Pizza Hut 2011 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

As a result of the use of derivative instruments, the Company is exposed to risk that the counterparties will fail to meet their

contractual obligations. To mitigate the counterparty credit risk, we only enter into contracts with carefully selected major financial

institutions based upon their credit ratings and other factors, and continually assess the creditworthiness of counterparties. At

December 31, 2011 and December 25, 2010, all of the counterparties to our interest rate swaps and foreign currency forwards had

investment grade ratings according to the three major ratings agencies. To date, all counterparties have performed in accordance

with their contractual obligations.

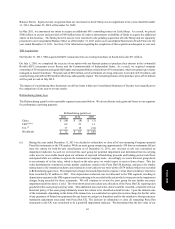

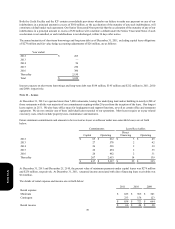

Note 13 – Fair Value Disclosures

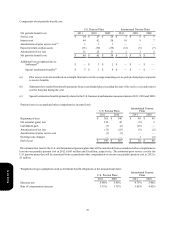

The following table presents fair values for those assets and liabilities measured at fair value on a recurring basis and the level

within the fair value hierarchy in which the measurements fall. No transfers among the levels within the fair value hierarchy

occurred during the years ended December 31, 2011 or December 25, 2010.

Foreign Currency Forwards, net

Interest Rate Swaps, net

Other Investments

Total

Fair Value

Level

2

2

1

2011

$ 2

32

15

$ 49

2010

$ 4

41

14

$ 59

The fair value of the Company’s foreign currency forwards and interest rate swaps were determined based on the present value

of expected future cash flows considering the risks involved, including nonperformance risk, and using discount rates appropriate

for the duration based upon observable inputs. The other investments include investments in mutual funds, which are used to

offset fluctuations in deferred compensation liabilities that employees have chosen to invest in phantom shares of a Stock Index

Fund or Bond Index Fund. The other investments are classified as trading securities and their fair value is determined based on

the closing market prices of the respective mutual funds as of December 31, 2011 and December 25, 2010.

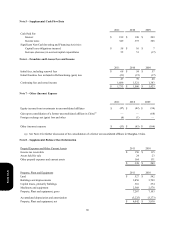

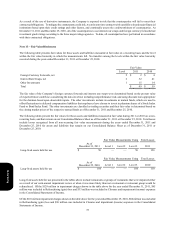

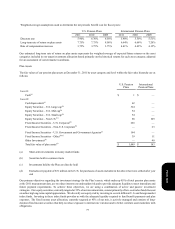

The following tables present the fair values for those assets and liabilities measured at fair value during 2011 or 2010 on a non-

recurring basis, and that remain on our Consolidated Balance Sheet as of December 31, 2011 or December 25, 2010. Total losses

include losses recognized from all non-recurring fair value measurements during the years ended December 31, 2011 and

December 25, 2010 for assets and liabilities that remain on our Consolidated Balance Sheet as of December 31, 2011 or

December 25, 2010:

Long-lived assets held for use

Long-lived assets held for use

As of

December 31, 2011

$ 50

As of

December 25, 2010

$ 184

Fair Value Measurements Using

Level 1

—

Fair Value Measurements Using

Level 1

—

Level 2

—

Level 2

—

Level 3

50

Level 3

184

Total Losses

2011

128

Total Losses

2010

110

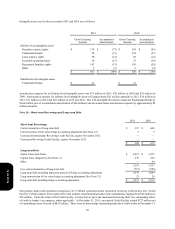

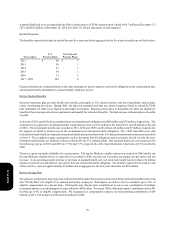

Long-lived assets held for use presented in the tables above include restaurants or groups of restaurants that were impaired either

as a result of our semi-annual impairment review or when it was more likely than not a restaurant or restaurant group would be

refranchised. Of the $128 million in impairment charges shown in the table above for the year ended December 31, 2011, $95

million was included in Refranchising (gain) loss and $33 million was included in Closures and impairment (income) expenses

in the Consolidated Statements of Income.

Of the $110 million impairment charges shown in the table above for the year ended December 25, 2010, $80 million was included

in Refranchising (gain) loss and $30 million was included in Closures and impairment (income) expenses in the Consolidated

Statements of Income.

Form 10-K