Pizza Hut 2011 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

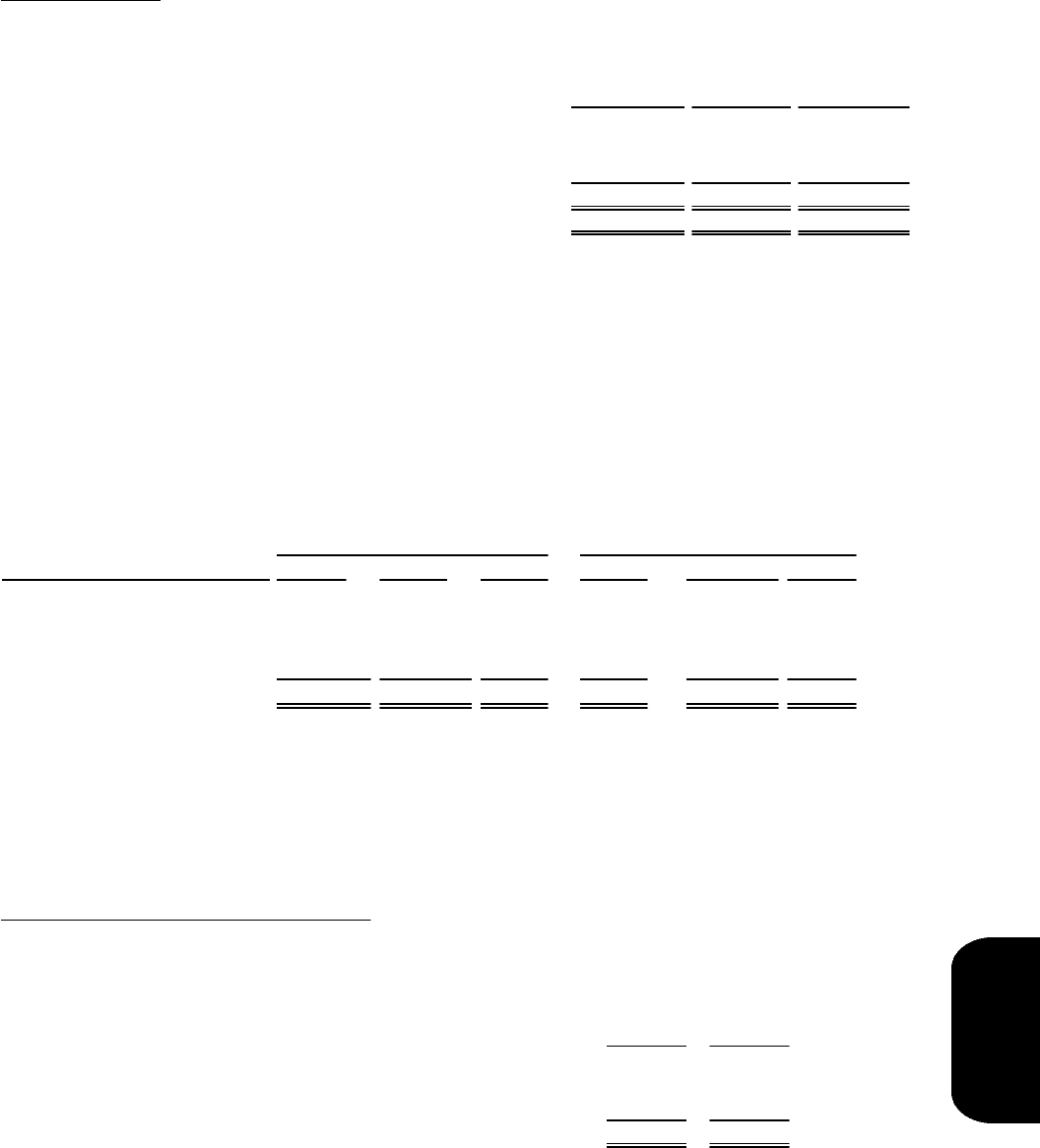

Impact on Net Income

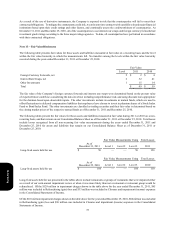

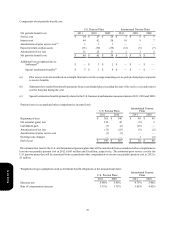

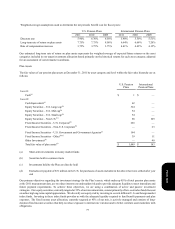

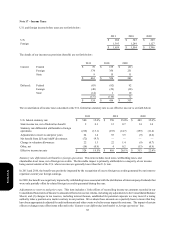

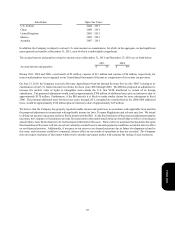

The components of share-based compensation expense and the related income tax benefits are shown in the following table:

Options and SARs

Restricted Stock Units

Performance Share Units

Total Share-based Compensation Expense

Deferred Tax Benefit recognized

EID compensation expense not share-based

2011

$ 49

5

5

$ 59

$ 18

$ 2

2010

$ 40

5

2

$ 47

$ 13

$ 4

2009

$ 48

7

1

$ 56

$ 17

$ 4

Cash received from stock option exercises for 2011, 2010 and 2009, was $59 million, $102 million and $113 million,

respectively. Tax benefits realized on our tax returns from tax deductions associated with stock options and SARs exercised for

2011, 2010 and 2009 totaled $72 million, $82 million and $68 million, respectively.

Note 16 – Shareholders’ Equity

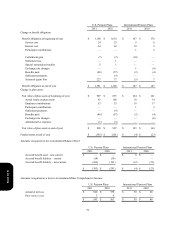

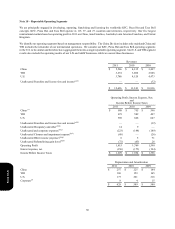

Under the authority of our Board of Directors, we repurchased shares of our Common Stock during 2011 and 2010. All amounts

exclude applicable transaction fees. There were no shares of our Common Stock repurchased during 2009.

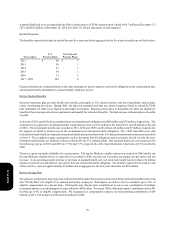

Authorization Date

November 2011

January 2011

March 2010

September 2009

Total

Shares Repurchased

(thousands)

2011

—

10,864

3,441

—

14,305 (a)

2010

—

—

2,161

7,598

9,759 (a)

2009

—

—

—

—

—

Dollar Value of Shares

Repurchased

2011

$ —

562

171

—

$ 733 (a)

2010

$ —

—

107

283

$ 390 (a)

2009

$ —

—

—

—

$ —

(a) 2011 amount excludes and 2010 amount includes the effect of $19 million in share repurchases (0.4 million shares)

with trade dates prior to the 2010 fiscal year end but cash settlement dates subsequent to the 2010 fiscal year.

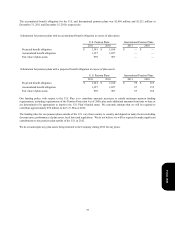

As of December 31, 2011, we have $188 million available for future repurchases under our January 2011 share repurchase

authorization. Additionally, on November 18, 2011, our Board of Directors authorized share repurchases through May 2013 of

up to $750 million (excluding applicable transaction fees) of our outstanding Common Stock. No shares have been repurchased

under the November 2011 authorization as of December 31, 2011.

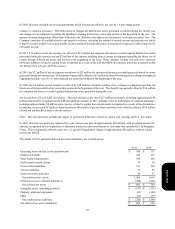

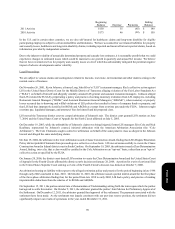

Accumulated Other Comprehensive Income (Loss) – Comprehensive income is Net Income plus certain other items that are

recorded directly to Shareholders’ Equity. The following table gives further detail regarding the composition of accumulated other

comprehensive loss at December 31, 2011 and December 25, 2010. Refer to Note 14 for additional information about our pension

and post-retirement plan accounting and Note 12 for additional information about our derivative instruments.

Foreign currency translation adjustment

Pension and post-retirement losses, net of tax

Net unrealized losses on derivative instruments, net of tax

Total accumulated other comprehensive loss

2011

$ 140

(375)

(12)

$(247)

2010

$ 55

(269)

(13)

$(227)

Form 10-K