Pizza Hut 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

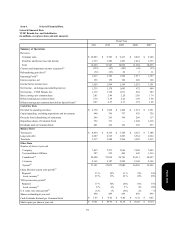

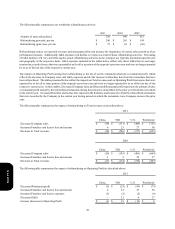

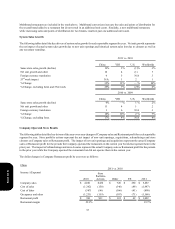

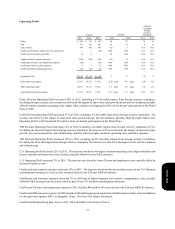

27

Revenues

Company sales

Franchise and license fees

Total Revenues

Operating profit

Franchise and license fees

Restaurant profit

General and administrative expenses

Operating profit(a)

U.S.

$ 43

13

$ 56

$ 13

9

(4)

$ 18

YRI

$ 29

6

$ 35

$ 6

6

(4)

$ 8

Unallocated

$ —

—

$ —

$ —

—

(1)

$(1)

Total

$ 72

19

$ 91

$ 19

15

(9)

$ 25

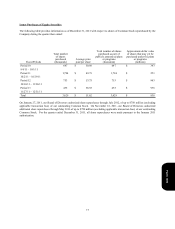

(a) The $25 million benefit was offset throughout 2011 by investments, including franchise development incentives, as well

as higher-than-normal spending, such as restaurant closures in the U.S. and YRI.

Acquisition of Controlling Interest in Little Sheep

On February 1, 2012 we paid $584 million to acquire an additional 66% interest in Little Sheep, a leading Chinese casual dining

concept with approximately 450 system-wide restaurants headquartered in Inner Mongolia, China. This acquisition brought our

total ownership to approximately 93% of the business. We expect that the consolidation of Little Sheep will increase our revenue

in China in 2012 by approximately 5%, with only a corresponding modest impact to Operating profit given the transaction and

transition related costs we expect to incur in our initial year of ownership.

YRI Acquisitions

On October 31, 2011 YRI acquired 68 KFC restaurants from an existing franchisee in South Africa for $71 million.

On July 1, 2010, we completed the exercise of our option with our Russian partner to purchase their interest in the co-branded

Rostik’s-KFC restaurants across Russia and the Commonwealth of Independent States. As a result, we acquired company

ownership of 50 restaurants and gained full rights and responsibilities as franchisor of 81 restaurants, which our partner previously

managed as master franchisee. We paid cash of $60 million, net of settlement of a long-term note receivable of $11 million, and

assumed long-term debt of $10 million which was subsequently repaid. The remaining balance of the purchase price of $12 million

will be paid in cash by July 2012.

The impact of consolidating these businesses on all line-items within our Consolidated Statement of Income was insignificant to

the comparison of our year-over-year results and is not expected to materially impact our results going forward.

Pizza Hut South Korea Goodwill Impairment

As a result of a decline in future profit expectations for our Pizza Hut South Korea business, we recorded a goodwill impairment

charge of $12 million for this market during 2009. This charge was recorded in Closure and impairment (income) expenses in

our Consolidated Statement of Income and was allocated to our International Division for performance reporting purposes.

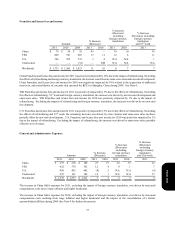

Store Portfolio Strategy

From time to time we sell Company restaurants to existing and new franchisees where geographic synergies can be obtained or

where franchisees’ expertise can generally be leveraged to improve our overall operating performance, while retaining Company

ownership of strategic U.S. and international markets in which we choose to continue investing capital. In the U.S., we are targeting

Company ownership of KFC, Pizza Hut and Taco Bell restaurants of about 8%, down from its current level of 13%, with our

primary remaining focus being refranchising at KFC and Taco Bell to about 5% and 16% Company ownership,

respectively. Consistent with this strategy, 404, 404 and 541 Company restaurants in the U.S. were sold to franchisees in the

years ended December 31, 2011, December 25, 2010 and December 26, 2009, respectively. At December 31, 2011, we have

offered for refranchising approximately 250 KFCs in the U.S. Additionally, we have offered for refranchise all remaining Company-

owned restaurants in the Pizza Hut UK business (approximately 420 restaurants remaining as of December 31, 2011) and during

2010, we refranchised all Company-owned KFCs and Pizza Huts in Mexico (345 restaurants) and KFCs in Taiwan (124 restaurants).

Form 10-K