MasterCard 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

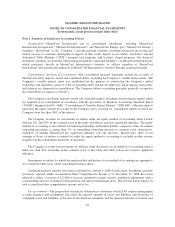

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

expenses during the reporting periods. Management has established detailed policies and control procedures to

ensure the methods used to make estimates are well controlled and applied consistently from period to period.

Actual results may differ from these estimates.

Cash and cash equivalents—Cash and cash equivalents include certain liquid investments with a maturity of

three months or less from the date of purchase. Cash equivalents are recorded at cost, which approximates fair

value.

Investment securities—Effective January 1, 2008, the Company adopted Statement of Financial Accounting

Standards (“SFAS”) No. 157, “Fair Value Measurements” (“SFAS 157”) for financial assets and liabilities

measured at fair value on a recurring basis. SFAS 157 accomplishes the following key objectives: defines fair

value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date; establishes a three-level hierarchy (“Valuation Hierarchy”)

for fair value measurements; requires consideration of the Company’s creditworthiness when valuing liabilities;

and expands disclosures about instruments measured at fair value. SFAS 157 applies only to fair value

measurements required or permitted under other accounting pronouncements and does not require any new fair

value measurements.

The Valuation Hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as

of the measurement date. A financial instrument’s categorization within the Valuation Hierarchy is based upon

the lowest level of input that is significant to the fair value measurement. The three levels of the Valuation

Hierarchy are as follows:

• Level 1—inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or

liabilities in active markets.

• Level 2—inputs to the valuation methodology include quoted prices for similar assets and liabilities in

active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for

substantially the full term of the financial instrument.

• Level 3—inputs to the valuation methodology are unobservable and significant to the fair value

measurement.

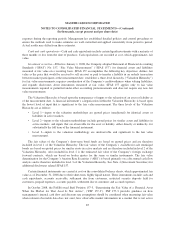

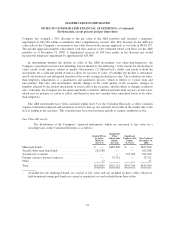

The fair values of the Company’s short-term bond funds are based on quoted prices and are therefore

included in level 1 of the Valuation Hierarchy. The fair values of the Company’s available-for-sale municipal

bonds are based on quoted prices for similar assets in active markets and are therefore included in level 2 of the

Valuation Hierarchy. Also included in level 2 is the estimated fair value of the Company’s foreign exchange

forward contracts, which are based on broker quotes for the same or similar instruments. The fair value

determination for the Company’s Auction Rate Securities (“ARS”) is based primarily on a discounted cash flow

analysis and is therefore included in level 3 of the Valuation Hierarchy. See Note 4 (Investment Securities) for

additional disclosures related SFAS 157.

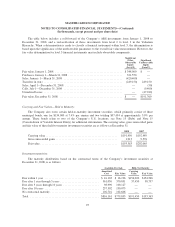

Certain financial instruments are carried at cost on the consolidated balance sheets, which approximated fair

value as of December 31, 2008 due to their short-term, highly liquid nature. These instruments include cash and

cash equivalents, accounts receivable, settlement due from customers, restricted security deposits held for

customers, prepaid expenses, accounts payable, settlement due to customers and accrued expenses.

In October 2008, the FASB issued Staff Position 157-3, “Determining the Fair Value of a Financial Asset

When the Market for That Asset Is Not Active”, (“FSP 157-3”). FSP 157-3 provides guidance on how

management’s internal cash flow and discount rate assumptions should be considered when measuring fair value

when relevant observable data does not exist, how observable market information in a market that is not active

85