Pizza Hut 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

record the full value of share repurchases, upon the trade date, against Common Stock on our Consolidated Balance Sheet except

when to do so would result in a negative balance in such Common Stock account. In such instances, on a period basis, we record

the cost of any further share repurchases as a reduction in retained earnings. Due to the large number of share repurchases and

the increase in the market value of our stock over the past several years, our Common Stock balance is frequently zero at the end

of any period. Accordingly, $483 million in share repurchases were recorded as a reduction in Retained Earnings in 2011. Our

Common Stock balance was such that no share repurchases impacted Retained Earnings in 2010. There were no shares of our

Common Stock repurchased during 2009. See Note 16 for additional information.

Pension and Post-retirement Medical Benefits. We measure and recognize the overfunded or underfunded status of our pension

and post-retirement plans as an asset or liability in our Consolidated Balance Sheet as of our fiscal year end. The funded status

represents the difference between the projected benefit obligations and the fair value of plan assets. The projected benefit obligation

is the present value of benefits earned to date by plan participants, including the effect of future salary increases, as applicable. The

difference between the projected benefit obligations and the fair value of plan assets that has not previously been recognized in

our Consolidated Statement of Income is recorded as a component of Accumulated other comprehensive income (loss).

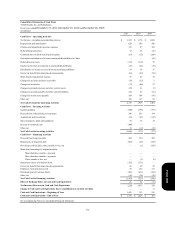

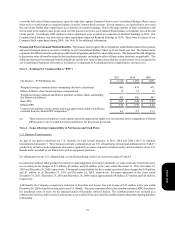

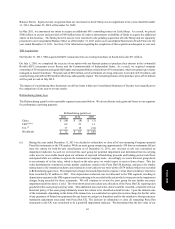

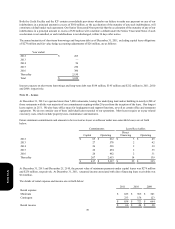

Note 3 – Earnings Per Common Share (“EPS”)

Net Income – YUM! Brands, Inc.

Weighted-average common shares outstanding (for basic calculation)

Effect of dilutive share-based employee compensation

Weighted-average common and dilutive potential common shares outstanding

(for diluted calculation)

Basic EPS

Diluted EPS

Unexercised employee stock options and stock appreciation rights (in millions)

excluded from the diluted EPS computation(a)

2011

$ 1,319

469

12

481

$ 2.81

$ 2.74

4.2

2010

$ 1,158

474

12

486

$ 2.44

$ 2.38

2.2

2009

$ 1,071

471

12

483

$ 2.28

$ 2.22

13.3

(a) These unexercised employee stock options and stock appreciation rights were not included in the computation of diluted

EPS because to do so would have been antidilutive for the periods presented.

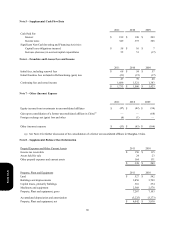

Note 4 – Items Affecting Comparability of Net Income and Cash Flows

U.S. Business Transformation

As part of our plan to transform our U.S. business we took several measures in 2011, 2010 and 2009 ("the U.S. business

transformation measures"). These measures include: continuation of our U.S. refranchising; General and Administrative ("G&A")

productivity initiatives and realignment of resources (primarily severance and early retirement costs); and investments in our U.S.

Brands made on behalf of our franchisees such as equipment purchases.

For information on our U.S. refranchising, see the Refranchising (Gain) Loss section on pages 63 and 64.

In connection with our G&A productivity initiatives and realignment of resources (primarily severance and early retirement costs),

we recorded pre-tax charges of $21 million, $9 million and $16 million in the years ended December 31, 2011, December 25,

2010 and December 26, 2009, respectively. The unpaid current liability for the severance portion of these charges was $18 million

and $1 million as of December 31, 2011 and December 25, 2010, respectively. Severance payments in the years ended

December 31, 2011, December 25, 2010 and December 26, 2009 totaled approximately $4 million, $7 million and $26 million,

respectively.

Additionally, the Company recognized a reduction to Franchise and license fees and income of $32 million in the year ended

December 26, 2009 related to investments in our U.S. Brands. These investments reflected our reimbursements to KFC franchisees

for installation costs of ovens for the national launch of Kentucky Grilled Chicken. The reimbursements were recorded as a

reduction to Franchise and license fees and income as we would not have provided the reimbursements absent the ongoing franchise

relationship.

Form 10-K