Pizza Hut 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16MAR201218540977

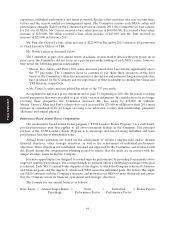

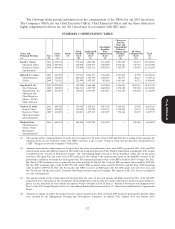

YUM’s Executive Stock Ownership Guidelines

The Committee has established stock ownership guidelines for our top 600 employees. Our Chief

Executive Officer is required to own 336,000 shares of YUM stock or stock equivalents (approximately

thirteen times his base salary at the end of fiscal 2011). NEOs (other than Mr. Novak) are expected to

attain their ownership targets, equivalent in value to two to three times their current annual base salary

depending upon their positions, within five years from the time the established targets become applicable.

If an NEO or other employee does not meet his or her ownership guideline, he or she is not eligible for a

grant under the LTI Plan. In 2011, all NEOs and all other employees subject to guidelines met or exceeded

their ownership guidelines.

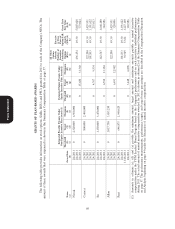

Value of Shares

Ownership Shares Value of Owned as

Guidelines Owned(1) Shares(2) Multiple of Salary

Novak 336,000 2,438,820 $143,914,768 99

Carucci 50,000 155,177 $ 9,156,995 11

Su 50,000 389,201 $ 22,966,751 23

Allan 50,000 733,153 $ 43,263,359 49

Pant 50,000 98,681 $ 5,823,164 8

(1) Calculated as of December 31, 2011 and represents shares owned outright by the NEO and vested

RSUs acquired under the Company’s executive income deferral program.

(2) Based on YUM closing stock price of $59.01 as of December 31, 2011.

Under our Code of Conduct, speculative trading in YUM stock, including trading in puts, calls or

other hedging or monetization transactions, is prohibited.

YUM’s Stock Option and SARs Granting Practices

Historically, we have awarded non-qualified stock option and stock appreciation rights grants annually

at the Committee’s January meeting. This meeting date is set by the Board of Directors more than

Proxy Statement

six months prior to the actual meeting. Beginning with the 2008 grant, the Committee set the annual grant

date as the second business day after our fourth-quarter earnings release. We do not backdate or make

grants retroactively. In addition, we do not time such grants in coordination with our possession or release

of material, non-public or other information.

We make grants at the same time other elements of annual compensation are determined so that we

can consider all elements of compensation in making the grants. Pursuant to the terms of our LTI Plan, the

exercise price is set as the closing price on the date of grant. We make these grants to NEOs at the same

time they are granted to the other approximately 600 above-restaurant leaders of our Company who are

eligible for stock option and stock appreciation rights grants.

Management recommends the awards to be made pursuant to our LTI Plan to the Committee. While

the Committee gives significant weight to management recommendations concerning grants to NEOs

(other than the CEO), the Committee makes the determination whether and to whom to issue grants and

determines the amount of the grant. The Board of Directors has delegated to Mr. Novak and Anne

Byerlein, our Chief People Officer, the ability to make grants to employees who are not executive officers

and whose grant is less than approximately 17,000 options or stock appreciation rights annually. In the case

of these grants, the Committee sets all the terms of each award, except the actual number of stock

appreciation rights or options, which are determined by Mr. Novak and Ms. Byerlein pursuant to

guidelines approved by the Committee in January of each year.

Grants may also be made on other dates that the Board of Directors meets. These grants generally are

Chairman’s Awards, which are made in recognition of superlative performance and extraordinary impact

52