MasterCard 2008 Annual Report Download - page 76

Download and view the complete annual report

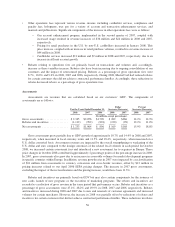

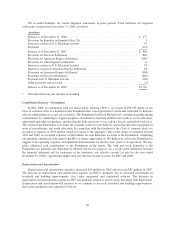

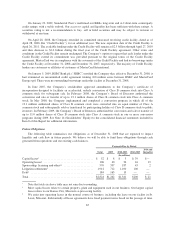

Please find page 76 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Some lease agreements provide us with the option to renew the lease or purchase the leased property. Our

future operating lease obligations would change if we exercised these renewal options and if we entered into

additional lease agreements.

3Amounts primarily relate to sponsorships with certain organizations to promote the MasterCard brand. The

amounts included are fixed and non-cancelable. In addition, these amounts include amounts due in

accordance with merchant agreements for future marketing, computer hardware maintenance, software

licenses and other service agreements. Future cash payments that will become due to our customers under

agreements which provide pricing rebates on our standard fees and other incentives in exchange for

increased transaction volumes are not included in the table because the amounts due are indeterminable and

contingent until such time as performance has occurred. MasterCard has accrued $527 million as of

December 31, 2008 related to customer and merchant agreements.

4We have included our current liability of $13 million relating to Financial Accounting Standards Board

(“FASB”) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”). Due to the high

degree of uncertainty regarding the timing of the non-current FIN 48 liabilities, we are unable to make

reasonable estimates of the period of cash settlements with the respective taxing authority.

5Represents amounts due in accordance with the Discover Settlement, American Express Settlement, U.S.

Merchant Lawsuit Settlement and other litigation settlements.

6Debt primarily represents principal owed on our Series A Senior Secured Notes, which are expected to be

paid in March 2009, and amounts due for the acquisition of MasterCard France. See Notes 13 (Debt) and 3

(Supplemental Cash Flows), respectively, to the consolidated financial statements included in Item 8 of this

Report for further discussion on these matters. We also have various credit facilities for which there were no

outstanding balances at December 31, 2008 that, among other things, would provide liquidity in the event of

settlement failures by our members. Our debt obligations would change if one or more of our members

failed and we borrowed under these credit facilities to settle on our members’ behalf or for other reasons.

Seasonality

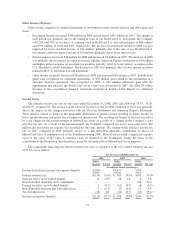

Our revenues are contingent upon the underlying metrics on which the revenues are calculated. Gross

revenues in the fourth quarter of 2008 were negatively impacted by lower purchase volumes and transactions due

to the economic crisis. In response, MasterCard accelerated its cost savings initiatives in the quarter, with

particular focus on advertising, personnel and travel expenses. Historically, during the fourth quarter, our

quarterly gross revenues have been positively impacted by increases in purchase volume related to the holiday

shopping period, with offsetting increases resulting from higher rebates and incentives to our customers. Also,

operating expenses have historically been higher in the fourth quarter due to additional advertising and

promotions related to the holiday period and increases in personnel incentives for exceeding the Company’s

objectives. The economic environment in 2008 caused our operating results to diverge from these historical

trends.

66