Pizza Hut 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

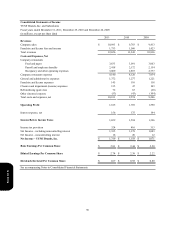

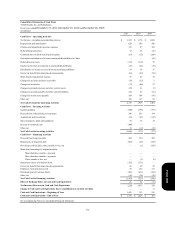

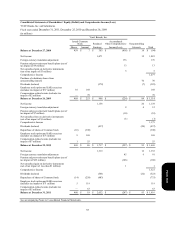

54

Notes to Consolidated Financial Statements

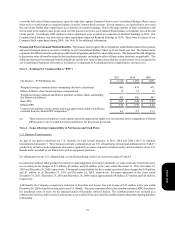

(Tabular amounts in millions, except share data)

Note 1 – Description of Business

YUM! Brands, Inc. and Subsidiaries (collectively referred to as “YUM” or the “Company”) comprises the worldwide operations

of KFC, Pizza Hut and Taco Bell (collectively the “Concepts”). YUM is the world’s largest quick service restaurant company

based on the number of system units, with approximately 37,000 units of which approximately 50% are located outside the U.S.

in more than 120 countries and territories. YUM was created as an independent, publicly-owned company on October 6, 1997

via a tax-free distribution by our former parent, PepsiCo, Inc., of our Common Stock to its shareholders. References to YUM

throughout these Consolidated Financial Statements are made using the first person notations of “we,” “us” or “our.”

Through our widely-recognized Concepts, we develop, operate, franchise and license a system of both traditional and non-traditional

quick service restaurants. Each Concept has proprietary menu items and emphasizes the preparation of food with high quality

ingredients as well as unique recipes and special seasonings to provide appealing, tasty and attractive food at competitive prices. Our

traditional restaurants feature dine-in, carryout and, in some instances, drive-thru or delivery service. Non-traditional units, which

are principally licensed outlets, include express units and kiosks which have a more limited menu and operate in non-traditional

locations like malls, airports, gasoline service stations, train stations, subways, convenience stores, stadiums, amusement parks

and colleges, where a full-scale traditional outlet would not be practical or efficient. We also operate multibrand units, where two

or more of our Concepts are operated in a single unit.

YUM consists of five operating segments: YUM Restaurants China ("China" or “China Division”), YUM Restaurants International

(“YRI” or “International Division”), KFC U.S., Pizza Hut U.S., and Taco Bell U.S. The China Division includes mainland China,

and the International Division includes the remainder of our international operations. For financial reporting purposes, management

considers the three U.S. operating segments to be similar and, therefore, has aggregated them into a single reportable operating

segment (“U.S.”). In December 2011 we sold our Long John Silver's ("LJS") and A&W All American Food Restaurants ("A&W")

brands to key franchise leaders and strategic investors in separate transactions. The results for these businesses through the sale

date are included in the Company's results for 2011, 2010 and 2009. As a result of changes to our management reporting structure,

in the first quarter of 2012 we will begin reporting information for our India business as a standalone reporting segment separated

from YRI. While our consolidated results will not be impacted, we will restate our historical segment information during 2012

for consistent presentation.

Note 2 – Summary of Significant Accounting Policies

Our preparation of the accompanying Consolidated Financial Statements in conformity with Generally Accepted Accounting

Principles in the United States of America (“GAAP”) requires us to make estimates and assumptions that affect reported amounts

of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported

amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. The Company

evaluated subsequent events through the date the Consolidated Financial Statements were issued and filed with the Securities and

Exchange Commission.

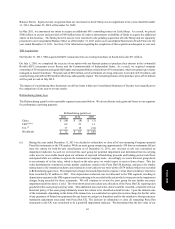

Principles of Consolidation and Basis of Preparation. Intercompany accounts and transactions have been eliminated in

consolidation. We consolidate entities in which we have a controlling financial interest, the usual condition of which is ownership

of a majority voting interest. We also consider for consolidation an entity, in which we have certain interests, where the controlling

financial interest may be achieved through arrangements that do not involve voting interests. Such an entity, known as a variable

interest entity (“VIE”), is required to be consolidated by its primary beneficiary. The primary beneficiary is the entity that possesses

the power to direct the activities of the VIE that most significantly impact its economic performance and has the obligation to

absorb losses or the right to receive benefits from the VIE that are significant to it.

Our most significant variable interests are in entities that operate restaurants under our Concepts’ franchise and license

arrangements. We do not generally have an equity interest in our franchisee or licensee businesses with the exception of certain

entities in China as discussed below. Additionally, we do not typically provide significant financial support such as loans or

guarantees to our franchisees and licensees. However, we do have variable interests in certain franchisees through real estate lease

arrangements with them to which we are a party. At the end of 2011, YUM has future lease payments due from franchisees, on a

nominal basis, of approximately $320 million. As our franchise and license arrangements provide our franchisee and licensee

entities the power to direct the activities that most significantly impact their economic performance, we do not consider ourselves

the primary beneficiary of any such entity that might otherwise be considered a VIE.

Form 10-K