Pizza Hut 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

Table of contents

-

Page 1

-

Page 2

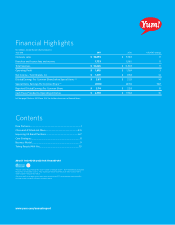

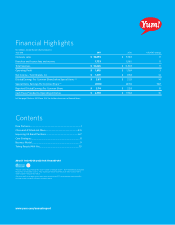

Financial Highlights

(In millions, except for per share amounts) Year-end 2011 2010 % B/(W) change

Company sales Franchise and license fees and income Total revenues Operating Profit Net Income - Yum! Brands, Inc. Diluted Earnings Per Common Share before Special Items Special Items Earnings Per ...

-

Page 3

... position our company for future growth.

14%

EPS Growth*

+7%

System Sales Growth**

+1,561

New Units Opened

$1.3 billion

Net Income

+14%

Increased Dividend

$1.14

Annual Dividend Per Share Rate

David C. Novak

Chairman & Chief Executive Officer, Yum! Brands, Inc.

*

**

Excluding special...

-

Page 4

2

-

Page 5

... Little Sheep's operational model and increasing its market leadership position. We're very excited about the long-term potential of this brand and will make the necessary investments required to ensure its success.

135

Pizza Hut Home Service stores in China.

We're building East Dawning to...

-

Page 6

... our equity presence and adding new units in South Africa. In all, we plan to have restaurants in about 20 African countries by the end of this year. With over a billion people throughout the continent, we know we're just getting started.

101

New restaurants in India in 2011.

We're re-branding...

-

Page 7

... France have the highest average unit volumes in our system. As a result, we continue to build our scale and increase television advertising. France is also the first market where we experimented with a franchise business rental program to drive new unit development and returns. And we've taken this...

-

Page 8

... our U.S. business which clearly under-performed in 2011, with same store sales down 1% and profit down 12%. The good news is we are poised to achieve significantly better results. In fact, we had positive net unit growth at Taco Bell and Pizza Hut in 2011, and we expect this trend to continue...

-

Page 9

...of a great year in 2010. The combination of everyday value, innovative new products and unique bundles has performed well and we'll continue to leverage these strategies going forward. In the U.S., I'm pleased KFC has formed a united front with its franchisees, investing in operations and galvanized...

-

Page 10

...2 Drive aggressive International expansion and build strong brands everywhere. 3 Dramatically improve U.S. brand positions, consistency and returns. 4 Drive industry-leading, long-term Shareholder & Franchisee value.

Our success in executing these strategies has driven our return on invested capital...

-

Page 11

... third quarter of 2011 to refranchise our Pizza Hut UK business. We have started the sale process and our intention is to sell this business in 2012.

At the same time, we are aggressively growing emerging and under-penetrated markets. While our franchise partners fuel the majority of our new unit...

-

Page 12

... our future. I'd like to thank our franchise partners, team members and associates around the globe for their hard work, dedication and commitment to help build Yum! Brands and for Serving the World.

After reading this Annual Report, I hope you will agree we are on the ground floor of global growth...

-

Page 13

...

Drive HWWT2 leadership principles every day! Make it a magnet for the best talent Be an "ABR black belt"...Be a "Know How junkie"

dynamhc, vhbrant brands everywxere whtx one system operathonal excellence as our foundathon

Make Customer Mania come alive for every customer in every restaurant Build...

-

Page 14

... category Drive aggressive, International expansion and build strong brands everywhere Dramatically improve U.S. brand positions, consistency and returns Drive industryleading, long-term shareholder and franchisee value

how we win together (HWWT)2

Believe in All People Be Restaurant and Customer...

-

Page 15

...Novak Chairman of the Board and Chief Executive Officer Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting to Be Held on May 17, 2012-this Notice and proxy statement is available at www.yum.com/investors/investor_materials.asp and the Annual Report on Form 10...

-

Page 16

-

Page 17

...of the close of business on March 19, 2012.

Proxy Statement

Annual Report: A copy of our 2011 Annual Report on Form 10-K is included with this proxy statement. Web site: You may also read the Company's Annual Report and this Notice and proxy statement on our Web site at www.yum.com/annualreport and...

-

Page 18

... at Fiscal Year-End ...Option Exercises and Stock Vested ...Pension Benefits ...Nonqualified Deferred Compensation ...Potential Payments Upon Termination or Change in Control ...DIRECTOR COMPENSATION ...EQUITY COMPENSATION PLAN INFORMATION ...AUDIT COMMITTEE REPORT ...ADDITIONAL INFORMATION ...AUDIT...

-

Page 19

... in order to help lower the cost and reduce the environmental impact of the Annual Meeting. Who may attend the Annual Meeting? The Annual Meeting is open to all shareholders of record as of close of business on March 19, 2012, or their duly appointed proxies. Seating is limited and admission is...

-

Page 20

...on Executive Compensation; and • Two (2) shareholder proposals. We will also consider other business that properly comes before the meeting. How does the Board of Directors recommend that I vote? Our Board of Directors recommends that you vote your shares: • ''FOR'' each of the nominees named in...

-

Page 21

... Web site (www.proxyvote.com). Votes submitted through the Internet or by telephone through the Broadridge program must be received by 11:59 p.m., Eastern Daylight Saving Time, on May 16, 2012. Can I vote at the Annual Meeting? Shares registered directly in your name as the shareholder of record...

-

Page 22

... have the authority under the New York Stock Exchange rules to vote shares for which their customers do not provide voting instructions on certain ''routine'' matters. The proposal to ratify the selection of KPMG LLP as our independent auditors for fiscal year 2012 is considered a routine matter for...

-

Page 23

... results? The Company will announce the voting results of the Annual Meeting on a Current Report on Form 8-K within four business days of the Annual Meeting. What if other matters are presented for consideration at the Annual Meeting? As of the date of this proxy statement, our management knows of...

-

Page 24

... independent under the rules of the New York Stock Exchange (''NYSE''). How often did the Board meet in fiscal 2011? The Board of Directors met six times during fiscal 2011. Each director attended at least 75% of the meetings of the Board and the committees of which he or she was a member and that...

-

Page 25

...the rules issued thereunder, including the requirements of the NYSE. Each charter is available on the Company's Web site at www.yum.com/investors/governance/charters.asp. • Corporate Governance Principles. The Board of Directors has documented its corporate governance guidelines in the YUM! Brands...

-

Page 26

information and procedures for employees to report ethical or accounting concerns, misconduct or violations of the Code in a confidential manner. The Code of Conduct applies to the Board of Directors and all employees of the Company, including the principal executive officer, the principal financial...

-

Page 27

... at all levels that align team performance, individual performance, customer satisfaction and shareholder return, emphasize long-term incentives and require executives to personally invest in Company stock. In 2012, the Management Planning and Development Committee of the Board of Directors oversaw...

-

Page 28

... by the Board, require that we meet the listing standards of the NYSE. The full text of the Principles can be found on the Company's Web site (www.yum.com/investors/governance/principles.asp).

Proxy Statement

Pursuant to the Principles, the Board undertook its annual review of director independence...

-

Page 29

... members of management and/or the Board of Directors with respect to all concerns it receives. The full text of our Policy on Reporting of Concerns Regarding Accounting and Other Matters is available on our Web site at www.yum.com/investors/governance/complaint.asp.

16MAR201218

Proxy Statement...

-

Page 30

... the annual audited financial statements and results of the audit with management and the independent auditors • Reviews the Company's accounting and financial reporting principles and practices including any significant changes • Advises the Board with respect to Company policies and procedures...

-

Page 31

... of the listing standards of the NYSE.

Name of Committee and Members

Functions of the Committee

Number of Meetings in Fiscal 2011

Executive/Finance: David C. Novak, Chair J. David Grissom Kenneth G. Langone How are directors compensated? Employee Directors. Board of Directors.

• Exercises all...

-

Page 32

... number of shares of Company common stock and expects non-management directors to retain shares acquired as compensation as a director until at least 12 months following their departure from the Board. YUM directors receive a significant portion of their annual compensation in stock. The Company...

-

Page 33

... demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to YUM and our Board. Finally, we value their significant experience on other public company boards of directors and board committees. Information about the number of shares of common stock...

-

Page 34

... international sales and distribution business • Expertise in branding, marketing, sales and international business development • Public company directorship and committee experience • Independent of Company

Proxy Statement

Mirian M. Graddick-Weir Age 57 Director since January 2012 Executive...

-

Page 35

... to 2010. Specific qualifications, experience, skills and expertise: • Operating and management experience, including as chairman of private investment firms and chief executive officer of a financial institution • Expertise in finance, accounting and public company leadership • Public company...

-

Page 36

... and chief executive officer of global travel-related services company • Expertise in finance, marketing and international business development • Public company directorship and committee experience • Independent of Company

16MAR201218540977

Proxy Statement

Thomas C. Nelson Age 49 Director...

-

Page 37

... KFC and Pizza Hut. Specific qualifications, experience, skills and expertise: • Operating and management experience, including as president of the Company's China division • Expertise in marketing and brand development • Expertise in strategic planning and international business development...

-

Page 38

... as chief executive officer, of global healthcare and service provider business • Expertise in finance, business development, business integrations, financial reporting, compliance and controls • Public company directorship and committee experience • Independent of Company

Proxy Statement

If...

-

Page 39

... financial reporting, statutory audits and services rendered in connection with the Company's securities offerings. (2) Audit-related fees for 2011 and 2010 included audits of financial statements of certain employee benefit plans, agreed upon procedures and other attestations. (3) Tax fees for 2011...

-

Page 40

...actual services provided and associated fees, and must promptly report any non-compliance with the pre-approval policy to the Chairperson of the Audit Committee. The complete policy is available on the Company's Web site at www.yum.com/investors/governance/ media/gov_auditpolicy.pdf.

Proxy Statement...

-

Page 41

...Elements • Annual Bonus. The annual bonus program is tied to key financial metrics that are long-term drivers of shareholder value-growth in EPS, operating profit at the business unit level, same store sales and new store growth. • Long Term Incentives. In 2011, 63% of our CEO's targeted pay and...

-

Page 42

.... Our named executive officers do not have employment agreements or guaranteed bonuses. • Clawbacks. Our compensation recovery (''clawback'') policy gives our Board discretion to recover incentive compensation paid to senior management in the event of a restatement of our financial statements due...

-

Page 43

... vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. While this vote is advisory and non-binding on the Company, the Board of Directors and the Management Planning and Development Committee will review the voting results and consider...

-

Page 44

... can best provide the necessary oversight of management. Thus, the California Public Employees' Retirement System's Global Principles of Accountable Corporate Governance recommends that a Company's board should generally be chaired by an independent director, as does the Council of Institutional...

-

Page 45

... of the Board and Chief Executive Officer and requests that the Board Chairman be an independent director who has not previously served as an executive officer of the Company. The Company does not support the proposal. Our Board approaches its work with the belief that good corporate governance...

-

Page 46

... THAT YOU VOTE AGAINST THIS PROPOSAL What vote is required to approve this proposal? Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

16MAR201218540977

Proxy Statement

28

-

Page 47

... Problem: What's Driving Palm Oil Today, Ucsusa.org, June 2011). Due to high levels of continuing deforestation and the burning of peat lands in land clearance, Indonesia is now the 3rd largest emitter of GHGs globally. A 2010 report commissioned by Indonesia's National Development Planning Agency...

-

Page 48

..., the Company requires its suppliers to adhere to all laws and regulations associated with sourcing and purchasing on behalf of the Company. To this end, as described more fully in the Company's 2010 Corporate Social Responsibility Report (located on the Company's website at www.yum.com/CSR), our...

-

Page 49

...each of the executive officers named in the Summary Compensation Table on page 57, and • all directors and executive officers as a group. Unless we note otherwise, each of the following persons and their family members has sole voting and investment power with respect to the shares of common stock...

-

Page 50

... and executive officers as a group, 35,676 shares (2) The amounts shown include beneficial ownership of shares that may be acquired within 60 days pursuant to stock options and stock appreciation rights awarded under our employee or director incentive compensation plans. For stock options, we report...

-

Page 51

...SEC. To our knowledge, based solely on a review of the copies of such reports furnished to YUM and representations that no other reports were required, all of our directors and executive officers complied with all Section 16(a) filing requirements during fiscal 2011.

Proxy Statement

16MAR201218

33

-

Page 52

... Per Share (excluding special items) (''EPS'') of 14%-marking the tenth consecutive year that we exceeded our annual target of at least 10% • Grew worldwide system sales by 7% (prior to foreign currency translation) • Opened a record 1,561 new restaurants outside the United States-the eleventh...

-

Page 53

... cash bonuses, and • Long-term equity compensation consisting of stock options or stock-settled stock appreciation rights (''SARs'') and performance share units (''PSUs''). • Pay for Performance. We emphasize pay-for-performance in order to align executive compensation with our business strategy...

-

Page 54

... Brand Positions, Consistency and Returns • Drive Industry-Leading Long-Term Shareholder and Franchisee Value Our compensation program is designed to support these strategies. For our annual bonus program, the Committee sets performance measures and targets that it believes will help the Company...

-

Page 55

... to be distortive of consolidated results on a year-over-year basis and the initial impact of expensing stock options in 2005. The special items excluded are the same as those excluded in the Company's annual earning releases. Annual Total Shareholder Return Through 12/31/11

86th percentile 86th...

-

Page 56

... percentile for target total compensation (see ''How We Compensate our Chief Executive Officer'', beginning on page 48 for detail) and our other NEOs at the 75th percentile for salary and bonus and above the 50th percentile for equity-based compensation has helped attract and retain top talent and...

-

Page 57

..., Chief Executive Officer-YRI * YUM's Compensation Philosophy YUM's compensation philosophy is reviewed annually by the Committee. Our philosophy is to: • reward performance • pay our restaurant general managers and executives like owners • design pay programs at all levels that align team and...

-

Page 58

...shareholders' returns on their investments Provide tax-advantaged means to accumulate retirement benefits

Cash

Cash

Long-term incentive compensation ...

Stock Appreciation Rights/Stock Options, and Performance Share Units Defined Benefit Plan, Defined Contribution Plan

Retirement benefits ...

We...

-

Page 59

.... During 2011, Meridian did not provide any services to the Company unrelated to executive compensation. Role of Comparative Compensation Data One of the factors used by our Committee in setting executive compensation is an evaluation of how our compensation levels compare to compensation levels for...

-

Page 60

...are added complexities and responsibilities for managing the relationships, arrangements, and overall scope of the enterprise that franchising introduces, in particular, managing product introductions, marketing, driving new unit development, customer satisfaction and overall operations improvements...

-

Page 61

...and target total cash compensation as well as 75th percentile for target total compensation. 2011 Executive Compensation Decisions Base Salary Base salary is designed to compensate our NEOs for their primary roles and responsibilities and to provide a stable level of annual compensation. Market data...

-

Page 62

... also received a base salary increase of $125,000 in December 2011 related to his promotion to Chief Executive Officer of YRI. Mr. Novak's salary is discussed below. The Committee, as part of its annual review of salaries, reviews market data for the peer group. As in prior years, the Committee did...

-

Page 63

... targets are key factors that drive individual and team performance, which will result in increased shareholder value over the long term. These measures are designed to align employee goals with the Company's and individual Divisions' current-year objectives to grow earnings and sales, develop new...

-

Page 64

...TP Target

Novak and Carucci Weighted Average Divisions' Team Factors(1) EPS Growth Total Weighted TP Factor-Yum Su Operating Profit Growth (Before Tax; Excluding Forex) System Sales Growth (Excluding Forex) System Gross New Builds System Customer Satisfaction Total Weighted TP Factor-China Division...

-

Page 65

... stock options and SARs because they emphasize YUM's focus on long-term growth, they reward employees only if the stock price goes up and they align Restaurant General Managers and senior management on the same equity incentive program. The Company believes that this compensation program design...

-

Page 66

... under the Executive Income Deferral Plan. The target, threshold and maximum potential value of these awards for each NEO are described at page 60. From time to time and in addition to the regular annual grant, Chairman's Award stock option or SAR grants are made to selected employees in recognition...

-

Page 67

... the compensation of chief executives in the peer group. Based on this analysis, the Committee approved the following compensation for 2011: Salary Target Bonus Percentage Grant Date Estimated Fair Value of 2011 LTI Awards: 1,450,000 160 7,190,000

The Committee increased Mr. Novak's base salary by...

-

Page 68

...CEO role relative to other executive roles. This comparative market data analyzed over several years supports the differences in salary, annual bonus and long-term incentives. Other Benefits Retirement Benefits We offer competitive retirement benefits through the YUM! Brands Retirement Plan. This is...

-

Page 69

... for 2011. These elements included salary, annual bonuses, long-term incentive awards, value of outstanding equity awards (vested and unvested), and lump sum value of pension at retirement and gains realized from exercising stock options. The Committee will continue to review total compensation at...

-

Page 70

... for our top 600 employees. Our Chief Executive Officer is required to own 336,000 shares of YUM stock or stock equivalents (approximately thirteen times his base salary at the end of fiscal 2011). NEOs (other than Mr. Novak) are expected to attain their ownership targets, equivalent in value to two...

-

Page 71

...'s future success • supporting the compelling business need to retain key employees during uncertain times • providing a powerful retention device during change in control discussions, especially for more senior executives whose equity awards represents a significant portion of their total pay...

-

Page 72

... a new policy in 2007 to limit future severance agreements with NEOs or our other executives. The Committee adopted a policy under which the Company will seek shareholder approval for future severance payments to an NEO if such payments would exceed 2.99 times the sum of (a) the NEO's annual base...

-

Page 73

salary for the first time exceeded $1 million; however, the Committee noted that Mr. Su's compensation is not subject to United States tax rules and therefore the one million dollar limitation does not apply in his case. The 2011 annual bonuses were all paid pursuant to our annual bonus program and ...

-

Page 74

MANAGEMENT PLANNING AND DEVELOPMENT COMMITTEE REPORT The Management Planning and Development Committee of the Board of Directors reports that it has reviewed and discussed with management the section of this proxy statement headed ''Compensation Discussion and Analysis,'' and, on the basis of that ...

-

Page 75

... our Chief Executive Officer, Chief Financial Officer and our three other most highly compensated officers for our 2011 fiscal year in accordance with SEC rules. SUMMARY COMPENSATION TABLE

Change in Pension Value and Non-Equity Nonqualified Incentive Deferred Option/SAR Plan Compensation All Other...

-

Page 76

... the aggregate increase in actuarial present value of age 62 accrued benefits under all actuarial pension plans during the 2011 fiscal year (using interest rate and mortality assumptions consistent with those used in the Company's financial statements). The change in pension value for 2011 is mainly...

-

Page 77

...explained at page 51, this amount represents the Company provided tax reimbursement for China income taxes incurred on deferred income distributions and stock option exercises which exceed the marginal Hong Kong tax rate. These amounts reflect the income each executive was deemed to receive from IRS...

-

Page 78

...The following table provides information on stock options, SARs, RSUs and PSUs granted for 2011 to each of the Company's NEOs. The amount of these awards that were expensed is shown in the Summary Compensation Table at page 57.

16MAR201218540977

Proxy Statement

Name (a)

Grant Date (b)

Estimated...

-

Page 79

... Data'' of the 2011 Annual Report in Notes to Consolidated Financial Statements at Note 15, ''Share-based and Deferred Compensation Plans.''

There can be no assurance that the SARs/stock options will ever be exercised or PSUs paid out (in which case no value will be realized by the executive...

-

Page 80

...2011.

Option/SAR Awards(1) Stock Awards Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($)(3) (i)

Name (a) Novak

Grant Date 1/27/2004 1/28/2005 1/26/2006 1/19/2007 1/24/2008 2/5/2009 2/5/2010 2/4/2011

Number...30/2012 1/23/2013 1/...

-

Page 81

...,616 RSUs represent a 2010 retention award (including accrued dividends) that vests after 5 years. The market value of these awards are calculated by multiplying the number of shares covered by the award by $59.01, the closing price of YUM stock on the NYSE on December 30, 2011. The awards reflected...

-

Page 82

... Plan'') or the YUM! Brands International Retirement Plan determined using interest rate and mortality rate assumptions consistent with those used in the Company's financial statements.

2011 Fiscal Year Pension Benefits Table Number of Present Value of Years of Accumulated Credited Service Benefit...

-

Page 83

... tax qualified and funded basis. Benefit Formula Benefits under the Retirement Plan are based on a participant's Final Average Earnings (subject to the limits under Internal Revenue Code Section 401(a)(17)) and service under the plan. Upon termination of employment, a participant's Normal Retirement...

-

Page 84

... required by Internal Revenue Code Section 417(e)(3) (currently this is the annual 30-year Treasury rate for the 2nd month preceding the date of distribution and the gender blended 1994 Group Annuity Reserving Table as set forth in Revenue Ruling 2001-62). (2) YUM! Brands Inc. Pension Equalization...

-

Page 85

... Statement

Benefits are payable under the same terms and conditions as the Retirement Plan without regard to Internal Revenue Service limitations on amounts of includible compensation and maximum benefits. (4) Present Value of Accumulated Benefits As noted at footnote 5 of the Summary Compensation...

-

Page 86

... provide market rate returns and do not provide for preferential earnings. The S&P 500 index fund, bond market index fund and stable value fund are designed to track the investment return of like-named funds offered under the Company's 401(k) Plan. The YUM! Stock Fund tracks the investment return of...

-

Page 87

Investments in the YUM! Stock Fund are only distributed in shares of Company stock. Under the LRP, participants receive a distribution of their vested account balance following the later to occur of their attainment of age 55 or retirement from the Company.

Executive Contributions in Last FY ($)(1) ...

-

Page 88

... if the NEO's employment had terminated on December 31, 2011, given the NEO's compensation and service levels as of such date and, if applicable, based on the Company's closing stock price on that date. These benefits are in addition to benefits available generally to salaried employees, such as...

-

Page 89

..., assuming target performance. Pension Benefits. The Pension Benefits Table on page 64 describes the general terms of each pension plan in which the NEOs participate, the years of credited service and the present value of the annuity payable to each NEO assuming termination of employment as of...

-

Page 90

... as of December 31, 2011, the following payments, or other benefits would have been made.

Proxy Statement

Novak $ Carucci $ Su $ Allan $ Pant $

16MAR201218540977

Annual Incentive ...Severance Payment ...Outplacement ...Excise Tax and Gross-Up ...Accelerated Vesting of Stock Options and SARs...

-

Page 91

... stock awards and option awards contained in Part II, Item 8, ''Financial Statements and Supplementary Data'' of the 2011 Annual Report in Notes to Consolidated Financial Statements at Note 15, ''Share-based and Deferred Compensation Plans.'' (3) At December 31, 2011, the aggregate number of options...

-

Page 92

... to share ownership requirements. The directors' requirements provide that directors will not sell any of the Company's common stock received as compensation for service on the Board until the director has ceased being a member of the Board for one year (sales are permitted to cover income taxes...

-

Page 93

... 31, 2011, the equity compensation plans under which we may issue shares of stock to our directors, officers and employees under the 1999 Long Term Incentive Plan (''1999 Plan''), the 1997 Long Term Incentive Plan (the ''1997 Plan''), SharePower Plan and Restaurant General Manager Stock Option Plan...

-

Page 94

... RGMs. In addition, the Plan provides incentives to Area Coaches, Franchise Business Leaders and other supervisory field operation positions that support RGMs and have profit and loss responsibilities within a defined region or area. While all non-executive officer employees are eligible to receive...

-

Page 95

... Web site at www.yum.com/investors/governance. What are the responsibilities of the Audit Committee? The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of the Company's financial statements, the adequacy of the Company's system of internal...

-

Page 96

...with KPMG LLP matters relating to its independence, including a review of audit and non-audit fees and the written disclosures and letter received from KPMG LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP's communications with the Committee...

-

Page 97

... directly in their name who received shareholder materials in the mail may elect to receive future annual reports and proxy statements from us and to vote their shares through the Internet instead of receiving copies through the mail. We are offering this service to provide shareholders with added...

-

Page 98

... our proxy statement. These procedures provide that nominations for director nominees and/or an item of business to be introduced at an Annual Meeting of Shareholders must be submitted in writing to our Corporate Secretary at our principal executive offices and you must include information set forth...

-

Page 99

... charter for the Company and its subsidiaries. III. Committee Membership 1. The Committee shall have at least three (3) members at all times, each of whom shall satisfy the applicable independence, experience and financial expertise/literacy requirements of the New York Stock Exchange (''NYSE'') and...

-

Page 100

...financial statements, including analyses of the effects of alternative accounting treatments of financial information within accounting principles generally accepted in the United States of America (''GAAP''); (vi) any management letter provided by the independent auditors and the Company's response...

-

Page 101

... were passed as immaterial or otherwise. Review with management and the General Counsel the Company's system for assessing whether the Company's financial statements, reports and other financial information required to be disseminated to the public and filed with governmental organizations satisfy...

-

Page 102

...-K. Prior to filing the Company's Form 10-Q, review and discuss with the independent auditors and management the Company's quarterly financial statements, the disclosures made under ''Management's Discussion and Analysis of Financial Condition and Results of Operations'' or similar disclosures, and...

-

Page 103

... responsibility: 1. Advise the Board with respect to the Company's policies and procedures regarding compliance with applicable laws and regulations and with the Company's Worldwide Code of Conduct and Policy on Conflict of Interest.

Proxy Statement

2.

Obtain reports from management, the Company...

-

Page 104

... operations and the cash flows of the Company, in compliance with GAAP. This is the responsibility of management and/or the independent auditors. In carrying out these oversight responsibilities, the Committee is not providing any expert or special assurance as to the Company's financial statements...

-

Page 105

... solely of shares of Common Stock) held by non-affiliates of the registrant as of June 11, 2011 computed by reference to the closing price of the registrant's Common Stock on the New York Stock Exchange Composite Tape on such date was $24,430,261,521. All executive officers and directors of the...

-

Page 106

... 10-K. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. In making these statements, we are not undertaking to address or update any risk factor set forth herein in future filings or communications regarding our business results.

Form 10-K

2

-

Page 107

... package and sell a menu of competitively priced food items. Units are operated by a Concept or by independent franchisees or licensees under the terms of franchise or license agreements. Franchisees can range in size from individuals owning just one restaurant to large publicly traded companies. In...

-

Page 108

...many stores. Pizza Hut offers a drive-thru option on a much more limited basis. Pizza Hut and, on a much more limited basis, KFC offer delivery service. Each Concept has proprietary menu items and emphasizes the preparation of food with high quality ingredients, as well as unique recipes and special...

-

Page 109

... all aspects of restaurant operations, including food handling and product preparation procedures, food safety and quality, equipment maintenance, facility standards and accounting control procedures. The restaurant management teams are responsible for the day-to-day operation of each unit and for...

-

Page 110

.... U.S. Division The Company, along with the representatives of the Company's KFC, Pizza Hut and Taco Bell franchisee groups, are members in the Unified FoodService Purchasing Co-op, LLC (the "Unified Co-op") which was created for the purpose of purchasing certain restaurant products and equipment in...

-

Page 111

... food industry in terms of number of system units or system sales, either on a worldwide or individual country basis. Research and Development ("R&D") The Company's subsidiaries operate R&D facilities in Shanghai, China (China Division); Dallas, Texas (Pizza Hut U.S. and YRI); Irvine, California...

-

Page 112

... diverse cultures in which the Company operates. The Company and its Concepts consider their employee relations to be good. (d) Financial Information about Geographic Areas

Financial information about our significant geographic areas (China Division, International Division and U.S.) is incorporated...

-

Page 113

... operations, financial condition or cash flows. We may not attain our target development goals, and aggressive development could cannibalize existing sales. Our growth strategy depends in large part on our ability to increase our net restaurant count in markets outside the United States, especially...

-

Page 114

..., franchisees may not have access to the financial or management resources that they need to open or continue operating the restaurants contemplated by their franchise agreements with us. If our franchisees incur too much debt or if economic or sales trends deteriorate such that they are unable to...

-

Page 115

... unemployment, disposable income and consumer confidence. These and other macroeconomic factors could have an adverse effect on our sales mix, profitability or development plans, which could harm our financial condition and operating results. The impact of potentially limited credit availability on...

-

Page 116

... operate is highly competitive. The retail food industry in which we operate is highly competitive with respect to price and quality of food products, new product development, price, advertising levels and promotional initiatives, customer service, reputation, restaurant location, and attractiveness...

-

Page 117

... number of issues, including, but not limited to, compliance with product specifications and terms of procurement and service requirements. Employees At any given time, the Company or its Concepts employ hundreds of thousands of persons, primarily in its restaurants. In addition, each year thousands...

-

Page 118

Intellectual Property The Company has registered trademarks and service marks, many of which are of material importance to the Company's business. From time to time, the Company may become involved in litigation to defend and protect its use and ownership of its registered marks.

Form 10-K

14

-

Page 119

... as Chief Operating and Development Officer - Designate from January 2008 until April 2008. From 2000 until January 2008, he was Senior Vice President/Managing Director of YUM Restaurants International South Pacific. Muktesh Pant, 57, is Chief Executive Officer of YRI. He has served in this position...

-

Page 120

...Market for the Registrant's Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company's Common Stock trades under the symbol YUM and is listed on the New York Stock Exchange ("NYSE"). The following sets forth the high and low NYSE composite closing sale prices...

-

Page 121

... value of shares that may yet be purchased under the plans or programs (millions) $ 343 $ $ $ $ 253 963 938 938

On January 27, 2011, our Board of Directors authorized share repurchases through July 2012, of up to $750 million (excluding applicable transaction fees) of our outstanding Common Stock...

-

Page 122

... Stock to the cumulative total return of the S&P 500 Stock Index and the S&P 500 Consumer Discretionary Sector, a peer group that includes YUM, for the period from December 29, 2006 to December 30, 2011, the last trading day of our 2011 fiscal year. The graph assumes that the value of the investment...

-

Page 123

...and investments Proceeds from refranchising of restaurants Repurchase shares of Common Stock Dividends paid on Common Stock Balance Sheet Total assets Long-term debt Total debt Other Data Number of stores at year end Company Unconsolidated Affiliates Franchisees(d) Licensees System(d) China Division...

-

Page 124

... incorporates all our revenue drivers, Company and franchise same-store sales as well as net unit development. Same-store sales growth includes the estimated growth in sales of all restaurants that have been open one year or more. Local currency represents the percentage change excluding the impact...

-

Page 125

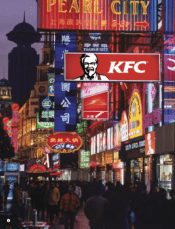

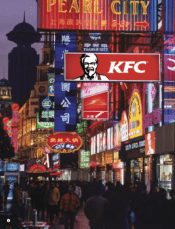

... of 1.3 billion in mainland China, the Company is rapidly adding KFC and Pizza Hut Casual Dining restaurants and testing the additional restaurant concepts of Pizza Hut Home Service (pizza delivery) and East Dawning (Chinese food). Additionally, on February 1, 2012 we acquired an additional 66...

-

Page 126

... in 2011 in the Company's International Division, representing 12 straight years of opening over 700 restaurants, making YRI one of the leading international retail developers in terms of units opened. The Company expects to continue to experience strong growth by building out existing markets and...

-

Page 127

... of KFC restaurants we offered to sell in 2010 that remained Company restaurants for some or all of the periods presented, charges relating to U.S. G&A productivity initiatives and realignment of resources, investments in our U.S. Brands and a 2009 U.S. Goodwill impairment charge. Special Items...

-

Page 128

Year 12/31/2011 Detail of Special Items U.S. Refranchising gain (loss) Depreciation reduction from KFC U.S. restaurants impaired upon offer to sell Charges relating to U.S. G&A productivity initiatives and realignment of resources Investments in our U.S. Brands LJS and A&W Goodwill impairment charge...

-

Page 129

... operate the restaurants as company units. Accordingly, we wrote this asset group down to our estimate of its fair value, which is based on the sales price we would expect to receive from a buyer. This fair value determination considered current market conditions, trends in the Pizza Hut UK business...

-

Page 130

... reporting unit included an insignificant amount of goodwill. This loss did not result in a related income tax benefit. During the year ended December 26, 2009 we recognized a non-cash $10 million refranchising loss as a result of our decision to offer to refranchise our KFC Taiwan equity market...

-

Page 131

... during 2009. This charge was recorded in Closure and impairment (income) expenses in our Consolidated Statement of Income and was allocated to our International Division for performance reporting purposes. Store Portfolio Strategy From time to time we sell Company restaurants to existing and new...

-

Page 132

... activities: 2011 Number of units refranchised Refranchising proceeds, pre-tax Refranchising (gain) loss, pre-tax $ $ 529 246 72 $ $ 2010 949 265 63 $ $ 2009 613 194 (26)

Refranchisings reduce our reported revenues and restaurant profits and increase the importance of system sales growth as...

-

Page 133

... of operations as they are recorded. The Company does not expect resolution of this matter within twelve months and cannot predict with certainty the timing of such resolution. International Reporting Change In the first quarter of 2012, we will begin reporting information for our India business as...

-

Page 134

... (69) - 4,493 100%

China Balance at end of 2009 New Builds Acquisitions Refranchising Closures Other Balance at end of 2010 New Builds Acquisitions Refranchising Closures Other Balance at end of 2011 % of Total Form 10-K

Franchisees 118 3 - 33 (1) - 153 4 - 47 (3) - 201 4%

Company 2,866 442 - (33...

-

Page 135

... further detail of licensed unit activity provides significant or meaningful information at this time. The reductions to Worldwide, YRI and U.S. totals of 1,633, 347 and 1,286, respectively during 2011 represent the number of LJS and A&W units as of the beginning of 2011. Therefore, 2011 New Builds...

-

Page 136

... of the year-over-year changes of Company sales and Restaurant profit for each reportable segment by year. Store portfolio actions represent the net impact of new unit openings, acquisitions, refranchisings and store closures on Company sales or Restaurant profit. The impact of new unit openings and...

-

Page 137

...

In 2011, the increase in China Company sales and Restaurant profit associated with store portfolio actions was primarily driven by the development of new units partially offset by lapping the benefit of our participation in the World Expo in 2010. Significant other factors impacting Company sales...

-

Page 138

... actions was driven by new unit development partially offset by refranchising. Another significant factor impacting Restaurant profit during the year was labor inflation. Company same-store sales were flat for the year. U.S. Income / (Expense) Company sales Cost of sales Cost of labor Occupancy and...

-

Page 139

... during 2009. See Note 4. YRI Franchise and license fees and income for 2011 was positively impacted by 3% due to the effects of refranchising. Excluding the effects of refranchising, 53rd week and foreign currency translation, the increase was driven by net new unit development and same-store sales...

-

Page 140

...at KFC) and 2011 bi-annual YRI franchise convention costs. Franchise and license expenses decreased 7% in 2010. The decrease was driven by lower provision for U.S. past-due receivables (primarily at KFC and Pizza Hut) and lapping 2009 international franchise convention costs. Worldwide Other (Income...

-

Page 141

... by the impact of same-store sales growth and new unit development, partially offset by higher G&A costs. Operating Profit in 2010 benefited $16 million from our brands' participation in the World Expo. YRI Division Operating Profit increased 14% in 2011, including a favorable impact from foreign...

-

Page 142

... of our income being earned outside of the U.S. where tax rates are generally lower than the U.S. rate. In 2011 and 2010, the benefit was positively impacted by the recognition of excess foreign tax credits generated by our intent to repatriate current year foreign earnings. In 2009, the benefit was...

-

Page 143

... cash flows from the operations of our company stores and from our extensive franchise operations which require a limited YUM investment. Net cash provided by operating activities has exceeded $1 billion in each of the last ten fiscal years, including over $2 billion in 2011. We expect these levels...

-

Page 144

... 18, 2011 our Board of Directors approved cash dividends of $0.285 per share of Common Stock to be distributed on February 3, 2012 to shareholders of record at the close of business on January 13, 2012. The Company is targeting an ongoing annual dividend payout ratio of 35% to 40% of net income. In...

-

Page 145

... specified in the agreement. Given the Company's strong balance sheet and cash flows we were able to comply with all debt covenant requirements at December 31, 2011 with a considerable amount of cushion. We are in the process of renewing these facilities. Our remaining long-term debt primarily...

-

Page 146

...of our recorded liability for self-insured employee healthcare, long-term disability and property and casualty losses represents estimated reserves for incurred claims that have yet to be filed or settled. Off-Balance Sheet Arrangements We have agreed to provide financial support, if required, to an...

-

Page 147

... assets on a number of factors including the competitive environment, our future development plans for the applicable Concept and the level of franchisee commitment to the Concept. We generally base the expected useful lives of our franchise contract rights on their respective contractual terms...

-

Page 148

... YRI business units (typically individual countries) and our China Division brands. Fair value is the price a willing buyer would pay for the reporting unit, and is generally estimated using discounted expected future after-tax cash flows from company operations and franchise royalties. Future cash...

-

Page 149

... present value of all benefits earned to date by employees and incorporates assumptions as to future compensation levels. Due to the relatively long time frame over which benefits earned to date are expected to be paid, our PBOs are highly sensitive to changes in discount rates. For our U.S. plans...

-

Page 150

... term and pre-vesting forfeitures. These groups consist of grants made primarily to restaurant-level employees under our Restaurant General Manager Stock Option Plan (the "RGM Plan") and grants made to executives under our other stock award plans. Historically, approximately 10% - 15% of total...

-

Page 151

... volatility in food costs as a result of market risk associated with commodity prices. Our ability to recover increased costs through higher pricing is, at times, limited by the competitive environment in which we operate. We manage our exposure to this risk primarily through pricing agreements with...

-

Page 152

... Data. INDEX TO FINANCIAL INFORMATION Page Reference

Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Consolidated Statements of Income for the fiscal years ended December 31, 2011, December 25, 2010 and December 26, 2009 Consolidated Statements of Cash...

-

Page 153

...Registered Public Accounting Firm

The Board of Directors and Shareholders YUM! Brands, Inc. We have audited the accompanying consolidated balance sheets of YUM! Brands, Inc. and Subsidiaries (YUM) as of December 31, 2011 and December 25, 2010, and the related consolidated statements of income, cash...

-

Page 154

...! Brands, Inc. and Subsidiaries Fiscal years ended December 31, 2011, December 25, 2010 and December 26, 2009 (in millions, except per share data) 2011 Revenues Company sales $ 10,893 $ Franchise and license fees and income 1,733 Total revenues 12,626 Costs and Expenses, Net Company restaurants Food...

-

Page 155

... Stock Excess tax benefit from share-based compensation Employee stock option proceeds Dividends paid on Common Stock Other, net Net Cash Used in Financing Activities Effect of Exchange Rates on Cash and Cash Equivalents Net Increase (Decrease) in Cash and Cash Equivalents Change in Cash and Cash...

-

Page 156

... Balance Sheets YUM! Brands, Inc. and Subsidiaries December 31, 2011 and December 25, 2010 (in millions) 2011 ASSETS Current Assets Cash and cash equivalents Accounts and notes receivable, net Inventories Prepaid expenses and other current assets Deferred income taxes Advertising cooperative assets...

-

Page 157

... shares of Common Stock Employee stock option and SARs exercises (includes tax impact of $73 million) Compensation-related events (includes tax impact of $7 million) Balance at December 25, 2010 Net Income Foreign currency translation adjustment Pension and post-retirement benefit plans (net of tax...

-

Page 158

... of Business YUM! Brands, Inc. and Subsidiaries (collectively referred to as "YUM" or the "Company") comprises the worldwide operations of KFC, Pizza Hut and Taco Bell (collectively the "Concepts"). YUM is the world's largest quick service restaurant company based on the number of system units, with...

-

Page 159

... begin consolidating this business in 2012. In the second quarter of 2009 we began consolidating the entity that operates the KFCs in Shanghai, China, which was previously accounted for using the equity method. The increase in cash related to the consolidation of this entitiy's cash balance of $17...

-

Page 160

...for franchise-related intangible assets and certain other direct incremental franchise and license support costs. Revenue Recognition. Revenues from Company-operated restaurants are recognized when payment is tendered at the time of sale. The Company presents sales net of sales-related taxes. Income...

-

Page 161

... sell assets, primarily land, associated with a closed store, any gain or loss upon that sale is also recorded in Closures and impairment (income) expenses. Considerable management judgment is necessary to estimate future cash flows, including cash flows from continuing use, terminal value, sublease...

-

Page 162

... Income Taxes. We record deferred tax assets and liabilities for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases as well as operating loss and tax credit carryforwards...

-

Page 163

... (e.g. when Company sales occur). Internal Development Costs and Abandoned Site Costs. We capitalize direct costs associated with the site acquisition and construction of a Company unit on that site, including direct internal payroll and payroll-related costs. Only those site-specific costs incurred...

-

Page 164

... pay for a reporting unit, and is generally estimated using discounted expected future after-tax cash flows from Company operations and franchise royalties. The discount rate is our estimate of the required rate of return that a third-party buyer would expect to receive when purchasing a business...

-

Page 165

...Common Stock account. In such instances, on a period basis, we record the cost of any further share repurchases as a reduction in retained earnings. Due to the large number of share repurchases and the increase in the market value of our stock over the past several years, our Common Stock balance is...

-

Page 166

... result of a decline in future profit expectations for our LJS and A&W U.S. businesses due in part to the impact of a reduced emphasis on multi-branding, we recorded a non-cash charge of $26 million, which resulted in no related income tax benefit, in the fourth quarter of 2009 to write-off goodwill...

-

Page 167

... operate the restaurants as company units. Accordingly, we wrote this asset group down to our estimate of its fair value, which is based on the sales price we would expect to receive from a buyer. This fair value determination considered current market conditions, trends in the Pizza Hut UK business...

-

Page 168

... current market conditions, real-estate values, trends in the KFC U.S. business, prices for similar transactions in the restaurant industry and preliminary offers for the restaurant groups to date. The non-cash impairment charges that were recorded related to our offers to refranchise these company...

-

Page 169

... for our Pizza Hut South Korea market.

(b)

The following table summarizes the 2011 and 2010 activity related to reserves for remaining lease obligations for closed stores. Estimate/ Decision Changes 2 -

2011 Activity 2010 Activity

Beginning Balance $ 28 $ 27

Amounts Used New Decisions (12...

-

Page 170

...affiliate in Shanghai, China. Note 8 - Supplemental Balance Sheet Information Prepaid Expenses and Other Current Assets Income tax receivable Assets held for sale Other prepaid expenses and current assets 2011 150 24 164 $ 338 $ 2011 527 3,856 316 2,568 7,267 2010 115 23 131 $ 269 2010 542 3,709 274...

-

Page 171

...expense related to property, plant and equipment was $599 million, $565 million and $553 million in 2011, 2010 and 2009, respectively. Accounts Payable and Other Current Liabilities Accounts payable Accrued capital expenditures Accrued compensation and benefits Dividends payable Accrued taxes, other...

-

Page 172

... future amortization expense by approximately $8 million annually. Note 10 - Short-term Borrowings and Long-term Debt 2011 Short-term Borrowings Current maturities of long-term debt Current portion of fair value hedge accounting adjustment (See Note 12) Unsecured International Revolving Credit...

-

Page 173

... in the agreement. Given the Company's balance sheet and cash flows, we were able to comply with all debt covenant requirements at December 31, 2011 with a considerable amount of cushion. We are in the process of renewing the Credit Facility and ICF. The majority of our remaining long-term debt...

-

Page 174

... to our operations. Most leases require us to pay related executory costs, which include property taxes, maintenance and insurance. Future minimum commitments and amounts to be received as lessor or sublessor under non-cancelable leases are set forth below: Commitments Capital 2012 2013 2014 2015...

-

Page 175

... designated as hedging instruments for the years ended December 31, 2011 and December 25, 2010 were: Fair Value 2011 2010 $ 10 $ 8 22 33 3 7 (1) (3) $ 34 $ 45 Consolidated Balance Sheet Location Prepaid expenses and other current assets Other assets Prepaid expenses and other current assets Accounts...

-

Page 176

... employees have chosen to invest in phantom shares of a Stock Index Fund or Bond Index Fund. The other investments are classified as trading securities and their fair value is determined based on the closing market prices of the respective mutual funds as of December 31, 2011 and December 25, 2010...

-

Page 177

... estimated the fair value of debt using market quotes and calculations based on market rates. Note 14 - Pension, Retiree Medical and Retiree Savings Plans Pension Benefits We sponsor noncontributory defined benefit pension plans covering certain full-time salaried and hourly U.S. employees. The most...

-

Page 178

... on plan assets Employer contributions Participant contributions Settlement payments Benefits paid Exchange rate changes Administrative expenses Fair value of plan assets at end of year Funded status at end of year Amounts recognized in the Consolidated Balance Sheet: U.S. Pension Plans 2011 2010...

-

Page 179

...907 International Pension Plans 2011 2010 $ 99 $ 187 87 87 155 164

Projected benefit obligation Accumulated benefit obligation Fair value of plan assets

$

Our funding policy with respect to the U.S. Plan is to contribute amounts necessary to satisfy minimum pension funding requirements, including...

-

Page 180

... of the service cost and interest cost for that plan during the year. Special termination benefits primarily related to the U.S. business transformation measures taken in 2011, 2010 and 2009.

Pension losses in accumulated other comprehensive income (loss): U.S. Pension Plans 2011 2010 $ 363 $ 346...

-

Page 181

...benefit cost for fiscal years: U.S. Pension Plans 2009 2010 2011 6.50% 6.30% 5.90% 8.00% 7.75% 7.75% 3.75% 3.75% 3.75% International Pension Plans 2009 2010 2011 5.51% 5.50% 5.40% 7.20% 6.66% 6.64% 4.12% 4.42% 4.41%

Discount rate Long-term rate of return on plan assets Rate of compensation increase...

-

Page 182

... held as an investment by the Plan includes shares of YUM common stock valued at $0.7 million at December 31, 2011 and $0.6 million at December 25, 2010 (less than 1% of total plan assets in each instance). Benefit Payments The benefits expected to be paid in each of the next five years and in the...

-

Page 183

... - Share-based and Deferred Compensation Plans Overview At year end 2011, we had four stock award plans in effect: the YUM! Brands, Inc. Long-Term Incentive Plan and the 1997 LongTerm Incentive Plan (collectively the "LTIPs"), the YUM! Brands, Inc. Restaurant General Manager Stock Option Plan ("RGM...

-

Page 184

... to group our stock option and SAR awards into two homogeneous groups when estimating expected term. These groups consist of grants made primarily to restaurant-level employees under the RGM Plan, which cliff-vest after four years and expire ten years after grant, and grants made to executives under...

-

Page 185

.... Tax benefits realized on our tax returns from tax deductions associated with stock options and SARs exercised for 2011, 2010 and 2009 totaled $72 million, $82 million and $68 million, respectively. Note 16 - Shareholders' Equity Under the authority of our Board of Directors, we repurchased shares...

-

Page 186

Note 17 - Income Taxes U.S. and foreign income before taxes are set forth below: 2011 266 1,393 $ 1,659 $ 2010 345 1,249 $ 1,594 $ 2009 269 1,127 $ 1,396 $

U.S. Foreign

The details of our income tax provision (benefit) are set forth below: 2011 Current: Federal Foreign State $ 78 374 9 461 (83) (...

-

Page 187

...

Operating losses and tax credit carryforwards Employee benefits Share-based compensation Self-insured casualty claims Lease-related liabilities Various liabilities Deferred income and other Gross deferred tax assets Deferred tax asset valuation allowances Net deferred tax assets Intangible assets...

-

Page 188

...: Year of Expiration 2012 Foreign U.S. federal and state $ $ 4 22 26 2013-2016 66 192 $ 258 $ 2017-2031 136 1,770 $ 1,906 $ Indefinitely $ 833 5 $ 838 $ $ Total 1,039 1,989 3,028

We recognize the benefit of positions taken or expected to be taken in tax returns in the financial statements when...

-

Page 189

... adverse effect on our financial position. Additionally, if increases to our reserves are deemed necessary due to future developments related to this issue, such increases could have a material, adverse effect on our results of operations as they are recorded. The Company does not expect resolution...

-

Page 190

...worldwide KFC, Pizza Hut and Taco Bell concepts. KFC, Pizza Hut and Taco Bell operate in 115, 97, and 27 countries and territories, respectively. Our five largest international markets based on operating profit in 2011 are China, Asia Franchise, Australia, Latin America Franchise, and United Kingdom...

-

Page 191

... from the impairment of Pizza Hut UK restaurants we decided to sell in 2011 of $3 million. See Note 4. 2011, 2010 and 2009 include approximately $21 million, $9 million and $16 million, respectively, of charges relating to U.S. general and administrative productivity initiatives and realignment of...

-

Page 192

..., 2011 and December 25, 2010 was not material. Franchise Loan Pool and Equipment Guarantees We have agreed to provide financial support, if required, to a variable interest entity that operates a franchisee lending program used primarily to assist franchisees in the development of new restaurants in...

-

Page 193

... and annual Net income. We believe that we have recorded reserves for property and casualty losses at a level which has substantially mitigated the potential negative impact of adverse developments and/or volatility. Legal Proceedings We are subject to various claims and contingencies related to...

-

Page 194

... in California state court on behalf of all California hourly employees alleging various California Labor Code violations, including rest and meal break violations, overtime violations, wage statement violations and waiting time penalties. Plaintiff is a former non-managerial KFC restaurant employee...

-

Page 195

... costs, uniforms costs, and other job-related expenses and seeks to represent a class of delivery drivers nationwide under the FLSA and Colorado state law. On January 4, 2010, plaintiffs filed a motion for conditional certification of a nationwide class of current and former Pizza Hut, Inc. delivery...

-

Page 196

...receive compensation for all hours worked and did not receive overtime pay after 40 hours worked in a week. The plaintiff also purports to represent a separate class of Colorado assistant managers under Colorado state law, which provides for daily overtime after 12 hours worked in a day. The Company...

-

Page 197

... Data (Unaudited) 2011 Third Quarter $ 2,854 420 3,274 494 488 383 0.82 0.80 - 2010 Third Quarter $ 2,496 366 2,862 479 544 357 0.76 0.74 - $ $

First Quarter Revenues: Company sales Franchise and license fees and income Total revenues Restaurant profit Operating Profit(a) Net Income - YUM! Brands...

-

Page 198

... in the United States of America and include certain amounts based upon our estimates and assumptions, as required. Other financial information presented in the annual report is derived from the financial statements. We maintain a system of internal control over financial reporting, designed to...

-

Page 199

...Chief Financial Officer (the "CFO"), the Company's management, including the CEO and CFO, concluded that the Company's disclosure controls and procedures were effective as of the end of the period covered by this report. Management's Report on Internal Control Over Financial Reporting Our management...

-

Page 200

... proxy statement which will be filed with the Securities and Exchange Commission no later than 120 days after December 31, 2011. Information regarding executive officers of the Company is included in Part I. Item 11. Executive Compensation.

Information regarding executive and director compensation...

-

Page 201

... (1)

Exhibits and Financial Statement Schedules. Financial Statements: Consolidated Financial Statements filed as part of this report are listed under Part II, Item 8 of this Form 10-K. Financial Statement Schedules: No schedules are required because either the required information is not present...

-

Page 202

... annual report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Signature /s/ David C. Novak David C. Novak

Title Chairman of the Board, Chief Executive Officer and President (principal executive officer) Chief Financial...

-

Page 203

...Shyh S. Su Jing-Shyh S. Su /s/ Robert D. Walter Robert D. Walter

Director

February 20, 2012

Director

February 20, 2012

Director

February 20, 2012

Director

February 20, 2012

Director

February 20, 2012

Vice-Chairman of the Board

February 20, 2012

Director

February 20, 2012

Form 10-K

99

-

Page 204

...Distribution Joinder Agreement between Unified Foodservice Purchasing Co-op, LLC, McLane Foodservice, Inc., and certain subsidiaries of Yum! Brands, Inc., which are incorporated herein by reference from Exhibit 10.1 to YUM's Quarterly Report on Form 10-Q for the quarter ended September 4, 2010.

100

-

Page 205

... 10-K for the fiscal year ended December 31, 2005. YUM! Brands Executive Income Deferral Program, Plan Document for the 409A Program, as effective January 1, 2005, and as Amended through June 30, 2009, which is incorporated by reference from Exhibit 10.10.1 to YUM's Quarterly Report on Form 10-Q for...

-

Page 206

10.11

Second Amended and Restated YUM Purchasing Co-op Agreement, dated as of January 1, 2012, between YUM and the Unified FoodService Purchasing Co-op, LLC, as filed herewith.

10.12â€

YUM Restaurant General Manager Stock Option Plan, as effective April 1, 1999, and as amended through June 23, ...

-

Page 207

...! Brands Supplemental Long Term Disability Coverage Summary, as effective January 1, 2010, which is incorporated by reference from Exhibit 10.26 to YUM's Annual Report on Form 10-K for the fiscal year ended December 26, 2009. 1999 Long Term Incentive Plan Award (Restricted Stock Unit Agreement) by...

-

Page 208

...at the Web site of American Stock Transfer & Trust (''AST''): www.amstock.com. • Access account balance and other general account information • Change an account's mailing address • View a detailed list of holdings represented by certificates and the identifying certificate numbers • Request...

-

Page 209

... Common Stock, which trades under the symbol YUM.

19MAR201018500758

Franchise Inquiries DOMESTIC FRANCHISING INQUIRY PHONE LINE (866) 2YUMYUM (298-6986) INTERNATIONAL FRANCHISING INQUIRY PHONE LINE (972) 338-7780 ONLINE FRANCHISE INFORMATION http://www.yumfranchises.com/ Yum! Brands' Annual Report...

-

Page 210

26MAR201222253896

YUM! BRANDS, INC. 2011 ANNUAL CUSTOMER MANIA REPORT

-

Page 211

... Director and Advisory Board Member, Essex Lake Group, P.C.

Niren Chaudhary 49

President, Yum! Restaurants India

Greg Creed 54

Chief Executive Officer, Taco Bell

Kenneth Langone 76

Founder, Chairman, Chief Executive Officer and President, Invemed Associates, LLC

John Cywinski 49 President, KFC...

-

Page 212