Pizza Hut 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16MAR201218540977

individual has either sole or shared voting power or investment power and also any shares that the

individual has the right to acquire within 60 days through the exercise of any stock option or other right.

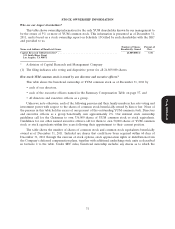

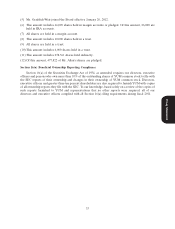

Beneficial Ownership

Number Options/SARS Deferral Additional

of Shares Exercisable Plans Total Underlying

Beneficially within Stock Beneficial Stock

Name Owned(1) 60 Days(2) Units(3) Ownership Units(4) Total

David C. Novak .......... 268,323 2,006,852 1,334,279 3,609,454 1,039,318 4,648,772

David W. Dorman ......... 39,184 18,275 0 57,459 5,254 62,713

Massimo Ferragamo ....... 46,394 23,781 43,130 113,305 27,291 140,596

Mirian M. Graddick-Weir(5) . 0 0 0 0 0 0

J. David Grissom ......... 89,956(6) 23,269 2,055 115,280 0 115,280

Bonnie G. Hill ........... 0 22,975 11,961 34,936 13,643 48,579

Robert Holland, Jr. ....... 59,060 23,781 12,168 95,009 16,403 111,412

Kenneth G. Langone ...... 650,490(7) 7,799 21,398 679,687 19,481 699,168

Jonathan Linen ........... 14,438(8) 18,275 0 32,713 28,400 61,113

Thomas C. Nelson ........ 0 10,841 0 10,841 28,254 39,095

Thomas M. Ryan ......... 19,755(9) 27,213 1,712 48,680 27,987 76,667

Robert D. Walter ......... 52,003 4,792 0 56,795 15,707 72,502

Richard T. Carucci ........ 25,918(10) 522,727 0 548,645 129,259 677,904

Jing-Shyh S. Su ........... 351,632(11) 997,022 0 1,348,654 214,184 1,562,838

Graham D. Allan ......... 490,517(12) 960,816 242,636 1,693,969 0 1,693,969

Muktesh Pant ............ 9,223 218,084 0 227,307 89,458 316,765

All Directors and Executive

Officers as a Group

(23 persons) ........... 2,295,828 6,139,043 1,793,754 10,228,625 2,010,099 12,238,724

(1) Shares owned outright. These amounts include the following shares held pursuant to YUM’s 401(k)

Plan as to which each named person has sole voting power:

Proxy Statement

• Mr. Novak, 31,493 shares

• Mr. Pant, 1,635 shares

• all directors and executive officers as a group, 35,676 shares

(2) The amounts shown include beneficial ownership of shares that may be acquired within 60 days

pursuant to stock options and stock appreciation rights awarded under our employee or director

incentive compensation plans. For stock options, we report shares equal to the number of options

exercisable within 60 days. For SARs we report the shares that would be delivered upon exercise

(which is equal to the number of SARs multiplied by the difference between the fair market value of

our common stock at year-end and the exercise price divided by the fair market value of the stock).

(3) These amounts reflect units denominated as common stock equivalents held in deferred

compensation accounts for each of the named persons under our Directors Deferred Compensation

Plan or our Executive Income Deferral Program. Amounts payable under these plans will be paid in

shares of YUM common stock at termination of employment/directorship or within 60 days if so

elected.

(4) Amounts include units denominated as common stock equivalents held in deferred compensation

accounts which become payable in shares of YUM common stock at a time (a) other than at

termination of employment or (b) after March 1, 2012. For Messrs. Novak and Su, amounts also

include restricted stock units awarded in 2008 and 2010, respectively.

32