Rogers 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

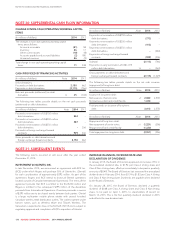

NOTE 30: SUPPLEMENTAL CASH FLOW INFORMATION

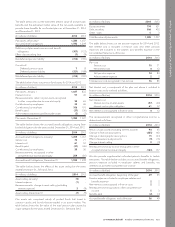

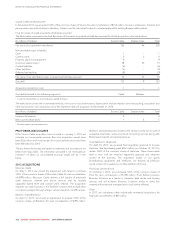

CHANGE IN NON-CASH OPERATING WORKING CAPITAL

ITEMS

(In millions of dollars) 2014 2013

The changes in non-cash operating working capital

items are as follows:

Accounts receivable (81) 58

Inventory 26 17

Other current assets (18) (8)

Accounts payable and accrued liabilities (2) 180

Unearned revenue 86 (9)

Total change in non-cash operating working capital

items 11 238

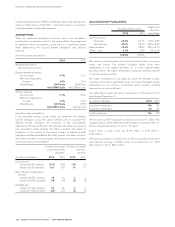

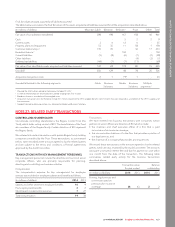

CASH PROVIDED BY FINANCING ACTIVITIES

(In millions of dollars) Note 2014 2013

Debt derivatives:

Proceeds on debt derivatives 2,150 662

Payments on debt derivatives (2,115) (766)

Net cash proceeds (settlement) on debt

derivatives 16 35 (104)

The following two tables provide details on the net cash proceeds

(settlement) on debt derivatives:

(In millions of dollars) Note 2014 2013

Proceeds on termination of US$750 million

debt derivatives 834 –

Proceeds on termination of US$350 million

debt derivatives 387 –

Proceeds on termination of US$350 million

debt derivatives –356

Proceeds on foreign exchange forward

contracts 929 306

Gross proceeds on debt derivatives and

foreign exchange forward contracts 2,150 662

(In millions of dollars) Note 2014 2013

Payments on termination of US$750 million

debt derivatives (773) –

Payments on termination of US$350 million

debt derivatives (413) –

Payments on termination of US$350 million

debt derivatives –(460)

Payments on foreign exchange forward

contracts (929) (306)

Subtotal (2,115) (766)

Payments on early termination of US$1,075

million debt derivatives 16 –(263)

Gross payments on debt derivatives and

foreign exchange forward contracts (2,115) (1,029)

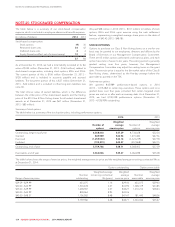

The following two tables provide details on the net cash issuance

(repayment) of long-term debt:

(In millions of dollars) Note 2014 2013

Issuance of long-term debt:

Net issuance of senior notes 21 2,082 2,578

Borrowings under bank credit facility 1,330 –

Total proceeds on issuance of long-term

debt 3,412 2,578

(In millions of dollars) Note 2014 2013

Repayment of long-term debt:

Net repayment of senior notes 21 (1,221) (356)

Repaymentofbankcreditfacility (1,330) –

Total repayment on long-term debt (2,551) (356)

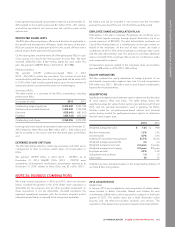

NOTE 31: SUBSEQUENT EVENTS

The following events occurred or will occur after the year ended

December 31, 2014:

INVESTMENT IN GLENTEL INC.

In late December 2014, we announced an agreement with BCE Inc.

(BCE) under which Rogers will purchase 50% of Glentel Inc. (Glentel)

for cash consideration of approximately $392 million. As part of the

agreement, Rogers and BCE intend to divest all Glentel operations

located outside of Canada (International Operations). The terms of the

agreement provide that BCE is entitled to the first $100 million and

Rogers is entitled to the subsequent $195 million of the divestiture

proceeds from International Operations. Divesture proceeds in excess

of $295 million are to be shared evenly between both parties. Glentel

is a large multicarrier mobile phone retailer with several hundred

Canadian wireless retail distribution outlets. The outlets operate under

banner names such as Wireless Wave and TBooth Wireless. The

transaction is expected to close in the first half of 2015 and is subject to

regulatory approval and completion of BCE’s acquisition of Glentel.

INCREASE IN ANNUAL DIVIDEND RATE AND

DECLARATION OF DIVIDENDS

In January 2015, the Board of Directors approved an increase of 5% in

the annualized dividend rate, to $1.92 per Class A Voting share and

Class B Non-Voting share, effective immediately to be paid in quarterly

amounts of $0.48. The Board of Directors last increased the annualized

dividend rate in February 2014, from $1.74 to $1.83 per Class A Voting

and Class B Non-Voting share. Dividends are payable when declared

by the Board of Directors.

On January 28, 2015, the Board of Directors declared a quarterly

dividend of $0.48 per Class A Voting share and Class B Non-Voting

share, to be paid on April 1, 2015, to shareholders of record on

March 13, 2015. This is the first quarterly dividend declared in 2015

and reflects the new dividend rate.

130 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT