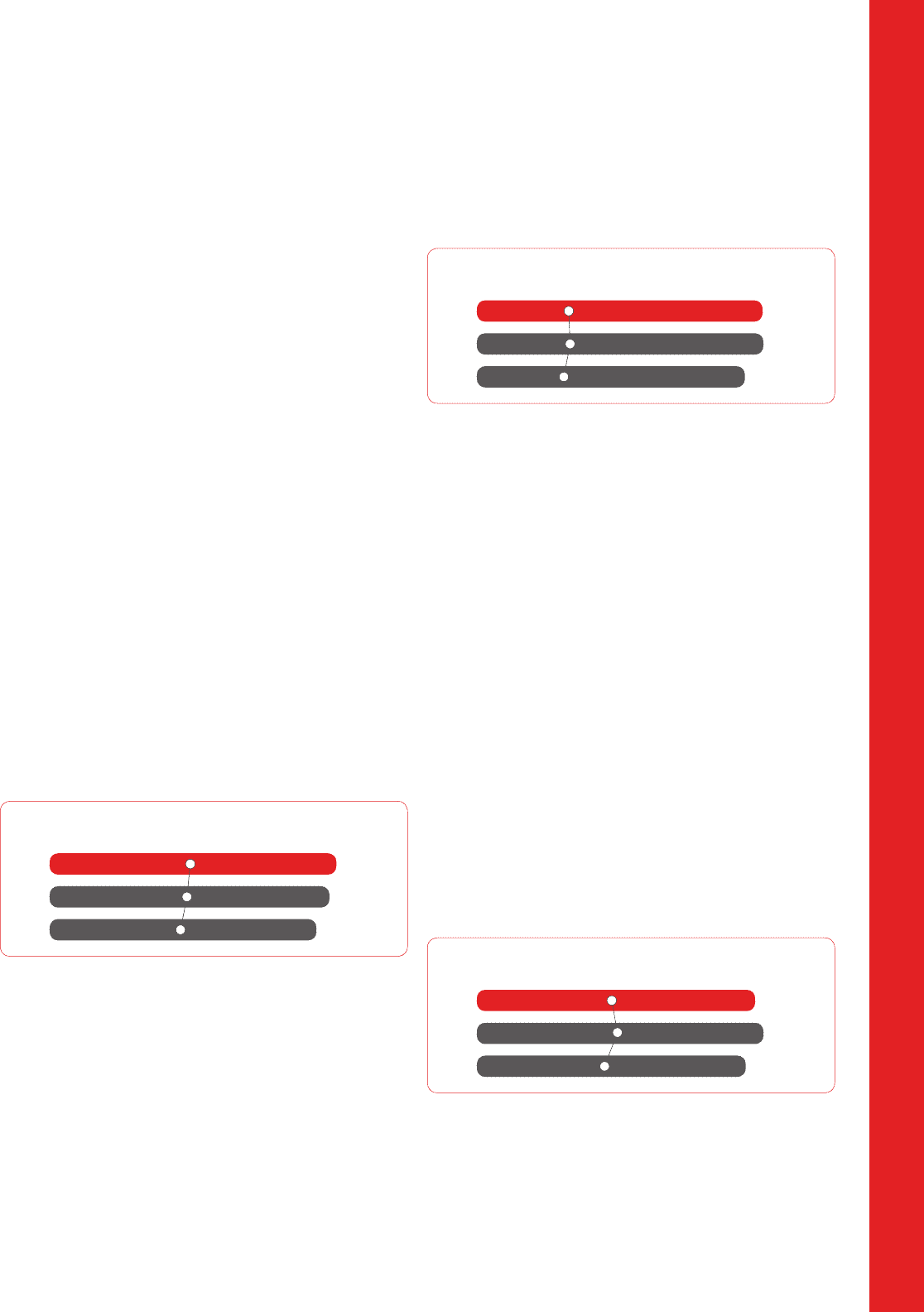

ADJUSTED OPERATING PROFIT

Adjusted operating profit decreased by 3% this year as a result of

higher operating expenses, as described above. The Source Cable

acquisition did not have a significant impact on adjusted operating

profit this year.

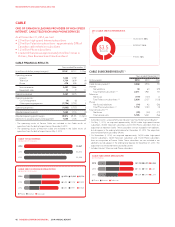

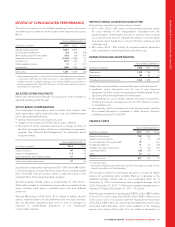

(IN MILLIONS OF DOLLARS)

CABLE ADJUSTED OPERATING PROFIT

AND CABLE ADJUSTED PROFIT MARGIN %

2014

2013

2012

$1,665

$1,718

$1,605

48.0%

49.4%

47.8%

CABLE ACQUISITION

On November 4, 2014, we acquired Source Cable Limited, a small

television, Internet, and phone service provider for $156 million. The

Source Cable footprint is situated adjacent to existing Rogers cable

systems in Southwestern Ontario and is expected to enable numerous

synergies.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 47