Pizza Hut 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

32

Multibrand restaurants are included in the totals above. Multibrand conversions increase the sales and points of distribution for

the second brand added to a restaurant but do not result in an additional unit count. Similarly, a new multibrand restaurant,

while increasing sales and points of distribution for two brands, results in just one additional unit count.

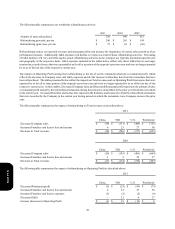

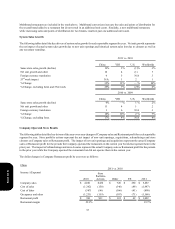

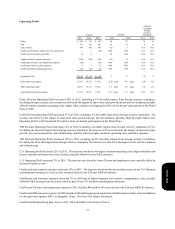

System Sales Growth

The following tables detail the key drivers of system sales growth for each reportable segment by year. Net unit growth represents

the net impact of actual system sales growth due to new unit openings and historical system sales lost due to closures as well as

any necessary rounding.

Same store sales growth (decline)

Net unit growth and other

Foreign currency translation

53rd week impact

% Change

% Change, excluding forex and 53rd week

Same store sales growth (decline)

Net unit growth and other

Foreign currency translation

% Change

% Change, excluding forex

2011 vs. 2010

China

19%

10

6

N/A

35%

29%

2010 vs. 2009

China

6%

11

1

18%

17%

YRI

3%

4

5

1

13%

7%

YRI

—%

4

6

10%

4%

U.S.

(1)%

(1)

N/A

2

— %

(2)%

U.S.

1 %

1

N/A

2 %

N/A

Worldwide

3%

3

3

1

10%

6%

Worldwide

2%

2

3

7%

4%

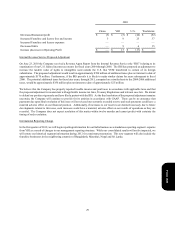

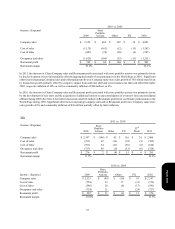

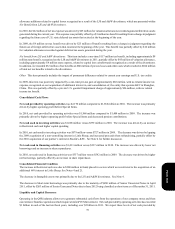

Company-Operated Store Results

The following tables detail the key drivers of the year-over-year changes of Company sales and Restaurant profit for each reportable

segment by year. Store portfolio actions represent the net impact of new unit openings, acquisitions, refranchisings and store

closures on Company sales or Restaurant profit. The impact of new unit openings and acquisitions represent the actual Company

sales or Restaurant profit for the periods the Company operated the restaurants in the current year but did not operate them in the

prior year. The impact of refranchisings and store closures represent the actual Company sales or Restaurant profit for the periods

in the prior year while the Company operated the restaurants but did not operate them in the current year.

The dollar changes in Company Restaurant profit by year were as follows:

China

Income / (Expense)

Company sales

Cost of sales

Cost of labor

Occupancy and other

Restaurant profit

Restaurant margin

2011 vs. 2010

2010

$ 4,081

(1,362)

(587)

(1,231)

$ 901

22.1%

Store

Portfolio

Actions

$436

(150)

(96)

(159)

$31

Other

$ 720

(346)

(166)

(107)

$ 101

FX

$ 250

(89)

(41)

(71)

$ 49

2011

$ 5,487

(1,947)

(890)

(1,568)

$ 1,082

19.7%

Form 10-K