Pizza Hut 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16MAR201218540977

considers the significant amount of time that directors expend in fulfilling their duties to the Company as

well as the skill level required by the Company of members of the Board.

Employee Directors. Employee directors do not receive additional compensation for serving on the

Board of Directors.

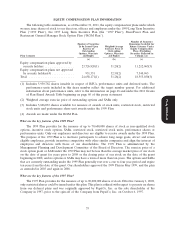

Non-Employee Directors Annual Compensation. Each director who is not an employee of YUM

receives an annual stock grant retainer with a fair market value of $170,000 and an annual grant of vested

SARs with respect to $150,000 worth of YUM common stock (‘‘face value’’) with an exercise price equal to

the fair market value of Company stock on the date of grant. (Prior to 2006, directors received an annual

grant of vested stock options.) Directors may request to receive up to one-half of their stock retainer in

cash. The request must be submitted to the Chair of the Management Planning and Development

Committee. For 2011, Bonnie Hill requested and received approval by the Committee chair for a cash

payment equal to one-half of her stock retainer. Directors may also defer payment of their retainers

pursuant to the Directors Deferred Compensation Plan. Deferrals are invested in phantom Company stock

and paid out in shares of Company stock. Deferrals may not be made for less than two years. In

recognition of the added duties of these chairs, the Chairperson of the Audit Committee (Mr. Grissom in

2011) receives an additional $20,000 stock retainer annually and the Chairpersons of the Management

Planning and Development Committee (Mr. Ryan in 2011) and Nominating and Governance Committee

(Mr. Walter in 2011) each receive an additional $10,000 stock retainer annually.

Initial Stock Grant upon Joining Board. Non-employee directors also receive a one-time stock grant

with a fair market value of $25,000 on the date of grant upon joining the Board, distribution of which is

deferred until termination from the Board.

Stock Ownership Requirements. Similar to executive officers, directors are subject to share ownership

requirements. The directors’ requirements provide that directors will not sell any of the Company’s

common stock received as compensation for service on the Board until the director has ceased being a

member of the Board for one year (sales are permitted to cover income taxes attributable to any stock

retainer payment or exercise of a stock option or SAR).

Proxy Statement

Matching Gifts. To further YUM’s support for charities, non-employee directors are able to

participate in the YUM! Brands, Inc. Matching Gifts Program on the same terms as YUM’s employees.

Under this program, the YUM! Brands Foundation will match up to $10,000 a year in contributions by the

director to a charitable institution approved by the YUM! Brands Foundation. At its discretion, the

Foundation may match director contributions exceeding $10,000.

Insurance. We also pay the premiums on directors’ and officers’ liability and business travel accident

insurance policies. The annual cost of this coverage is approximately $2.5 million. This is not included in

the tables above as it is not considered compensation to the directors.

74