Pizza Hut 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

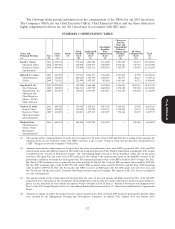

16MAR201218540977

measure or review the percentile ranking of the value realized from any LTI award. Realized value is a

function of the performance of the Company common stock and the length of time a participant holds an

award after vesting.

The Performance Share Plan under our LTI Plan awards performance share units (‘‘PSUs’’) which are

denominated in shares of Company common stock. The PSU awards provide for the distribution of a

number of shares of Company common stock based on the 3-year compound annual growth rate

(‘‘CAGR’’) of the Company’s EPS adjusted to exclude special items believed to be distortive of

consolidated results on a year-over-year basis. The target grant value is set based on a value equal to 33%

of the NEO’s annual bonus target. The Committee continued the Performance Share Plan for 2011 for

each NEO. The performance period covers 2011-2013 fiscal years and will be leveraged up or down based

on the 3-year CAGR EPS performance against a target of 10%. The potential payout range is 0 - 200% of

the target number of shares granted with no payout if CAGR EPS is less than 7% and a 200% payout if

CAGR EPS is at or above 16%. Dividend equivalents will accrue during the performance cycle but will be

distributed in shares only in the same proportion and at the same time as the original PSUs are earned. If

no PSUs are earned, no dividend equivalents will be paid. The PSUs are eligible for deferral under the

Executive Income Deferral Plan. The target, threshold and maximum potential value of these awards for

each NEO are described at page 60.

From time to time and in addition to the regular annual grant, Chairman’s Award stock option or

SAR grants are made to selected employees in recognition of superlative performance and extraordinary

impact on business results. In the case of employees below the Senior Leadership Team Level, these

awards are made at the discretion of the CEO within guidelines set by the Committee. Awards to

executives on the Senior Leadership Team must be approved by the Committee. These SARs or stock

options may vest in their entirety after four or five years or 25% per year over four years. In 2011, in

addition to their regular grants, Messrs. Carucci and Pant each received a Chairman’s Award grant of stock

appreciation rights with a grant date fair value of approximately $1.2 million. Mr. Carucci’s award was

based on the Committee’s subjective assessment of the consistently superior financial performance of the

Company in the areas of total shareholder return, return on net assets, EPS growth and operating income

growth under his leadership. Mr. Pant’s award, granted at year-end, was based on the Committee’s

subjective assessment of the continued strong performance of YRI, his position as a senior leader of the

Proxy Statement

Company and as part of his compensation package upon his promotion to President of the International

Division at year end.

Mr. Novak’s long-term incentive compensation is discussed below.

How we Compensate our Chief Executive Officer

Comparative Compensation Data for Mr. Novak

The discussion of the comparative compensation data and peer group used by the Committee for

Mr. Novak begins at page 43. Meridian provided a comprehensive review for the Committee using data

from the peer group.

Mr. Novak’s Compensation

Each year, our Board, under the leadership of the Committee Chairperson, conducts an evaluation of

the performance of our CEO, David Novak. This evaluation includes a review of his:

• leadership pertaining to the achievement of business results

• leadership in the development and implementation of Company strategies

• development of culture, diversity and talent management

48