Pizza Hut 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.I want to give you

my perspective

about our successful

evolving and enduring

business model.

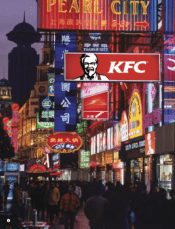

Our philosophy is pretty simple. We reduce company

ownership in highly penetrated or under-performing

markets, and we increase exposure in emerging and

under-penetrated markets.

By following this philosophy and due to strong

execution by our Division teams, our business model

has evolved. Today over 70% of our operating profit

is generated by our international businesses. We

ended 2011 with over $1.5 billion in operating profit

in China and YRI. Ten years ago, we made about

$315 million in these businesses combined, which

represented 30% of our profits at that time. The vast

majority of this growth was in emerging markets.

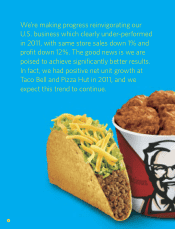

We continue to reduce our ownership in highly-

penetrated markets. In December, we completed the

sale of Long John Silver’s and A&W All American

Restaurants. The larger of these concepts, Long John

Silver’s, has about 97% of its restaurants in the U.S.

We are continuing our U.S. refranchising program.

Our plan is to retain about 5% ownership in KFC

and Pizza Hut and to be at this target ownership for

both brands by the end of 2012. We also recently

announced our plan to reduce Taco Bell U.S.

ownership from 23% to about 16% over the next

two years. We are fortunate to have great franchise

operators who have the capability to run these

restaurants extremely well. In return, we will collect

royalties and make our profit return more consistent.

We announced our decision in the third quarter of

2011 to refranchise our Pizza Hut UK business. We

have started the sale process and our intention is to

sell this business in 2012.

At the same time, we are aggressively growing

emerging and under-penetrated markets. While our

franchise partners fuel the majority of our new unit

growth outside China, we will also build company

units in international markets where we can achieve

scale, realize high growth, and yield high returns.

We’ve made three acquisitions in recent times that

meet our criteria. First, in 2010 we exercised our

option to take full management control of Rostiks-

KFC in Russia. During 2011, our first full year of

operations, results have been impressive. Russia had

the highest same store sales growth rates in all of

Yum! We’ve made significant progress re-branding

this business as a KFC brand. This has increased our

confidence that Russia will become a big business

for Yum!

Secondly, we bought out our largest KFC franchisee

in South Africa in the fourth quarter of 2011. This

acquisition provides a 68 store equity base in South

Africa to help fuel the high growth potential for the

rest of Africa.

And finally, we just completed the acquisition of

Little Sheep in China. We’re very excited to bring

our operating and development expertise to this

business.

The Little Sheep business will add about 5% to our

revenue base in China for 2012. When you take into

account transaction and transition costs, we expect

only a modest profit impact in 2012.

Looking back and forward, I am very confident in the

sustainable and growing strength of our business

model. We believe that the investing decisions we

are making will set us up for success now and for

the long term. We will continue to invest in under-

penetrated markets with a long runway for growth,

deploying capital in our existing asset base that

generates high returns, and leverages these assets

with additional sales layers and dayparts to generate

same store sales growth.

There’s no question in our minds that our business

model is evolving and enduring. In fact, our robust

EPS model gives us a clear capability to sustain our at

least 10% growth model well beyond 2020.

9