Rogers 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

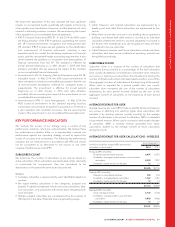

MANAGEMENT’S DISCUSSION AND ANALYSIS

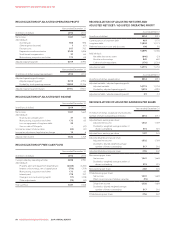

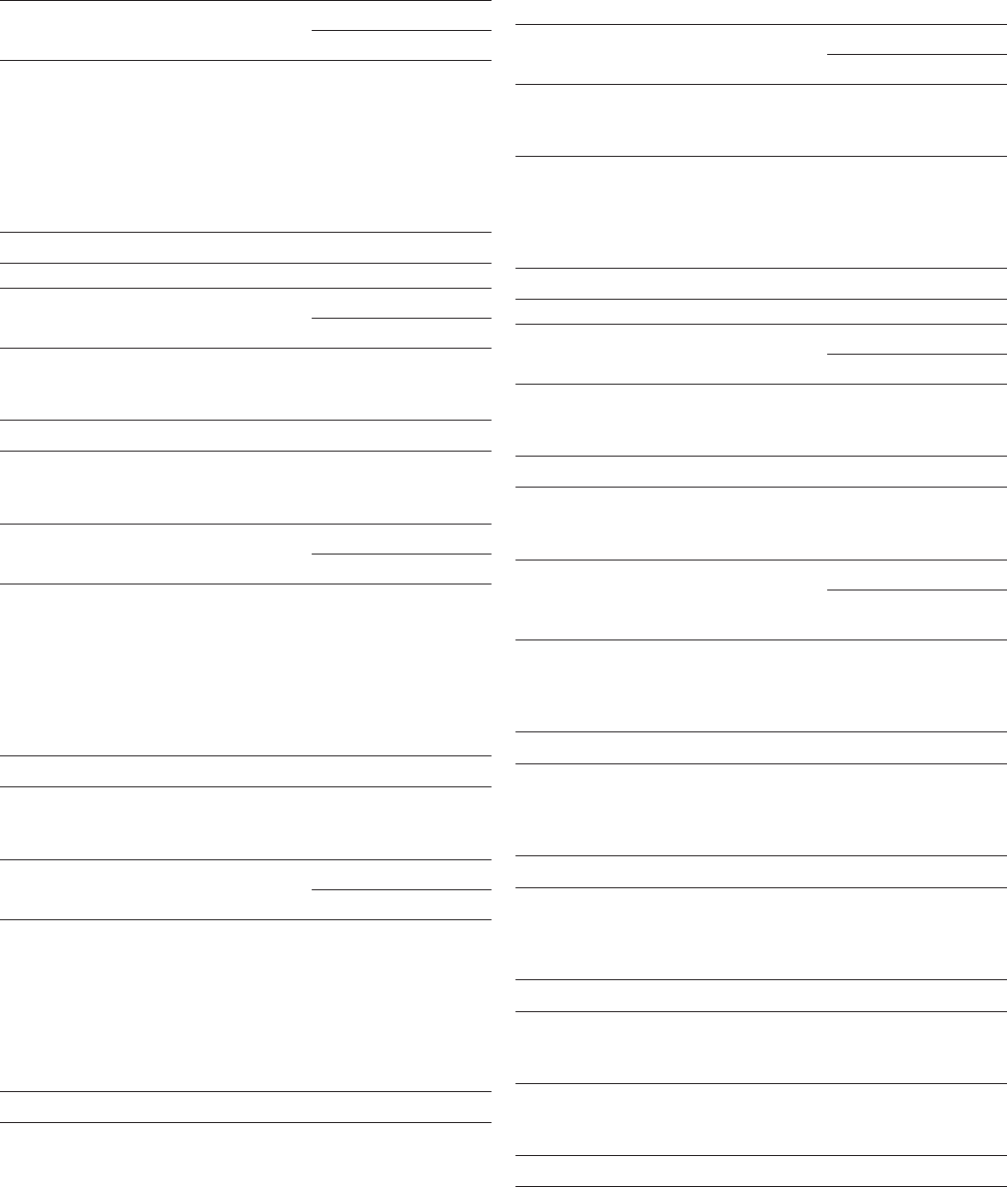

RECONCILIATION OF ADJUSTED OPERATING PROFIT

Years ended December 31

(In millions of dollars) 2014 2013

Net income 1,341 1,669

Add (deduct):

Income taxes 506 596

Other expense (income) 1(81)

Finance costs 817 742

Depreciation and amortization 2,144 1,898

Stock-based compensation 37 84

Restructuring, acquisition and other 173 85

Adjusted operating profit 5,019 4,993

Years ended December 31

(In millions of dollars, except percentages) 2014 2013

Adjusted operating profit margin:

Adjusted operating profit 5,019 4,993

Divided by: total operating revenue 12,850 12,706

Adjusted operating profit margin 39.1% 39.3%

RECONCILIATION OF ADJUSTED NET INCOME

Years ended December 31

(In millions of dollars) 2014 2013

Net income 1,341 1,669

Add (deduct):

Stock-based compensation 37 84

Restructuring, acquisition and other 173 85

Loss on repayment of long-term debt 29 —

Gain on sale of TVtropolis —(47)

Income tax impact of above items (62) (30)

Income tax adjustment, legislative tax change 14 8

Adjusted net income 1,532 1,769

RECONCILIATION OF FREE CASH FLOW

Years ended December 31

(In millions of dollars) 2014 2013

Cash provided by operating activities 3,698 3,990

Add (deduct):

Property, plant and equipment expenditures (2,366) (2,240)

Interest on borrowings, net of capitalization (756) (709)

Restructuring, acquisition and other 173 85

Interest paid 778 700

Change in non-cash working capital (11) (238)

Other adjustments (79) (40)

Free cash flow 1,437 1,548

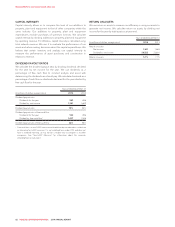

RECONCILIATION OF ADJUSTED NET DEBT AND

ADJUSTED NET DEBT / ADJUSTED OPERATING PROFIT

As at December 31

(In millions of dollars) 2014 2013

Current portion of long-term debt 963 1,170

Long-term debt 13,824 12,173

Deferred transaction costs and discounts 108 93

14,895 13,436

Add (deduct):

Net debt derivatives assets (846) (51)

Short-term borrowings 842 650

Cash and cash equivalents (176) (2,301)

Adjusted net debt 14,715 11,734

As at December 31

(In millions of dollars, except ratios) 2014 2013

Adjusted net debt / adjusted operating profit:

Adjusted net debt 14,715 11,734

Divided by: adjusted operating profit 5,019 4,993

Adjusted net debt / adjusted operating profit 2.9 2.4

RECONCILIATION OF ADJUSTED EARNINGS PER SHARE

Years ended December 31

(In millions of dollars, except per share amounts;

number of shares outstanding in millions) 2014 2013

Adjusted basic earnings per share:

Adjusted net income 1,532 1,769

Divided by: weighted average number of

shares outstanding 515 515

Adjusted basic earnings per share 2.97 3.43

Adjusted diluted earnings per share:

Adjusted net income 1,532 1,769

Dividedby:dilutedweightedaverage

number of shares outstanding 517 518

Adjusted diluted earnings per share 2.96 3.42

Basic earnings per share:

Net income 1,341 1,669

Divided by: weighted average number of

shares outstanding 515 515

Basic earnings per share 2.60 3.24

Diluted earnings per share:

Net income 1,341 1,669

Effect on net income of dilutive securities (15) —

Diluted net income 1,326 1,669

Dividedby:dilutedweightedaverage

number of shares outstanding 517 518

Diluted earnings per share 2.56 3.22

84 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT