MasterCard 2008 Annual Report Download - page 99

Download and view the complete annual report

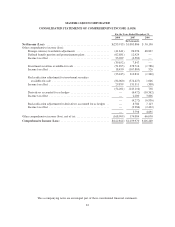

Please find page 99 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

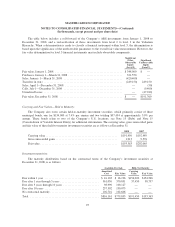

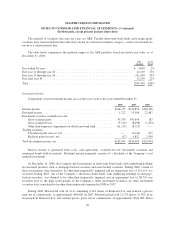

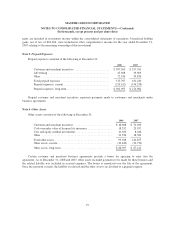

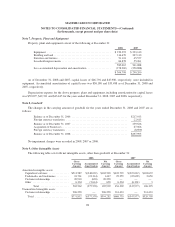

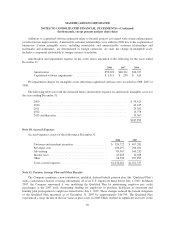

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

services, including currency conversion, cross border transaction processing, acceptance development, warning

bulletins, connectivity, consulting and research, cardholder services, compliance and penalties, holograms,

transaction enhancement services and manuals and publications. Transaction processing and other product and

service fees are recognized as revenue in the same period as the related transactions occur or services are

rendered.

Assessments are based principally upon daily, monthly or quarterly gross dollar volumes, in non-European

regions, or gross euro volumes for MasterCard Europe. Rates vary depending on the nature of the transactions

that generate volume. Assessments are recorded as revenue in the period they are earned, which is when the

related volume is generated on the cards. Quarterly assessments are based on management’s estimate of the

customers’ performance in a given period, and actual results may differ from these estimates.

MasterCard has business agreements with certain customers that provide for fee rebates when the customers

meet certain hurdles. Such rebates are calculated on a monthly basis based upon estimated performance and the

contracted discount rates for the services provided. MasterCard also enters into agreements with certain

customers to provide volume as well as other support incentives such as marketing, which are tied to

performance. MasterCard may incur costs directly related to the acquisition of the contract, which are deferred

and amortized over the life of the contract. Rebates and incentives are recorded as a reduction of revenue in the

same period as the revenue is earned or performance has occurred, in accordance with Emerging Issues Task

Force (“EITF”) Issue No. 01-9, “Accounting for Consideration Given by a Vendor to a Customer (Including a

Reseller of the Vendor’s Products)”. Rebates and incentives are calculated on a monthly basis based upon

estimated performance and the terms of the related business agreements. Actual results may differ from these

estimates.

In addition, certain rebate and incentive agreements provide for free or discounted services, which are

recorded in accordance with EITF Issue No. 00-21, “Revenue Arrangements with Multiple Deliverables”. The

discount from the fair value of the services is recorded as a reduction of revenue related to other elements of the

contract using the residual method.

Pension and other postretirement plans—Compensation cost of an employee’s pension benefit is

recognized on the projected unit credit method over the employee’s approximate service period. The unit credit

cost method is utilized for funding purposes.

The Company recognizes the overfunded or underfunded status of its single-employer defined benefit plan

or postretirement plan as an asset or liability in its balance sheet and recognizes changes in the funded status in

the year in which the changes occur through comprehensive income, in accordance with SFAS No. 158,

“Employers’ Accounting for Defined Benefit Plans and Other Postretirement Plans” (“SFAS 158”). The

Company also measures the funded status of a plan as of the date of its year-end balance sheet.

Share based payments—The Company accounts for share based payments in accordance with SFAS

No. 123R, “Share-Based Payment” (“SFAS 123R”). SFAS 123R requires the fair value of all share-based

payments to employees to be recognized in the financial statements. Effective January 1, 2008, the Company

adopted EITF Issue No. 06-11, “Accounting for Income Tax Benefits of Dividends on Share-Based Payment

Awards” (“EITF 06-11”). EITF 06-11 requires entities to recognize a realized tax benefit associated with

dividends on certain equity shares and options as an increase to additional paid-in capital. The benefit should be

included in the pool of excess tax benefits available to absorb potential future tax liabilities on share based

payment awards. EITF 06-11 is applied prospectively for share-based awards declared beginning January 1,

2008.

89