Pizza Hut 2011 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

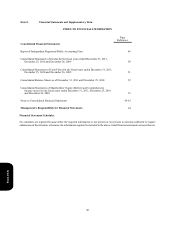

53

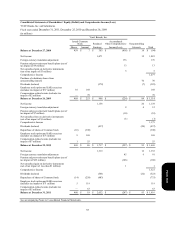

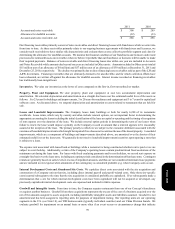

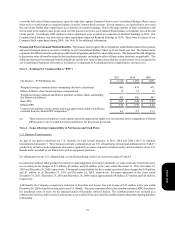

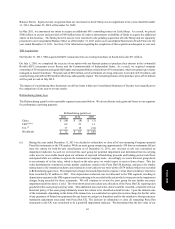

Consolidated Statements of Shareholders’ Equity (Deficit) and Comprehensive Income (Loss)

YUM! Brands, Inc. and Subsidiaries

Fiscal years ended December 31, 2011, December 25, 2010 and December 26, 2009

(in millions)

Balance at December 27, 2008

Net Income

Foreign currency translation adjustment

Pension and post-retirement benefit plans (net of

tax impact of $9 million)

Net unrealized gain on derivative instruments

(net of tax impact of $3 million)

Comprehensive Income

Purchase of subsidiary shares from

noncontrolling interest

Dividends declared

Employee stock option and SARs exercises

(includes tax impact of $57 million)

Compensation-related events (includes tax

impact of $2 million)

Balance at December 26, 2009

Net Income

Foreign currency translation adjustment

Pension and post-retirement benefit plans (net of

tax impact of $7 million)

Net unrealized loss on derivative instruments

(net of tax impact of $1 million)

Comprehensive Income

Dividends declared

Repurchase of shares of Common Stock

Employee stock option and SARs exercises

(includes tax impact of $73 million)

Compensation-related events (includes tax

impact of $7 million)

Balance at December 25, 2010

Net Income

Foreign currency translation adjustment

Pension and post-retirement benefit plans (net of

tax impact of $65 million)

Net unrealized gain on derivative instruments

(net of tax impact of less than $1 million)

Comprehensive Income

Dividends declared

Repurchase of shares of Common Stock

Employee stock option and SARs exercises

(includes tax impact of $71 million)

Compensation-related events (includes tax

impact of $5 million)

Balance at December 31, 2011

See accompanying Notes to Consolidated Financial Statements.

Yum! Brands, Inc.

Issued Common

Stock

Shares

459

10

—

469

(10)

9

1

469

(14)

5

—

460

Amount

$ 7

168

78

$ 253

(390)

168

55

$ 86

(250)

119

63

$ 18

Retained

Earnings

$ 303

1,071

(378)

$ 996

1,158

(437)

$ 1,717

1,319

(501)

(483)

$ 2,052

Accumulated

Other Comprehensive

Income(Loss)

$ (418)

176

13

5

$ (224)

8

(10)

(1)

$ (227)

85

(106)

1

$ (247)

Noncontrolling

Interests

$ 14

12

70

(7)

$ 89

20

4

(20)

$ 93

16

6

(22)

$ 93

Total

$ (94)

1,083

176

13

5

1,277

70

(385)

168

78

$ 1,114

1,178

12

(10)

(1)

1,179

(457)

(390)

168

55

$ 1,669

1,335

91

(106)

1

1,321

(523)

(733)

119

63

$ 1,916

Form 10-K