Pizza Hut 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

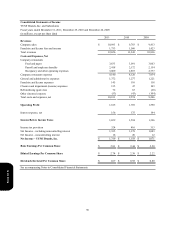

59

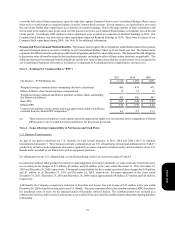

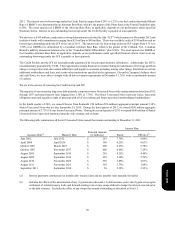

Accounts and notes receivable

Allowance for doubtful accounts

Accounts and notes receivable, net

2011

$ 308

(22)

$ 286

2010

$ 289

(33)

$ 256

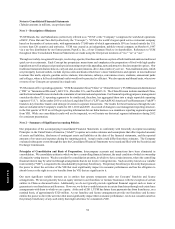

Our financing receivables primarily consist of notes receivables and direct financing leases with franchisees which we enter into

from time to time. As these receivables primarily relate to our ongoing business agreements with franchisees and licensees, we

consider such receivables to have similar risk characteristics and evaluate them as one collective portfolio segment and class for

determining the allowance for doubtful accounts. We monitor the financial condition of our franchisees and licensees and record

provisions for estimated losses on receivables when we believe it probable that our franchisees or licensees will be unable to make

their required payments. Balances of notes receivable and direct financing leases due within one year are included in Accounts

and Notes Receivable while amounts due beyond one year are included in Other assets. Amounts included in Other assets totaled

$15 million (net of an allowance of $4 million) and $57 million (net of an allowance of $30 million) at December 31, 2011 and

December 25, 2010, respectively. The decline was primarily due to direct financing lease receivables sold as part of the LJS and

A&W divestitures. Financing receivables that are ultimately deemed to be uncollectible, and for which collection efforts have

been exhausted, are written off against the allowance for doubtful accounts. Interest income recorded on financing receivables

has traditionally been insignificant.

Inventories. We value our inventories at the lower of cost (computed on the first-in, first-out method) or market.

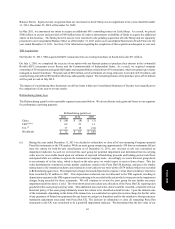

Property, Plant and Equipment. We state property, plant and equipment at cost less accumulated depreciation and

amortization. We calculate depreciation and amortization on a straight-line basis over the estimated useful lives of the assets as

follows: 5 to 25 years for buildings and improvements, 3 to 20 years for machinery and equipment and 3 to 7 years for capitalized

software costs. As discussed above, we suspend depreciation and amortization on assets related to restaurants that are held for

sale.

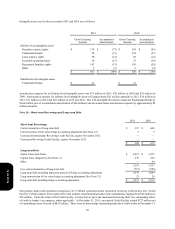

Leases and Leasehold Improvements. The Company leases land, buildings or both for nearly 6,200 of its restaurants

worldwide. Lease terms, which vary by country and often include renewal options, are an important factor in determining the

appropriate accounting for leases including the initial classification of the lease as capital or operating and the timing of recognition

of rent expense over the duration of the lease. We include renewal option periods in determining the term of our leases when

failure to renew the lease would impose a penalty on the Company in such an amount that a renewal appears to be reasonably

assured at the inception of the lease. The primary penalty to which we are subject is the economic detriment associated with the

existence of leasehold improvements which might be impaired if we choose not to continue the use of the leased property. Leasehold

improvements, which are a component of buildings and improvements described above, are amortized over the shorter of their

estimated useful lives or the lease term. We generally do not receive leasehold improvement incentives upon opening a store that

is subject to a lease.

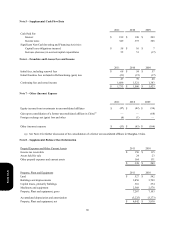

We expense rent associated with leased land or buildings while a restaurant is being constructed whether rent is paid or we are

subject to a rent holiday. Additionally, certain of the Company's operating leases contain predetermined fixed escalations of the

minimum rent during the lease term. For leases with fixed escalating payments and/or rent holidays, we record rent expense on

a straight-line basis over the lease term, including any option periods considered in the determination of that lease term. Contingent

rentals are generally based on sales levels in excess of stipulated amounts, and thus are not considered minimum lease payments

and are included in rent expense when attainment of the contingency is considered probable (e.g. when Company sales occur).

Internal Development Costs and Abandoned Site Costs. We capitalize direct costs associated with the site acquisition and

construction of a Company unit on that site, including direct internal payroll and payroll-related costs. Only those site-specific

costs incurred subsequent to the time that the site acquisition is considered probable are capitalized. If we subsequently make a

determination that a site for which internal development costs have been capitalized will not be acquired or developed, any

previously capitalized internal development costs are expensed and included in G&A expenses.

Goodwill and Intangible Assets. From time to time, the Company acquires restaurants from one of our Concept’s franchisees

or acquires another business. Goodwill from these acquisitions represents the excess of the cost of a business acquired over the

net of the amounts assigned to assets acquired, including identifiable intangible assets and liabilities assumed. Goodwill is not

amortized and has been assigned to reporting units for purposes of impairment testing. Our reporting units are our operating

segments in the U.S. (see Note 18), our YRI business units (typically individual countries) and our China Division brands. We

evaluate goodwill for impairment on an annual basis or more often if an event occurs or circumstances change that indicate

Form 10-K