Rogers 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

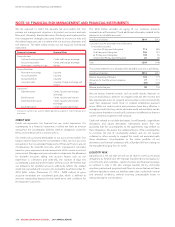

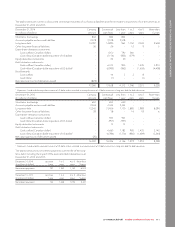

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

We have made certain assumptions for the discount and terminal

growth rates to reflect variations in expected future cash flows. These

assumptions may differ or change quickly depending on economic

conditions or other events. It is therefore possible that future changes

in assumptions may negatively affect future valuations of cash

generating units and goodwill, which could result in impairment losses.

For purposes of impairment testing of goodwill, our cash generating

units or groups of cash generating units correspond to our reporting

segments as disclosed in note 4.

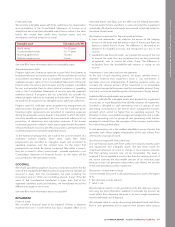

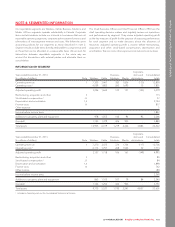

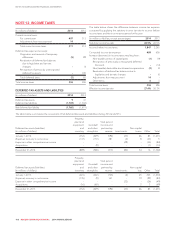

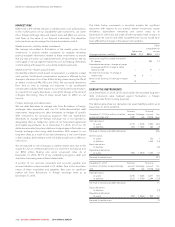

The table below is an overview of the methods and assumptions we used to determine recoverable amounts for cash generating units or groups

of cash generating units with indefinite life intangible assets or goodwill that we consider significant.

(In millions of dollars, except years and percentages)

Carrying value

of goodwill

Carrying value

of indefinite-life

intangible assets

Recoverable

amount method

Periods used

(years)

Terminal growth

rates %

Pre-tax discount

rates %

Wireless 1,155 5,576 Value in use 5 0.5 8.1

Cable 1,379 – Value in use 5 2.0 8.5

Media 923 225 Fair value less cost to sell 5 2.5 10.3

Our fair value measurement for Media is classified as level 3 in the fair

value hierarchy (see note 16).

Impairment losses

We did not record an impairment charge in 2014 or 2013 since the

recoverable amounts of the cash generating units exceeded their

carrying values.

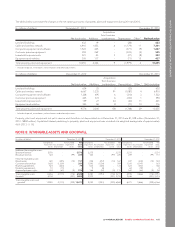

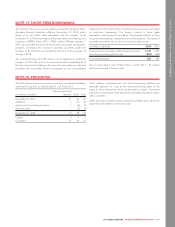

NOTE 9: RESTRUCTURING, ACQUISITION AND OTHER

We incurred $173 million (2013 – $85 million) in restructuring,

acquisition and other expenses, comprised of:

• $131 million (2013 – $53 million) of restructuring expenses mainly

for costs relating to the reorganization associated with the

implementation of the Rogers 3.0 plan to structure teams around

our customers and remove management layers to ensure senior

leadership is closer to frontline employees and customers; and

• $42 million (2013 – $32 million) of acquisition-related transaction

costs, legal claims and other costs.

The corresponding liability was recorded in accounts payable and

accrued liabilities, other long-term liabilities and provisions.

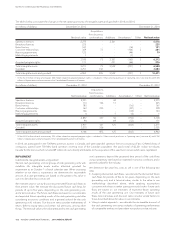

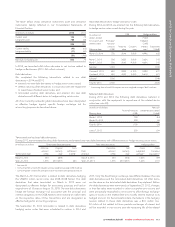

NOTE 10: FINANCE COSTS

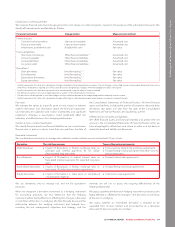

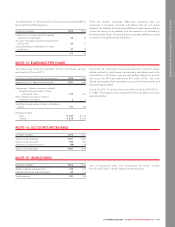

(In millions of dollars) Note 2014 2013

Interest on borrowings 782 734

Interest on post-employment benefits liability 23 714

Loss on repayment of long-term debt 16 29 –

Loss on foreign exchange 21 11 23

Change in fair value of derivative instruments 2(16)

Capitalized interest (26) (25)

Other 12 12

Total finance costs 817 742

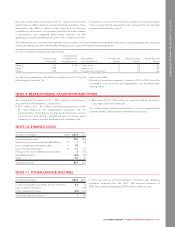

NOTE 11: OTHER EXPENSE (INCOME)

(In millions of dollars) 2014 2013

Losses (income) from associates and joint ventures 23 (7)

Gain on sale of TVtropolis –(47)

Other investment income (22) (27)

Total other expense (income) 1(81)

In 2013, we sold our one-third interest in TVtropolis after obtaining

regulatory approval from the CRTC. We received proceeds of

$59 million and recorded a gain of $47 million in other income.

2014 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 107