Pizza Hut 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Little Sheep Group Ltd. ("Little Sheep"), a leading casual dining concept in China. This acquisition brought our total ownership

to approximately 93% of the business. Our ongoing earnings growth model in China includes double-digit percentage unit growth,

system sales growth of at least 13%, same-store sales growth of at least 5% and moderate leverage of our General and Administrative

(“G&A”) infrastructure, which we expect to drive Operating Profit growth of 15%.

Drive Aggressive International Expansion and Build Strong Brands Everywhere – The Company and its franchisees opened over

900 new restaurants in 2011 in the Company’s International Division, representing 12 straight years of opening over 700 restaurants,

making YRI one of the leading international retail developers in terms of units opened. The Company expects to continue to

experience strong growth by building out existing markets and growing in new markets including France, Germany, Russia and

across Africa. The International Division’s Operating Profit has experienced a 9-year compound annual growth rate of 12%. Our

ongoing earnings growth model for YRI includes Operating Profit growth of 10% driven by 3-4% unit growth, system sales growth

of 6%, at least 2-3% same-store sales growth, margin improvement and leverage of our G&A infrastructure.

Dramatically Improve U.S. Brand Positions, Consistency and Returns – The Company continues to focus on improving its U.S.

position through differentiated products and marketing and an improved customer experience. The Company also strives to provide

industry-leading new product innovation which adds sales layers and expands day parts. We continue to evaluate our returns and

ownership positions with an earn-the-right-to-own philosophy on Company-owned restaurants. Our ongoing earnings growth

model calls for Operating Profit growth of 5% in the U.S.

Drive Industry-Leading, Long-Term Shareholder and Franchisee Value – The Company is focused on delivering high returns and

returning substantial cash flows to its shareholders via dividends and share repurchases. The Company has one of the highest

returns on invested capital in the Quick Service Restaurants (“QSR”) industry. The Company’s dividend and share repurchase

programs have returned over $2.1 billion and $6.7 billion to shareholders, respectively, since 2004. The Company is targeting an

annual dividend payout ratio of 35% to 40% of net income and has increased the quarterly dividend at a double-digit rate each year

since inception in 2004. Shares are repurchased opportunistically as part of our regular capital structure decisions.

The ongoing earnings growth rates referenced above represent our average annual expectations for the next several years. Details

of our 2012 Guidance by division as presented on December 7, 2011 can be found online at http://www.yum.com.

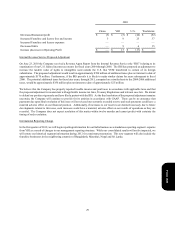

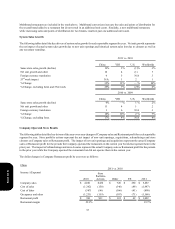

2011 Highlights

Worldwide system sales grew 7% prior to foreign currency translation, including 29% in China and 8% at YRI.

System sales in the U.S. were flat.

Same-store sales grew 19% in China, 3% at YRI and declined 1% in the U.S.

Record International development with 1,561 new restaurants including 656 in China and 905 at YRI.

Worldwide operating profit grew 8%, including a positive impact from foreign currency translation of $77

million. Prior to foreign currency translation, operating profit grew 4%, including 15% in China and 9% at

YRI, offsetting a 12% decline in the U.S.

Worldwide restaurant margin declined 0.9 points to 16.0%.

Increased annual dividend rate to $1.14 per share and repurchased 14.3 million shares totaling $733 million at

an average price of $51.

Increased return on invested capital to over 22%

All preceding comparisons are versus the same period a year ago and exclude the impact of Special Items. See the Significant

Known Events, Trends or Uncertainties Impacting or Expected to Impact Comparisons of Reported or Future Results section of

this MD&A for a description of Special Items.

Form 10-K