Pizza Hut 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

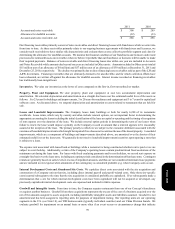

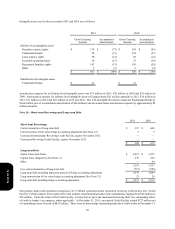

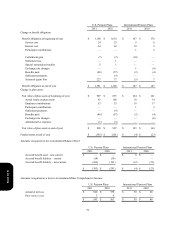

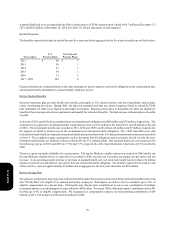

Intangible assets, net for the years ended 2011 and 2010 are as follows:

Definite-lived intangible assets

Franchise contract rights

Trademarks/brands

Lease tenancy rights

Favorable operating leases

Reacquired franchise rights

Other

Indefinite-lived intangible assets

Trademarks/brands

2011

Gross Carrying

Amount

$ 130

28

58

29

167

5

$ 417

$ 31

Accumulated

Amortization

$(77)

(12)

(12)

(13)

(33)

(2)

$(149)

2010

Gross Carrying

Amount

$ 163

234

56

27

143

5

$ 628

$ 31

Accumulated

Amortization

$(83)

(57)

(12)

(10)

(20)

(2)

$(184)

Amortization expense for all definite-lived intangible assets was $31 million in 2011, $29 million in 2010 and $25 million in

2009. Amortization expense for definite-lived intangible assets will approximate $21 million annually in 2012, $19 million in

2013, $17 million in 2014 and $16 million in 2015 and 2016. The LJS and A&W divestitures impacted Trademarks/brands by

$164 million (net of accumulation amortization of $48 million) and decreased future amortization expense by approximately $8

million annually.

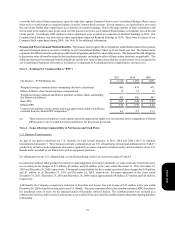

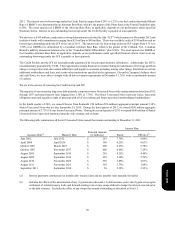

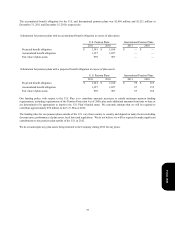

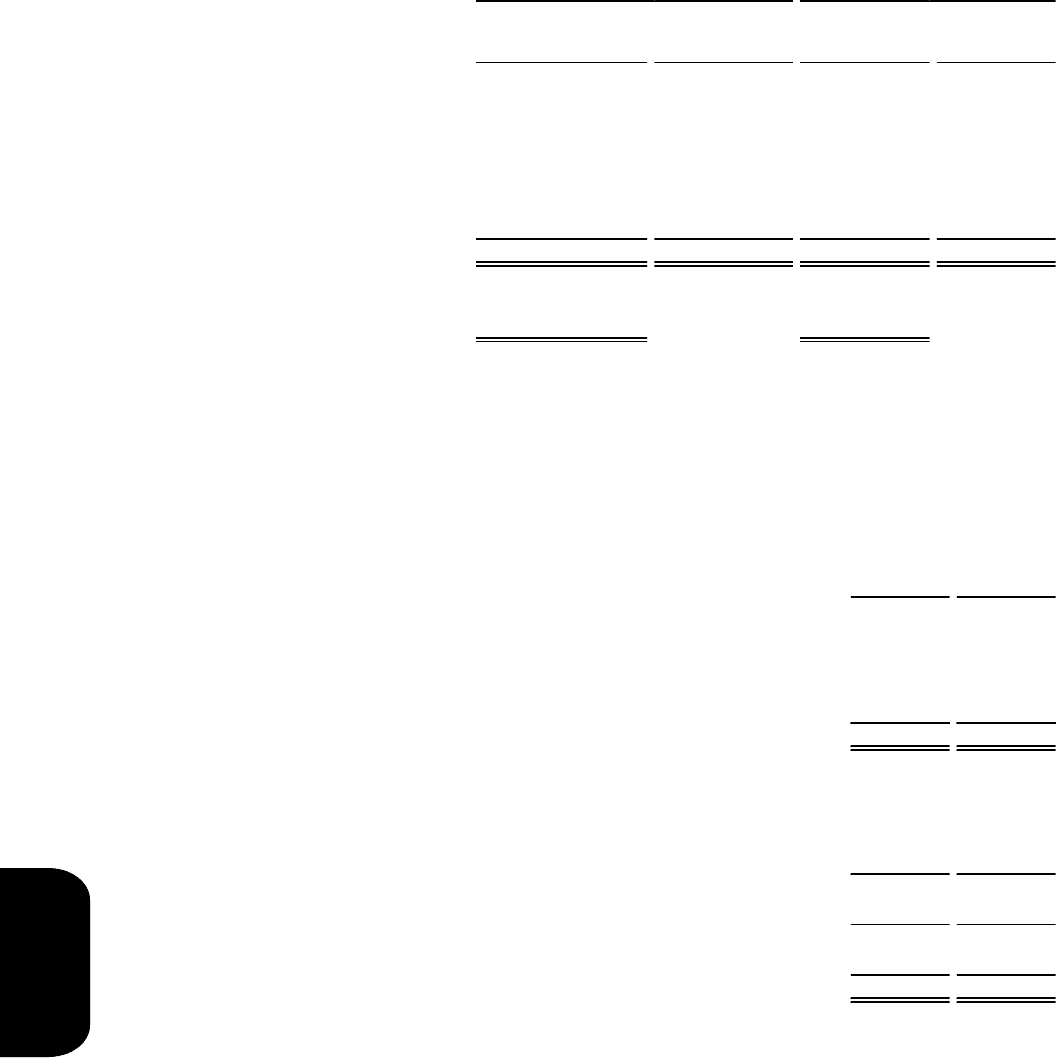

Note 10 – Short-term Borrowings and Long-term Debt

Short-term Borrowings

Current maturities of long-term debt

Current portion of fair value hedge accounting adjustment (See Note 12)

Unsecured International Revolving Credit Facility, expires November 2012

Unsecured Revolving Credit Facility, expires November 2012

Long-term Debt

Senior Unsecured Notes

Capital lease obligations (See Note 11)

Other

Less current maturities of long-term debt

Long-term debt excluding long-term portion of hedge accounting adjustment

Long-term portion of fair value hedge accounting adjustment (See Note 12)

Long-term debt including hedge accounting adjustment

2011

$ 315

5

—

—

$ 320

$ 3,012

279

—

3,291

(315)

2,976

21

$ 2,997

2010

$ 668

5

—

—

$ 673

$ 3,257

236

64

3,557

(668)

2,889

26

$ 2,915

Our primary bank credit agreement comprises a $1.15 billion syndicated senior unsecured revolving credit facility (the “Credit

Facility”) which matures in November 2012 and includes 24 participating banks with commitments ranging from $20 million to

$93 million. Under the terms of the Credit Facility, we may borrow up to the maximum borrowing limit, less outstanding letters

of credit or banker’s acceptances, where applicable. At December 31, 2011, our unused Credit Facility totaled $727 million net

of outstanding letters of credit of $423 million. There were no borrowings outstanding under the Credit Facility at December 31,

Form 10-K