Pizza Hut 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

(“LIBOR”) or is determined by an Alternate Base Rate, which is the greater of the Prime Rate or the Federal Funds Rate plus

0.50%. The exact spread over LIBOR or the Alternate Base Rate, as applicable, depends on our performance under specified

financial criteria. Interest on any outstanding borrowings under the Credit Facility is payable at least quarterly.

We also have a $350 million, syndicated international revolving credit facility (the “ICF”) which matures in November 2012 and

includes six banks with commitments ranging from $35 million to $90 million. We believe the syndication reduces our dependency

on any one bank. There was available credit of $350 million and no borrowings outstanding under the ICF at the end of 2011. The

interest rate for borrowings under the ICF ranges from 0.31% to 1.50% over LIBOR or is determined by a Canadian Alternate

Base Rate, which is the greater of the Citibank, N.A., Canadian Branch’s publicly announced reference rate or the “Canadian

Dollar Offered Rate” plus 0.50%. The exact spread over LIBOR or the Canadian Alternate Base Rate, as applicable, depends

upon YUM’s performance under specified financial criteria. Interest on any outstanding borrowings under the ICF is payable at

least quarterly.

The Credit Facility and the ICF are unconditionally guaranteed by our principal domestic subsidiaries. Additionally, the ICF is

unconditionally guaranteed by YUM. These agreements contain financial covenants relating to maintenance of leverage and fixed

charge coverage ratios and also contain affirmative and negative covenants including, among other things, limitations on certain

additional indebtedness and liens, and certain other transactions specified in the agreement. Given the Company’s strong balance

sheet and cash flows we were able to comply with all debt covenant requirements at December 31, 2011 with a considerable

amount of cushion.

We are in the process of renewing these facilities.

Our remaining long-term debt primarily comprises Senior Unsecured Notes with varying maturity dates from 2012 through 2037

and interest rates ranging from 2.38% to 7.70%. The Senior Unsecured Notes represent senior, unsecured obligations and rank

equally in right of payment with all of our existing and future unsecured unsubordinated indebtedness. Amounts outstanding

under Senior Unsecured Notes were $3.0 billion at December 31, 2011 including $263 million in Senior Unsecured Notes due in

July 2012.

Both the Credit Facility and the ICF contain cross-default provisions whereby our failure to make any payment on any of our

indebtedness in a principal amount in excess of $100 million, or the acceleration of the maturity of any such indebtedness, will

constitute a default under such agreement. Our Senior Unsecured Notes provide that the acceleration of the maturity of any of our

indebtedness in a principal amount in excess of $50 million will constitute a default under the Senior Unsecured Notes if such

acceleration is not annulled, or such indebtedness is not discharged, within 30 days after notice.

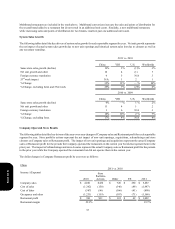

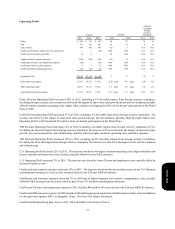

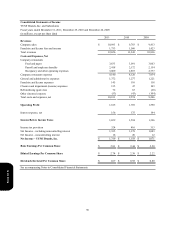

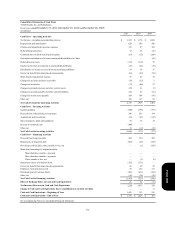

Contractual Obligations

In addition to any discretionary spending we may choose to make, our significant contractual obligations and payments as of

December 31, 2011 included:

Long-term debt obligations(a)

Capital leases(b)

Operating leases(b)

Purchase obligations(c)

Other(d)

Total contractual obligations

Total

$ 4,774

437

5,337

797

72

$ 11,417

Less than 1

Year

$ 414

65

612

695

37

$ 1,823

1-3 Years

$ 339

53

1,116

77

16

$ 1,601

3-5 Years

$ 814

52

956

16

7

$ 1,845

More than 5

Years

$ 3,207

267

2,653

9

12

$ 6,148

(a) Debt amounts include principal maturities and expected interest payments. Rates utilized to determine interest payments

for variable rate debt are based on the LIBOR forward yield curve. Excludes a fair value adjustment of $26 million

included in debt related to interest rate swaps that hedge the fair value of a portion of our debt. See Note 10.

(b) These obligations, which are shown on a nominal basis, relate to nearly 6,200 restaurants. See Note 11.

Form 10-K