Pizza Hut 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16MAR201218540977

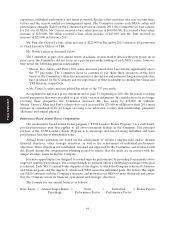

Comparative Compensation Data

Revenue size often correlates to some degree with the market value of compensation for senior

executive positions. For companies with significant franchise operations, measuring size is a more complex

undertaking. This is because there are added complexities and responsibilities for managing the

relationships, arrangements, and overall scope of the enterprise that franchising introduces, in particular,

managing product introductions, marketing, driving new unit development, customer satisfaction and

overall operations improvements across the entire franchise system. Accordingly, consistent with its

practice from prior years which Meridian had recommended, the Committee decided to add 25% of

estimated franchisee and licensee sales to the Company’s estimated 2010 sales to establish an appropriate

revenue benchmark to determine the market value of various components of compensation for 2011. This

means that the Company, when considering franchisee sales, is viewed as having estimated revenues of

$16.8 billion. Specifically, this amount was determined by adding 2010 estimated Company sales of

$9.8 billion and 25% of estimated franchisee and licensee sales (from which the Company derives revenues

in the form of royalties) of $28 billion.

The median annual revenues (for 2010, the most recent year available at that time) for the peer group

established by the Committee was $15 billion. Data for each individual job using the methodology

described in the previous paragraph was compiled based on the estimated revenue size of the division that

the NEO was responsible for in 2010, specifically $16.8 billion for Messrs. Novak and Carucci, $4.3 billion

for Mr. Su and $5.5 billion for Messrs. Allan and Pant.

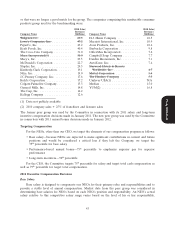

Companies included in the Peer Group

The peer group for all NEOs is made up of retail, hospitality and nondurable consumer product

companies. The Committee established this peer group for the CEO and other NEO compensation in

2008. The group was chosen because it is reflective of the market in which we operate for executive talent

and because of each of the companys’ relative leadership position in their sector, relative size as measured

by revenues, relative complexity of their business, and in some cases their global reach. Periodically the

Committee, with Meridian’s assistance, reviews the composition of the peer group to ensure the companies

remain relevant for comparative purposes.

Proxy Statement

As a result of the Committee’s review in March 2011, four new companies (H.J. Heinz, Nike,

Starbucks and Unilever USA) were added and six companies were removed from the peer group, as shown

below. Although the Committee prefers to keep the peer group substantially the same from year to year,

the companies deleted from the peer group represented companies whose data was not as readily available

42