Pizza Hut 2011 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

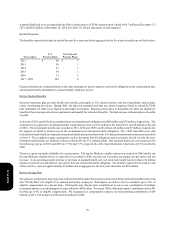

Both the Credit Facility and the ICF contain cross-default provisions whereby our failure to make any payment on any of our

indebtedness in a principal amount in excess of $100 million, or the acceleration of the maturity of any such indebtedness, will

constitute a default under such agreement. Our Senior Unsecured Notes provide that the acceleration of the maturity of any of our

indebtedness in a principal amount in excess of $50 million will constitute a default under the Senior Unsecured Notes if such

acceleration is not annulled, or such indebtedness is not discharged, within 30 days after notice.

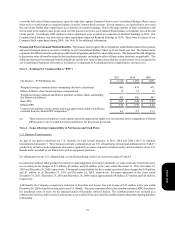

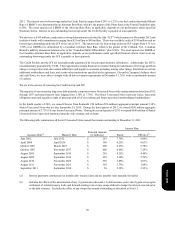

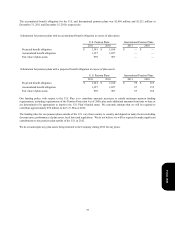

The annual maturities of short-term borrowings and long-term debt as of December 31, 2011, excluding capital lease obligations

of $279 million and fair value hedge accounting adjustments of $26 million, are as follows:

Year ended:

2012

2013

2014

2015

2016

Thereafter

Total

$ 263

—

56

250

300

2,150

$ 3,019

Interest expense on short-term borrowings and long-term debt was $184 million, $195 million and $212 million in 2011, 2010

and 2009, respectively.

Note 11 – Leases

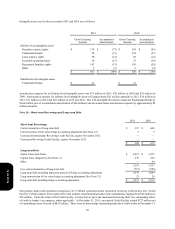

At December 31, 2011 we operated more than 7,400 restaurants, leasing the underlying land and/or building in nearly 6,200 of

those restaurants with the vast majority of our commitments expiring within 20 years from the inception of the lease. Our longest

lease expires in 2151. We also lease office space for headquarters and support functions, as well as certain office and restaurant

equipment. We do not consider any of these individual leases material to our operations. Most leases require us to pay related

executory costs, which include property taxes, maintenance and insurance.

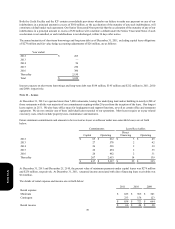

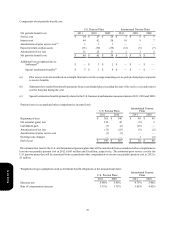

Future minimum commitments and amounts to be received as lessor or sublessor under non-cancelable leases are set forth

below:

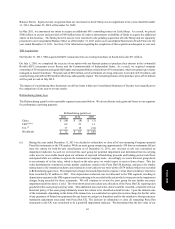

2012

2013

2014

2015

2016

Thereafter

Commitments

Capital

$ 65

27

26

26

26

267

$ 437

Operating

$ 612

578

538

494

462

2,653

$ 5,337

Lease Receivables

Direct

Financing

$ 3

2

2

2

2

14

$ 25

Operating

$ 49

42

39

35

31

139

$ 335

At December 31, 2011 and December 25, 2010, the present value of minimum payments under capital leases was $279 million

and $236 million, respectively. At December 31, 2011, unearned income associated with direct financing lease receivables was

$14 million.

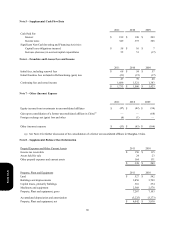

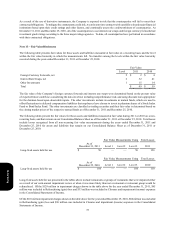

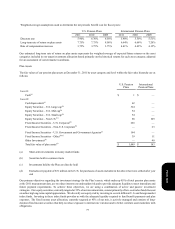

The details of rental expense and income are set forth below:

Rental expense

Minimum

Contingent

Rental income

2011

$ 625

233

$ 858

$ 66

2010

$ 565

158

$ 723

$ 44

2009

$ 541

123

$ 664

$ 38

Form 10-K