Pizza Hut 2011 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

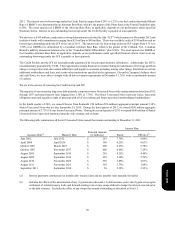

Balance Sheets. Equity income recognized from our investment in Little Sheep was not significant in the years ended December

31, 2011, December 25, 2010 or December 26, 2009.

In May 2011, we announced our intent to acquire an additional 66% controlling interest in Little Sheep. As a result, we placed

$300 million in escrow and provided a $300 million letter of credit to demonstrate availability of funds to acquire the additional

shares in this business. The funds placed in escrow were restricted to the pending acquisition of Little Sheep and are separately

presented in our Consolidated Balance Sheet as of December 31, 2011 and in our Consolidated Statement of Cash Flows for the

year ended December 31, 2011. See Note 21 for information regarding the completion of this acquisition subsequent to year-end.

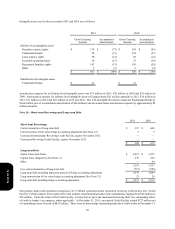

YRI Acquisitions

On October 31, 2011, YRI acquired 68 KFC restaurants from an existing franchisee in South Africa for $71 million.

On July 1, 2010, we completed the exercise of our option with our Russian partner to purchase their interest in the co-branded

Rostik’s-KFC restaurants across Russia and the Commonwealth of Independent States. As a result, we acquired company

ownership of 50 restaurants and gained full rights and responsibilities as franchisor of 81 restaurants, which our partner previously

managed as master franchisee. We paid cash of $60 million, net of settlement of a long-term note receivable of $11 million, and

assumed long-term debt of $10 million which was subsequently repaid. The remaining balance of the purchase price of $12 million

will be paid in cash in July 2012.

The impact of consolidating these businesses on all line-items within our Consolidated Statement of Income was insignificant to

the comparison of our year-over-year results.

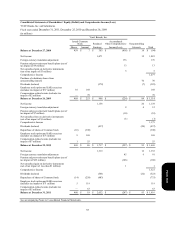

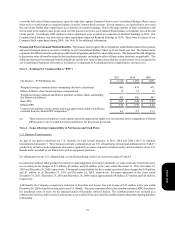

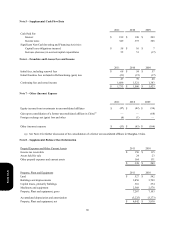

Refranchising (Gain) Loss

The Refranchising (gain) loss by reportable segment is presented below. We do not allocate such gains and losses to our segments

for performance reporting purposes.

China

YRI (a)(b)(c)

U.S. (d)

Worldwide

Refranchising (gain) loss

2011

$ (14)

69

17

$ 72

2010

$ (8)

53

18

$ 63

2009

$(3)

11

(34)

$(26)

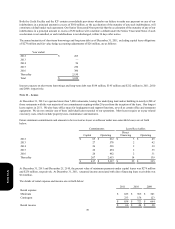

(a) During the year ended December 31, 2011 we decided to refranchise or close all of our remaining Company-operated

Pizza Hut restaurants in the UK market. While an asset group comprising approximately 350 dine-in restaurants did not

meet the criteria for held-for-sale classification as of December 31, 2011, our- decision to sell was considered an

impairment indicator. As such we reviewed this asset group for potential impairment and determined that its carrying

value was not recoverable based upon our estimate of expected refranchising proceeds and holding period cash flows

anticipated while we continue to operate the restaurants as company units. Accordingly, we wrote this asset group down

to our estimate of its fair value, which is based on the sales price we would expect to receive from a buyer. This fair

value determination considered current market conditions, trends in the Pizza Hut UK business, and prices for similar

transactions in the restaurant industry and resulted in a non-cash pre-tax write-down of $74 million which was recorded

to Refranchising (gain) loss. This impairment charge decreased depreciation expense versus what would have otherwise

been recorded by $3 million in 2011. This depreciation reduction was not allocated to the YRI segment, resulting in

depreciation expense in the YRI segment results continuing to be recorded at the rate at which it was prior to the impairment

charges being recorded for these restaurants. We will continue to review the asset group for any further necessary

impairment until the date it is sold. The write-down does not include any allocation of the Pizza Hut UK reporting unit

goodwill in the asset group carrying value. This additional non-cash write-down would be recorded, consistent with our

historical policy, if the asset group ultimately meets the criteria to be classified as held for sale. Upon the ultimate sale

of the restaurants, depending on the form of the transaction, we could also be required to record a charge for the fair value

of any guarantee of future lease payments for any leases we assign to a franchisee and for the cumulative foreign currency

translation adjustment associated with Pizza Hut UK. The decision to refranchise or close all remaining Pizza Hut

restaurants in the UK was considered to be a goodwill impairment indicator. We determined that the fair value of our

Form 10-K