Pizza Hut 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16MAR201218540977

Early Retirement Eligibility and Reductions

A participant is eligible for Early Retirement upon reaching age 55 with 10 years of vesting service. A

participant who has met the requirements for Early Retirement and who elects to begin receiving payments

from the plan prior to age 62 will receive a reduction of 1⁄12 of 4% for each month benefits begin before age

62. Benefits are unreduced at age 62.

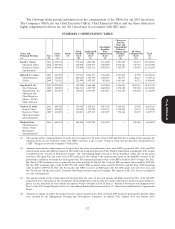

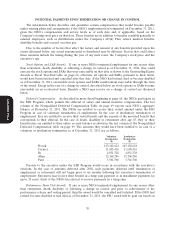

The table below shows when each of the NEOs will be eligible or became eligible for Early

Retirement and the estimated lump sum value of the benefit each participant would receive from the

YUM plans (both qualified and non-qualified) if he retired from the Company at that time and received a

lump sum payment (except however, in the case of Messrs. Novak, Su and Allan, who are already Early

Retirement eligible, the estimated lump sum is calculated as if they retired on December 31, 2011).

Earliest Estimated Lump Sum Estimated Lump Sum Total

Retirement from the from the Estimated

Name Date Qualified Plan(1) Non-Qualified Plan(2) Lump Sum

David Novak November 1, 2007 1,269,274.19 30,006,706.83 31,275,981.02

Richard Carucci July 1, 2012 1,148,127.75 8,623,279.02 9,771,406.77

Jing-Shyh S. Su May 1, 2007 — 13,692,345.55 13,692,345.55

Graham Allan May 1, 2010 691,794.05 5,963,660.93 6,655,454.98

Muktesh Pant — — —

(1) The YUM! Brands Retirement Plan

(2) Mr. Su’s benefit is paid solely from the YUM! Brands International Retirement Plan. All other non-

qualified benefits are paid from the YUM! Brands Inc. Pension Equalization Plan.

The estimated lump sum values in the table above are calculated assuming no increase in the

participant’s Final Average Earnings. The lump sums are estimated using the mortality table and interest

assumption as used for purposes of financial accounting. Actual lump sums may be higher or lower

depending on the mortality table and interest rate in effect at the time of distribution and the participant’s

Final Average Earnings at his date of retirement.

Proxy Statement

Termination of Employment Prior to Retirement

If a participant terminates employment, either voluntarily or involuntarily, prior to meeting eligibility

for Early or Normal Retirement, benefits will be actuarially reduced from age 65 to his early

commencement date using the mortality rates in the YUM! Brands Retirement Plan and an interest rate

equal to 7% (e.g., this results in a 62.97% reduction at age 55). In addition, the participant may NOT elect

to receive his benefit in the form of a lump sum.

Lump Sum Availability

Lump sum payments are available to participants who meet the requirements for Early or Normal

Retirement. Participants who leave the Company prior to meeting the requirements for Early or Normal

Retirement must take their benefits in the form of a monthly annuity and no lump sum is available. When

a lump sum is paid from the plan, it is calculated based on actuarial assumptions for lump sums required by

Internal Revenue Code Section 417(e)(3) (currently this is the annual 30-year Treasury rate for the

2nd month preceding the date of distribution and the gender blended 1994 Group Annuity Reserving Table

as set forth in Revenue Ruling 2001-62).

(2) YUM! Brands Inc. Pension Equalization Plan

The YUM! Brands Inc. Pension Equalization Plan is an unfunded, non-qualified plan that

complements the YUM! Brands Retirement Plan by providing benefits that federal tax law bars providing

66