Rogers 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

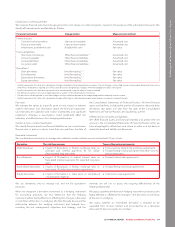

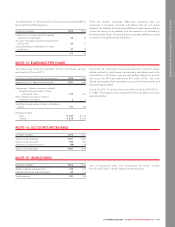

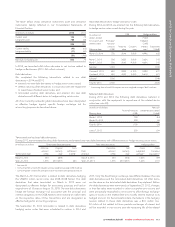

NOTE 12: INCOME TAXES

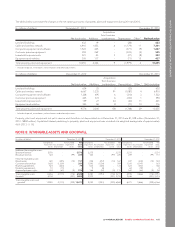

(In millions of dollars) 2014 2013

Current income taxes:

For current year 497 513

Adjustments from reassessment 14 –

Total current income taxes 511 513

Deferred tax expense (recovery):

Origination and reversal of temporary

differences (5) 89

Revaluation of deferred tax balances

due to legislative and tax rate

changes –8

Recognition of previously unrecognized

deferred tax assets –(14)

Total deferred taxes (5) 83

Total income taxes 506 596

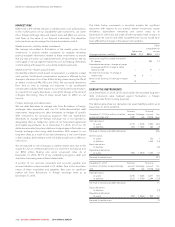

DEFERRED TAX ASSETS AND LIABILITIES

(In millions of dollars) 2014 2013

Deferred tax assets 931

Deferred tax liabilities (1,769) (1,702)

Net deferred tax liability (1,760) (1,671)

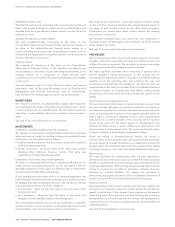

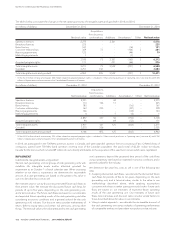

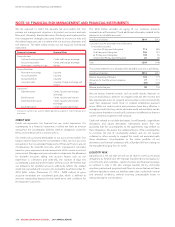

The table below shows the difference between income tax expense

computed by applying the statutory income tax rate to income before

income taxes and the income tax expense for the year.

(In millions of dollars, except percentages) 2014 2013

Statutory income tax rate 26.5% 26.5%

Income before income taxes 1,847 2,265

Computed income tax expense 489 600

Increase (decrease) in income taxes resulting from:

Non-taxable portion of capital gains (1) (9)

Recognition of previously unrecognized deferred

tax assets –(14)

Non-(taxable) deductible stock-based compensation (2) 8

Revaluation of deferred tax balances due to

legislativeandtaxratechanges –8

Adjustments from reassessment 14 –

Other items 63

Total income taxes 506 596

Effective income tax rate 27.4% 26.3%

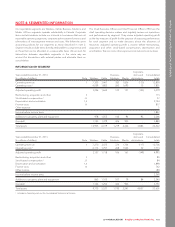

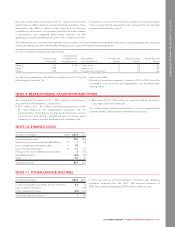

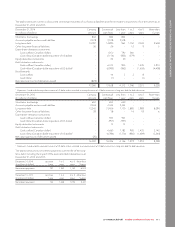

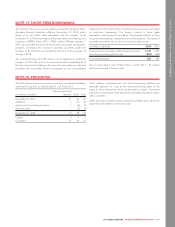

The table below summarizes the movement of net deferred tax assets and liabilities during 2014 and 2013.

Deferred tax assets (liabilities)

(In millions of dollars)

Property,

plant and

equipment

and

inventory

Goodwill

and other

intangibles

Stub period

income and

partnership

reserve Investments

Non-capital

losses Other Total

January 1, 2014 (752) (429) (594) (27) 46 85 (1,671)

(Expense) recovery in net income (137) (110) 281 (4) 8 (33) 5

Expense in other comprehensive income – – – (49) – (35) (84)

Acquisitions – (9) – – – (1) (10)

December 31, 2014 (889) (548) (313) (80) 54 16 (1,760)

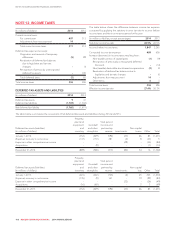

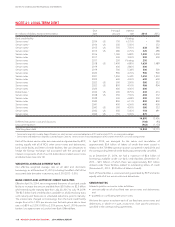

Deferred tax assets (liabilities)

(In millions of dollars)

Property,

plant and

equipment

and

inventory

Goodwill

and other

intangibles

Stub period

income and

partnership

reserve Investments

Non-capital

loss Other Total

January 1, 2013 (601) (360) (735) (4) 25 205 (1,470)

(Expense) recovery in net income (135) (9) 141 – 19 (99) (83)

Expense in other comprehensive income – – – (23) – (26) (49)

Acquisitions (16) (60) – – 2 5 (69)

December 31, 2013 (752) (429) (594) (27) 46 85 (1,671)

108 ROGERS COMMUNICATIONS INC. 2014 ANNUAL REPORT