Pizza Hut 2011 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

67

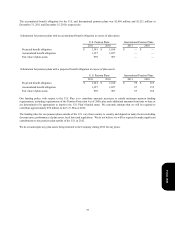

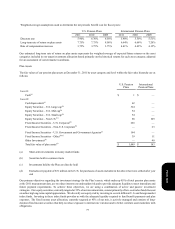

Depreciation and amortization expense related to property, plant and equipment was $599 million, $565 million and $553 million

in 2011, 2010 and 2009, respectively.

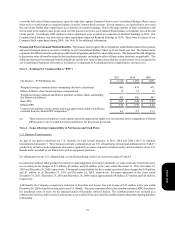

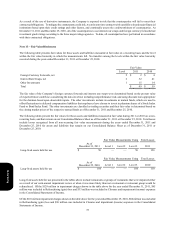

Accounts Payable and Other Current Liabilities

Accounts payable

Accrued capital expenditures

Accrued compensation and benefits

Dividends payable

Accrued taxes, other than income taxes

Other current liabilities

2011

$ 712

229

440

131

112

250

$ 1,874

2010

$ 540

174

357

118

95

318

$ 1,602

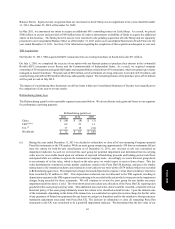

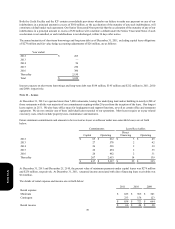

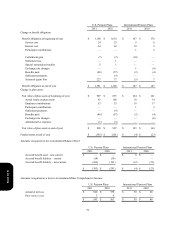

Note 9 – Goodwill and Intangible Assets

The changes in the carrying amount of goodwill are as follows:

Balance as of December 26, 2009

Goodwill, gross

Accumulated impairment losses

Goodwill, net

Acquisitions (a)

Disposals and other, net(b)

Balance as of December 25, 2010

Goodwill, gross

Accumulated impairment losses

Goodwill, net

Acquisitions(c)

Disposals and other, net(b)

Balance as of December 31, 2011(d)

Goodwill, gross

Accumulated impairment losses

Goodwill, net

China

$ 82

—

82

—

3

85

—

85

—

3

88

—

$ 88

YRI

$ 249

(17)

232

37

(17)

269

(17)

252

32

(2)

299

(17)

$ 282

U.S.

$ 352

(26)

326

—

(4)

348

(26)

322

—

(11)

311

—

$ 311

Worldwide

$ 683

(43)

640

37

(18)

702

(43)

659

32

(10)

698

(17)

$ 681

(a) We recorded goodwill in our YRI segment related to the July 1, 2010 exercise of our option with our Russian partner to

purchase their interest in the co-branded Rostik’s-KFC restaurants across Russia and the Commonwealth of Independent

States. See Note 4.

(b) Disposals and other, net includes the impact of foreign currency translation on existing balances and goodwill write-offs

associated with refranchising.

(c) We recorded goodwill in our YRI segment related to the acquisition of 68 stores in South Africa. See Note 4.

(d) As a result of the LJS and A&W divestitures in 2011, we disposed of $26 million of goodwill that was fully impaired in

2009.

Form 10-K