Pizza Hut 2011 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

73

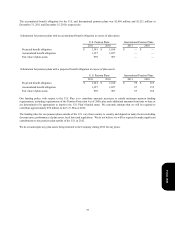

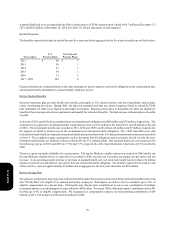

At December 31, 2011 the carrying values of cash and cash equivalents, accounts receivable and accounts payable approximated

their fair values because of the short-term nature of these instruments. The fair value of notes receivable net of allowances and

lease guarantees less subsequent amortization approximates their carrying value. The Company’s debt obligations, excluding

capital leases, were estimated to have a fair value of $3.5 billion, compared to their carrying value of $3.0 billion. We estimated

the fair value of debt using market quotes and calculations based on market rates.

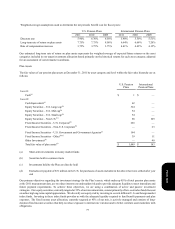

Note 14 – Pension, Retiree Medical and Retiree Savings Plans

Pension Benefits

We sponsor noncontributory defined benefit pension plans covering certain full-time salaried and hourly U.S. employees. The

most significant of these plans, the YUM Retirement Plan (the “Plan”), is funded while benefits from the other U.S. plans are paid

by the Company as incurred. During 2001, the plans covering our U.S. salaried employees were amended such that any salaried

employee hired or rehired by YUM after September 30, 2001 is not eligible to participate in those plans. Benefits are based on

years of service and earnings or stated amounts for each year of service. We also sponsor various defined benefit pension plans

covering certain of our non-U.S. employees, the most significant of which are in the UK. Our plans in the UK have previously

been amended such that new employees are not eligible to participate in these plans. Additionally, in 2011 one of our UK plans

was frozen such that existing participants can no longer earn future service credits. This resulted in a curtailment gain of $10

million which was credited to Accumulated other comprehensive income (loss).

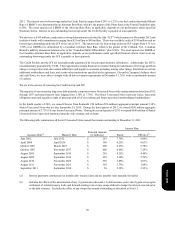

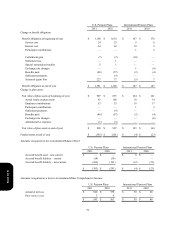

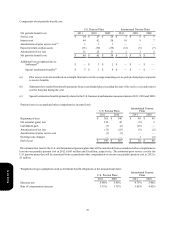

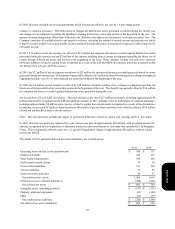

Obligation and Funded Status at Measurement Date:

The following chart summarizes the balance sheet impact, as well as benefit obligations, assets, and funded status associated with

our U.S. pension plans and significant International pension plans. The actuarial valuations for all plans reflect measurement dates

coinciding with our fiscal year ends.

Form 10-K