Pizza Hut 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

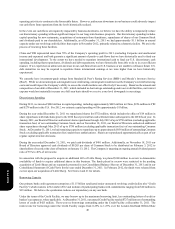

37

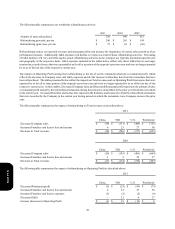

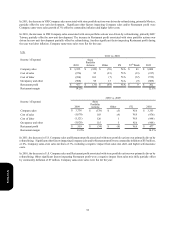

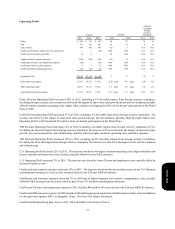

Operating Profit

China

YRI

United States

Unallocated Franchise and license fees and income

Unallocated Occupancy and Other

Unallocated and corporate expenses

Unallocated Closures and impairment expense

Unallocated Other income (expense)

Unallocated Refranchising gain (loss)

Operating Profit

China Operating margin

YRI Operating margin

United States Operating margin

Amount

2011

$ 908

673

589

—

14

(223)

(80)

6

(72)

$1,815

16.3%

20.6%

15.5%

2010

$ 755

589

668

—

9

(194)

—

5

(63)

$ 1,769

18.3%

19.1%

16.2%

2009

$ 596

497

647

(32)

—

(189)

(26)

71

26

$ 1,590

17.5%

16.6%

14.5%

% B/(W)

2011

20

14

(12)

NM

58

(15)

NM

NM

NM

3

(2.0)

1.5

(0.7)

ppts.

ppts.

ppts.

2010

27

19

3

NM

NM

(3)

NM

NM

NM

11

0.8

2.5

1.7

ppts.

ppts.

ppts.

% B/(W)

excluding

foreign

currency

translation

2011

15

9

N/A

N/A

N/A

N/A

N/A

N/A

N/A

(2)

(2.0)

1.4

N/A

2010

26

11

N/A

N/A

N/A

N/A

N/A

N/A

N/A

9

0.8

2.0

N/A

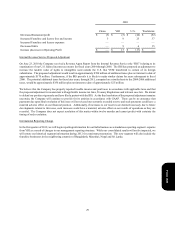

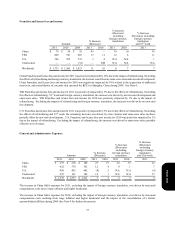

China Division Operating Profit increased 20% in 2011, including a 5% favorable impact from foreign currency translation.

Excluding foreign currency, the increase was driven by the impact of same-store sales growth and net unit development, partially

offset by higher restaurant operating costs, higher G&A expenses and lapping the effect of our brands' participation in the World

Expo in 2010.

China Division Operating Profit increased 27% in 2010, including a 1% favorable impact from foreign currency translation. The

increase was driven by the impact of same-store sales growth and new unit development, partially offset by higher G&A costs.

Operating Profit in 2010 benefited $16 million from our brands' participation in the World Expo.

YRI Division Operating Profit increased 14% in 2011, including a favorable impact from foreign currency translation of 5%.

Excluding the favorable impact from foreign currency translation, the increase of 9% was driven by the impact of same-store sales

growth, new unit development and refranchising, partially offset by higher restaurant operating costs and G&A expenses.

YRI Division Operating Profit increased 19% in 2010, including an 8% favorable impact from foreign currency translation.

Excluding the favorable impact from foreign currency translation, the increase was driven by the impact of new unit development

and refranchising.

U.S. Operating Profit decreased 12% in 2011. The decrease was driven by higher restaurant operating costs, higher franchise and

license expenses and same-store sales declines, partially offset by lower G&A expenses.

U.S. Operating Profit increased 3% in 2010. The increase was driven by lower Closure and impairment costs, partially offset by

increased litigation costs.

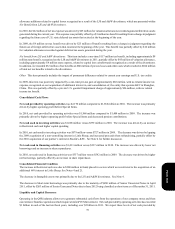

Unallocated and corporate expenses increased 15% in 2011. The increase was driven by actions taken as part of our U.S. Business

transformation measures, as well as costs incurred related to the LJS and A&W divestitures.

Unallocated and corporate expenses increased 3% in 2010 due to higher litigation and incentive compensation costs, partially

offset by G&A savings from the actions taken as part of our U.S. business transformation measures.

Unallocated Closures and impairment expense in 2011 includes $80 million of losses related to the LJS and A&W divestitures.

Unallocated Other income (expense) in 2009 includes a $68 million gain upon acquisition of additional ownership, and consolidation

of, the entity that operates KFCs in Shanghai, China. See Note 4 for further discussion.

Unallocated Refranchising gain (loss) in 2011, 2010 and 2009 is discussed in Note 4.

Form 10-K