Pizza Hut 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16MAR201218542623

on business results. Over the last four years, we have averaged six Chairman’s Award grants per year

outside of the January time frame. In 2011, we made three Chairman’s Awards on Board of Director

meeting dates other than the January meeting.

Payments upon Termination of Employment

The Company does not have agreements concerning payments upon termination of employment

except in the case of a change in control of the Company. The terms of these change in control agreements

are described beginning on page 71. The Committee believes these are appropriate agreements for

retaining NEOs and other executive officers to preserve shareholder value in case of a threatened change

in control. The Committee periodically reviews these agreements and other aspects of the Company’s

change in control program.

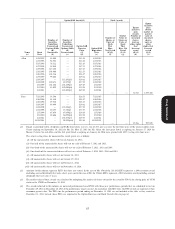

The Company’s change in control agreements, in general, pay, in case of an NEO’s termination of

employment for other than cause within two years of the change in control, a benefit of two times salary

and bonus and provide for a tax gross-up in case of any excise tax. In addition, unvested stock options and

stock appreciation rights vest upon a change in control (as fully described under ‘‘Change in Control’’

beginning on page 70). Other benefits (i.e., bonus, severance payments and outplacement) generally

require a change in control, followed by a termination of an NEO’s employment. In adopting the so-called

‘‘single’’ trigger treatment for equity awards, the Company is guided by:

• keeping employees relatively whole for a reasonable period but avoiding creating a ‘‘windfall’’

• ensuring that ongoing employees are treated the same as terminated employees with respect to

outstanding equity awards

• providing employees with the same opportunities as shareholders, who are free to sell their equity

at the time of the change in control event and thereby realize the value created at the time of the

deal

• the company that made the original equity grant may no longer exist after a change in control and

employees should not be required to have the fate of their outstanding equity tied to the new

company’s future success

Proxy Statement

• supporting the compelling business need to retain key employees during uncertain times

• providing a powerful retention device during change in control discussions, especially for more

senior executives whose equity awards represents a significant portion of their total pay package

• a double trigger on equity awards provides no certainty of what will happen when the transaction

closes.

As shown under ‘‘Change in Control’’ beginning on page 71, the Company will provide tax gross-ups

for the NEOs for any excise taxes due under Section 4999 of the Internal Revenue Code. The effects of

Section 4999 generally are unpredictable and can have widely divergent and unexpected effects based on

an NEO or other executive’s personal compensation history. Therefore, the purpose is to attempt to

deliver the intended benefit to all covered individuals without regard to the unpredictable effect of the

excise tax. The Company and Committee continue to believe that Section 4999 tax gross-up payments are

appropriate for the Company’s most senior executives.

The Company does provide for pension and life insurance benefits in case of retirement as described

beginning at page 71 and the continued ability to exercise options in case of retirement. The Committee

does not specifically consider the change in control benefits or any of these other benefits in determining

each NEO’s other compensation elements, although the Committee is aware of these items of

compensation when making annual compensation decisions. With respect to consideration of how these

benefits fit into the overall compensation policy, the change in control benefits are reviewed from time to

53