Pizza Hut 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

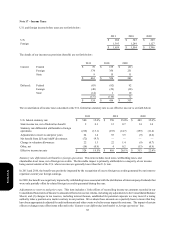

2011 Activity

2010 Activity

Beginning

Balance

$150

$173

Expense

55

46

Payments

(65)

(69)

Ending

Balance

$ 140

$ 150

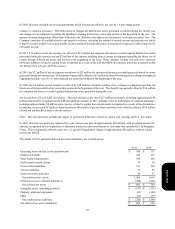

In the U.S. and in certain other countries, we are also self-insured for healthcare claims and long-term disability for eligible

participating employees subject to certain deductibles and limitations. We have accounted for our retained liabilities for property

and casualty losses, healthcare and long-term disability claims, including reported and incurred but not reported claims, based on

information provided by independent actuaries.

Due to the inherent volatility of actuarially determined property and casualty loss estimates, it is reasonably possible that we could

experience changes in estimated losses which could be material to our growth in quarterly and annual Net income. We believe

that we have recorded reserves for property and casualty losses at a level which has substantially mitigated the potential negative

impact of adverse developments and/or volatility.

Legal Proceedings

We are subject to various claims and contingencies related to lawsuits, real estate, environmental and other matters arising in the

normal course of business.

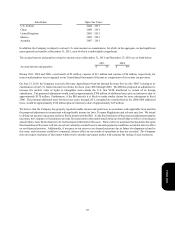

On November 26, 2001, Kevin Johnson, a former Long John Silver's (“LJS”) restaurant manager, filed a collective action against

LJS in the United States District Court for the Middle District of Tennessee alleging violation of the Fair Labor Standards Act

(“FLSA”) on behalf of himself and allegedly similarly-situated LJS general and assistant restaurant managers. Johnson alleged

that LJS violated the FLSA by perpetrating a policy and practice of seeking monetary restitution from LJS employees, including

Restaurant General Managers (“RGMs”) and Assistant Restaurant General Managers (“ARGMs”), when monetary or property

losses occurred due to knowing and willful violations of LJS policies that resulted in losses of company funds or property, and

that LJS had thus improperly classified its RGMs and ARGMs as exempt from overtime pay under the FLSA. Johnson sought

overtime pay, liquidated damages, and attorneys' fees for himself and his proposed class.

LJS moved the Tennessee district court to compel arbitration of Johnson's suit. The district court granted LJS's motion on June

7, 2004, and the United States Court of Appeals for the Sixth Circuit affirmed on July 5, 2005.

On December 19, 2003, while the arbitrability of Johnson's claims was being litigated, former LJS managers Erin Cole and Nick

Kaufman, represented by Johnson's counsel, initiated arbitration with the American Arbitration Association (the “Cole

Arbitration”). The Cole Claimants sought a collective arbitration on behalf of the same putative class as alleged in the Johnson

lawsuit and alleged the same underlying claims.

On June 15, 2004, the arbitrator in the Cole Arbitration issued a Clause Construction Award, finding that LJS's Dispute Resolution

Policy did not prohibit Claimants from proceeding on a collective or class basis. LJS moved unsuccessfully to vacate the Clause

Construction Award in federal district court in South Carolina. On September 19, 2005, the arbitrator issued a Class Determination

Award, finding, inter alia, that a class would be certified in the Cole Arbitration on an “opt-out” basis, rather than as an “opt-in”

collective action as specified by the FLSA.

On January 20, 2006, the district court denied LJS's motion to vacate the Class Determination Award and the United States Court

of Appeals for the Fourth Circuit affirmed the district court's decision on January 28, 2008. A petition for a writ of certiorari filed

in the United States Supreme Court seeking a review of the Fourth Circuit's decision was denied on October 7, 2008.

An arbitration hearing on liability with respect to the alleged restitution policy and practice for the period beginning in late 1998

through early 2002 concluded in June, 2010. On October 11, 2010, the arbitrator issued a partial interim award for the first phase

of the three-phase arbitration finding that, for the period from late 1998 to early 2002, LJS had a policy and practice of making

impermissible deductions from the salaries of its RGMs and ARGMs.

On September 15, 2011, the parties entered into a Memorandum of Understanding setting forth the terms upon which the parties

had agreed to settle this matter. On October 5, 2011, the arbitrator granted the parties' Joint Motion for Preliminary Approval of

the Settlement. On December 12, 2011, the arbitrator granted final approval of the settlement. The payments associated with the

settlement have been made. As the settlement was largely consistent with our previous reserve position, the settlement did not

significantly impact our results of operations in the year ended December 31, 2011.

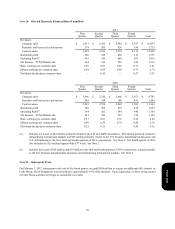

Form 10-K