Pizza Hut 2011 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

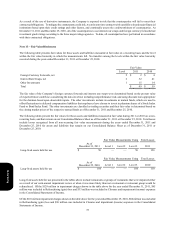

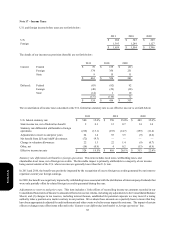

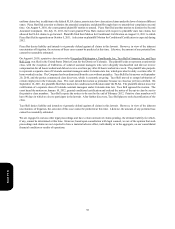

Note 17 – Income Taxes

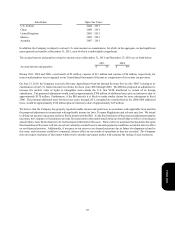

U.S. and foreign income before taxes are set forth below:

U.S.

Foreign

2011

$ 266

1,393

$ 1,659

2010

$ 345

1,249

$ 1,594

2009

$ 269

1,127

$ 1,396

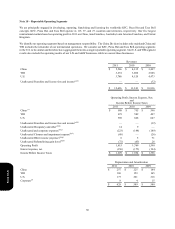

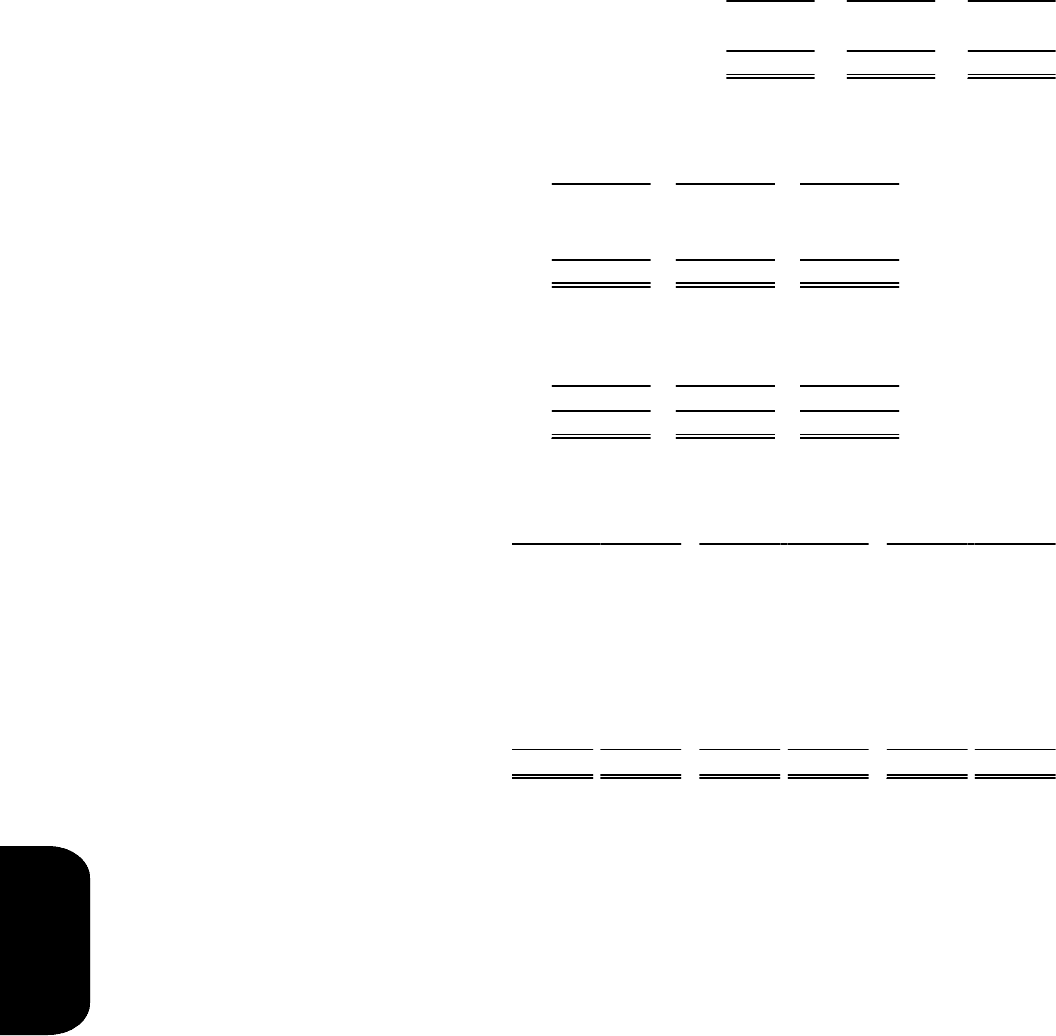

The details of our income tax provision (benefit) are set forth below:

Current:

Deferred:

Federal

Foreign

State

Federal

Foreign

State

2011

$ 78

374

9

$ 461

(83)

(40)

(14)

(137)

$ 324

2010

$ 155

356

15

$ 526

(82)

(29)

1

(110)

$ 416

2009

$(21)

251

11

241

92

(30)

10

72

$ 313

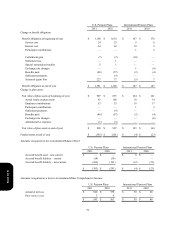

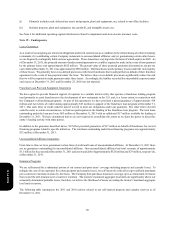

The reconciliation of income taxes calculated at the U.S. federal tax statutory rate to our effective tax rate is set forth below:

U.S. federal statutory rate

State income tax, net of federal tax benefit

Statutory rate differential attributable to foreign

operations

Adjustments to reserves and prior years

Net benefit from LJS and A&W divestitures

Change in valuation allowances

Other, net

Effective income tax rate

2011

$ 580

2

(218)

24

(72)

22

(14)

$ 324

35.0%

0.1

(13.1)

1.4

(4.3)

1.3

(0.9)

19.5%

2010

$ 558

12

(235)

55

—

22

4

$ 416

35.0%

0.7

(14.7)

3.5

—

1.4

0.2

26.1%

2009

$ 489

14

(159)

(9)

—

(9)

(13)

$ 313

35.0%

1.0

(11.4)

(0.6)

—

(0.7)

(0.9)

22.4%

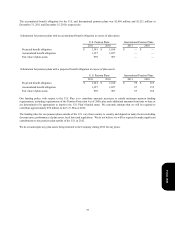

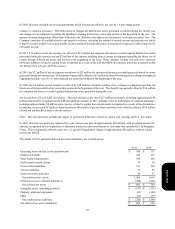

Statutory rate differential attributable to foreign operations. This item includes local taxes, withholding taxes, and

shareholder-level taxes, net of foreign tax credits. The favorable impact is primarily attributable to a majority of our income

being earned outside of the U.S. where tax rates are generally lower than the U.S. rate.

In 2011 and 2010, the benefit was positively impacted by the recognition of excess foreign tax credits generated by our intent to

repatriate current year foreign earnings.

In 2009, the benefit was negatively impacted by withholding taxes associated with the distribution of intercompany dividends that

were only partially offset by related foreign tax credits generated during the year.

Adjustments to reserves and prior years. This item includes: (1) the effects of reconciling income tax amounts recorded in our

Consolidated Statements of Income to amounts reflected on our tax returns, including any adjustments to the Consolidated Balance

Sheets; and (2) changes in tax reserves, including interest thereon, established for potential exposure we may incur if a taxing

authority takes a position on a matter contrary to our position. We evaluate these amounts on a quarterly basis to insure that they

have been appropriately adjusted for audit settlements and other events we believe may impact the outcome. The impact of certain

effects or changes may offset items reflected in the ‘Statutory rate differential attributable to foreign operations’ line.

Form 10-K