Pizza Hut 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16MAR201218540977

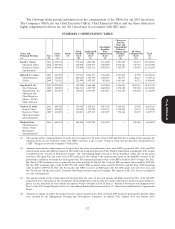

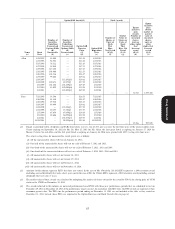

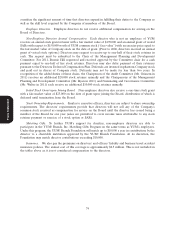

OPTION EXERCISES AND STOCK VESTED

The table below shows the number of shares of YUM common stock acquired during 2011 upon

exercise of stock options and vesting of stock awards in the form of RSUs and PSUs, each before payment

of applicable withholding taxes and broker commissions.

Option Awards Stock Awards

Number of Shares Value Realized Number of Shares Value realized

Acquired on Exercise on Exercise Acquired on Vesting on Vesting

Name (#) ($) (#)(1) ($)

(a) (b) (c) (d) (e)

Novak 824,574 37,862,433 47,675 2,813,294

Carucci 61,808 2,556,323 43,347 2,280,642

Su 171,640 7,488,629 19,973 1,178,600

Allan 114,600 4,585,547 19,973 1,178,600

Pant — — 48,543 2,484,704

(1) These amounts represent RSUs and PSUs that became vested in 2011. The shares represented by

RSUs will be distributed in accordance with the deferral election made by the NEO under the EID

Program. See page 68 for a discussion of the EID Program.

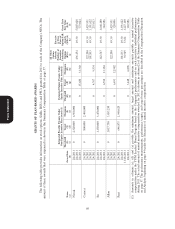

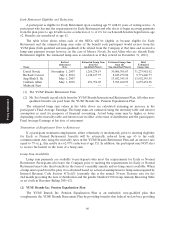

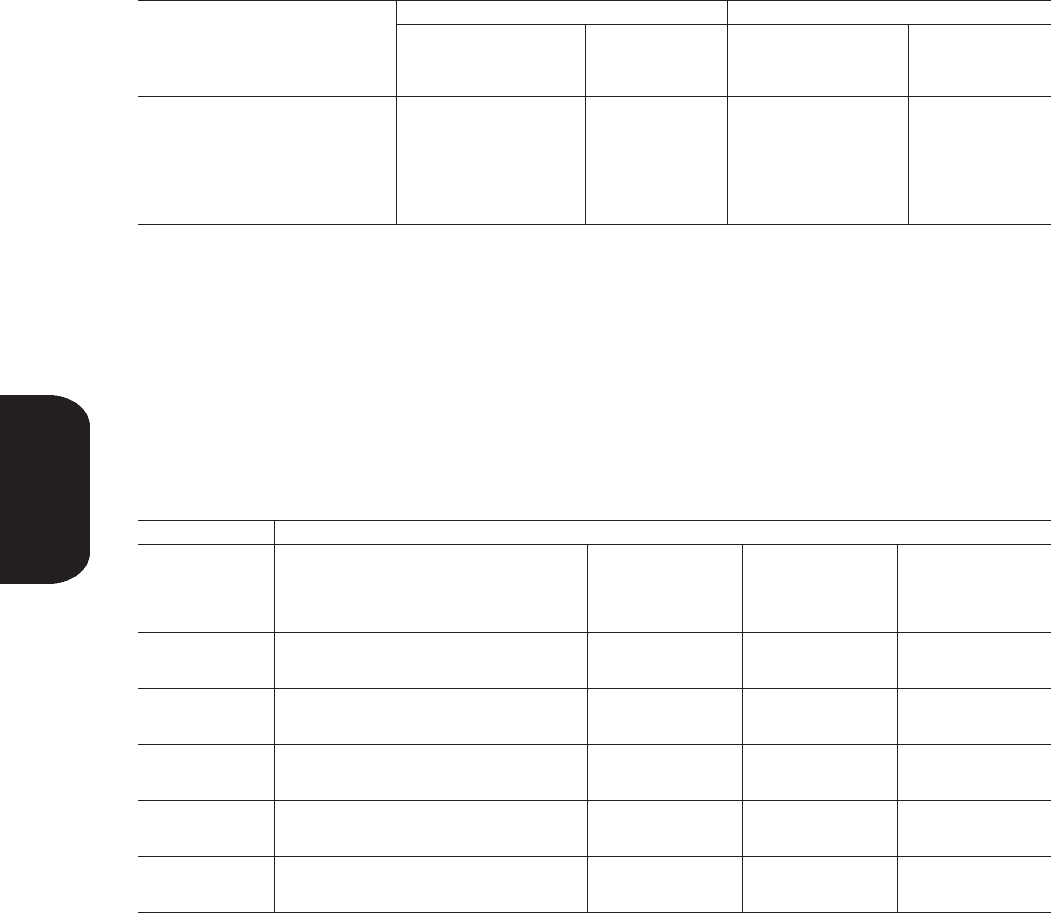

PENSION BENEFITS

The table below shows the present value of accumulated benefits payable to each of the NEOs,

including the number of years of service credited to each such NEO, under the YUM! Brands Retirement

Plan (‘‘Retirement Plan’’) and the YUM! Brands, Inc. Pension Equalization Plan (‘‘Pension Equalization

Plan’’) or the YUM! Brands International Retirement Plan determined using interest rate and mortality

rate assumptions consistent with those used in the Company’s financial statements.

2011 Fiscal Year Pension Benefits Table

Number of Present Value of Payments

Years of Accumulated During

Proxy Statement

Credited Service Benefit(4) Last Fiscal Year

Name Plan Name (#) ($) ($)

(a) (b) (c) (d) (e)

Novak Qualified Retirement Plan(1) 25 1,121,430 —

Pension Equalization Plan(2) 25 26,511,550 —

Carucci Qualified Retirement Plan 27 772,653 —

Pension Equalization Plan 27 8,100,607 —

Su International Retirement

Plan(3) 22 12,238,452 —

Allan* Qualified Retirement Plan 8 561,427 —

Pension Equalization Plan 8 4,839,814 —

Pant** Qualified Retirement Plan —

Pension Equalization Plan —

* Under these plans, Mr. Allan only receives credited service for his eligible U.S. based service.

Mr. Allan was based outside the U.S. for 11 years. He did not accrue a benefit under any retirement

plan based upon final compensation or years of service as in the case of these plans.

** Mr. Pant is not accruing a benefit under these plans because he was hired after September 30, 2001

and is therefore ineligible for these benefits. Mr. Pant participates in an unfunded, unsecured

64