Pizza Hut 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

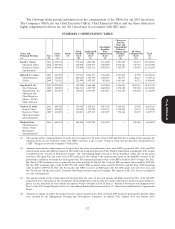

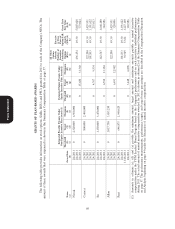

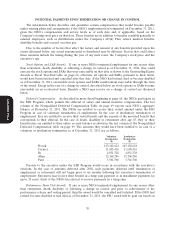

16MAR201218542623

Option/SAR Awards(1) Stock Awards

Equity

incentive

Equity plan

incentive awards:

plan market or

awards: payout

Market Number of value of

Number of Value of unearned unearned

Number of Number of Shares or Shares or shares, shares,

Securities Securities Units of Units of units or units or

Underlying Underlying Stock Stock other rights other

Unexercised Unexercised Option/SAR That That that rights that

Options/SARs Options/SARs Exercise Option/SAR Have Have Not have not have not

(#) (#) Price Expiration Not Vested Vested vested vested

Name Grant Exercisable Unexercisable ($) Date (#)(2) ($)(3) (#)(4) ($)(3)

(a) Date (b) (c) (d) (e) (f) (g) (h) (i)

Allan 1/24/2002 45,000 — $13.28 1/24/2012

1/23/2003 86,582 — $12.16 1/23/2013

5/15/2003 76,322 — $13.10 5/15/2013

1/27/2004 58,040 — $17.23 1/27/2014

1/27/2004 117,188 — $17.23 1/27/2014

1/28/2005 108,400 — $22.53 1/28/2015

1/26/2006 124,316 — $24.47 1/26/2016

1/19/2007 99,688 — $29.61 1/19/2017

1/19/2007 — 332,292(vi) $29.61 1/19/2017

1/24/2008 120,471 40,157(i) $37.30 1/24/2018

2/5/2009 101,488 101,489(ii) $29.29 2/5/2019

2/5/2010 43,029 129,089(iii) $32.98 2/5/2020

2/4/2011 — 122,200(iv) $49.30 2/4/2021

— — 31,782 1,875,456

Pant 7/21/2005 38,596 — $26.53 7/21/2015

1/26/2006 41,440 — $24.47 1/26/2016

1/26/2006 49,726 — $24.47 1/26/2016

1/19/2007 49,844 — $29.61 1/19/2017

1/24/2008 — 133,856(v) $37.30 1/24/2018

1/24/2008 40,157 13,386(i) $37.30 1/24/2018

2/5/2009 67,659 67,659(ii) $29.29 2/5/2019

2/5/2010 28,686 86,059(iii) $32.98 2/5/2020

2/4/2011 — 101,833(iv) $49.30 2/4/2021

11/18/2011 — 94,949(viii) $53.84 11/18/2021

Proxy Statement

— — 15,386 907,928

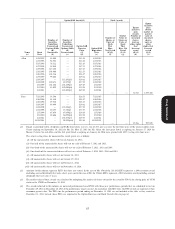

(1) Except as provided below, all options and SARs listed above vest at a rate of 25% per year over the first four years of the ten-year option term.

Grants expiring on September 30, 2012 for Mr. Su, May 15, 2013 for Mr. Allan, the first grant listed as expiring on January 27, 2014 for

Messrs. Carucci, Su and Allan and the first grant listed as expiring on January 26, 2016 were granted with 100% vesting after four years.

The actual vesting dates for unexercisable award grants are as follows:

(i) All the unexercisable shares will vest on January 24, 2012.

(ii) One-half of the unexercisable shares will vest on each of February 5, 2012 and 2013.

(iii) One-third of the unexercisable shares will vest on each of February 5, 2012, 2013 and 2014.

(iv) One-fourth of the unexercised shares will vest on each of February 4, 2012, 2013, 2014 and 2015.

(v) All unexercisable shares will vest on January 24, 2013.

(vi) All unexercisable shares will vest on January 19, 2012.

(vii) All unexercisable shares will vest on February 4, 2016.

(viii) All unexercisable shares will vest on November 18, 2016.

(2) Amounts in this column represent RSUs that have not vested. In the case of Mr. Novak the 203,101 RSUs represent a 2008 retention award

(including accrued dividends) that vests after 4 years and in the case of Mr. Su 176,616 RSUs represent a 2010 retention award (including accrued

dividends) that vests after 5 years.

(3) The market value of these awards are calculated by multiplying the number of shares covered by the award by $59.01, the closing price of YUM

stock on the NYSE on December 30, 2011.

(4) The awards reflected in this column are unvested performance-based PSUs with three-year performance periods that are scheduled to vest on

December 29, 2012 or December 28, 2013 if the performance targets are met. In accordance with SEC rules, the PSU awards are reported at their

maximum payout value. The PSUs for the performance period ending on December 31, 2011 are not included in the table as they vested on

December 31, 2011; instead, these PSUs are reported in the Option Exercises and Stock Vested table on page 64.

63