Pizza Hut 2011 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

66

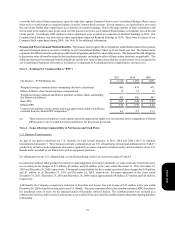

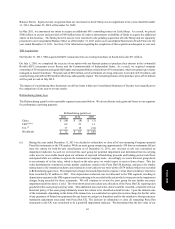

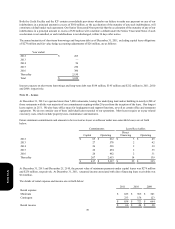

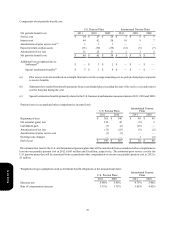

Note 5 – Supplemental Cash Flow Data

Cash Paid For:

Interest

Income taxes

Significant Non-Cash Investing and Financing Activities:

Capital lease obligations incurred

Increase (decrease) in accrued capital expenditures

2011

$ 199

349

$ 58

55

2010

$ 190

357

$ 16

51

2009

$ 209

308

$ 7

(17)

Note 6 – Franchise and License Fees and Income

Initial fees, including renewal fees

Initial franchise fees included in Refranchising (gain) loss

Continuing fees and rental income

2011

$ 68

(21)

47

1,686

$ 1,733

2010

$ 54

(15)

39

1,521

$ 1,560

2009

$ 57

(17)

40

1,383

$ 1,423

Note 7 – Other (Income) Expense

Equity income from investments in unconsolidated affiliates

Gain upon consolidation of a former unconsolidated affiliate in China(a)

Foreign exchange net (gain) loss and other

Other (income) expense

2011

$(47)

—

(6)

$(53)

2010

$(42)

—

(1)

$(43)

2009

$(36)

(68)

—

$(104)

(a) See Note 4 for further discussion of the consolidation of a former unconsolidated affiliate in Shanghai, China.

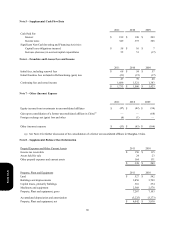

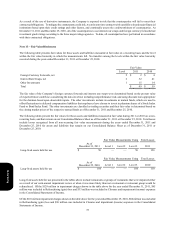

Note 8 – Supplemental Balance Sheet Information

Prepaid Expenses and Other Current Assets

Income tax receivable

Assets held for sale

Other prepaid expenses and current assets

2011

$ 150

24

164

$ 338

2010

$ 115

23

131

$ 269

Property, Plant and Equipment

Land

Buildings and improvements

Capital leases, primarily buildings

Machinery and equipment

Property, Plant and equipment, gross

Accumulated depreciation and amortization

Property, Plant and equipment, net

2011

$ 527

3,856

316

2,568

7,267

(3,225)

$ 4,042

2010

$ 542

3,709

274

2,578

7,103

(3,273)

$ 3,830

Form 10-K