MasterCard 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

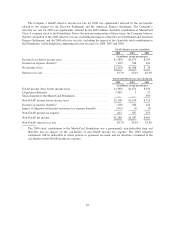

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

Postemployment Benefit Plan

We have a formal severance plan

which sets forth the guidelines with

respect to severance payments to

salaried employees whose normal

assignment is within the United

States. Approximately 3,600 of our

employees are covered by the Plan.

Severance benefits are determined

primarily by years of service and

career level in accordance with

either a standard or enhanced

payment schedule, which is

determined by the cause of the

severance action. The Company has

a severance plan committee with

members from different functional

responsibilities, including human

resources, legal and finance, that

review and approve assumptions

used in the determination of the

liability for expected future

severance obligations. Key

assumptions include the number of

severed participants, number of

severed individuals by career level,

benefit package and discount rate.

The assumption for the number of

severed participants used in the

calculation was 100, 100 and 120

for 2008, 2007 and 2006,

respectively. The career levels for

these individuals was estimated

using historical experience as a

base, adjusted for a number of

strategic and human resource

initiatives implemented during

these years and current

employment levels. We review

historical trends and future

expectations when determining the

assumptions.

The discount rate for our

postemployment plan is subject to

change each year, consistent with

changes in high-quality, long-term

corporate bond markets. To select

a discount rate, we performed an

analysis which matched the plans

expected cash flows with spot rates

developed from a yield curve

comprised of high-grade non-

callable corporate bonds and

arithmetically rounded this result.

Our discount rate of 5.75% as of

December 31, 2008 is 25 basis

points higher than the rate used in

calculating the severance

obligations for 2007, which was

5.5%.

A 5% increase in the number of

severed participants would increase

our severance obligations by $1.6

million. An equal but opposite

effect would be experienced for a

5% decrease in the number of

participants.

A quarter of a percentage point

decrease or increase in our discount

rate would have an impact of

approximately $0.4 million on our

severance obligations.

Recent Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS

141R”) which replaces SFAS No. 141, “Business Combinations”. SFAS 141R establishes the principles and

requirements for how an acquirer: 1) recognizes and measures in its financial statements the identifiable assets

acquired, the liabilities assumed, and any non-controlling interest in the acquiree; 2) recognizes and measures the

goodwill acquired in the business combination or a gain from a bargain purchase; and 3) discloses the business

combination. SFAS 141R applies to all transactions in which an entity obtains control of one or more businesses,

including transactions that occur without the transfer of any type of consideration. SFAS 141R is effective on a

prospective basis for all business combinations on or after January 1, 2009, with the exception of the accounting

for valuation allowances on deferred taxes and acquired tax contingencies. Early adoption is not allowed. The

Company will adopt SFAS 141R on January 1, 2009 and its effect on future periods will be dependent upon the

nature and significance of any acquisitions subject to this statement.

72