MasterCard 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

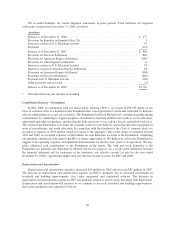

and incentives decreased rebates and incentives as a percentage of gross assessments. In 2008 and 2007, rebates

and incentives compared to gross assessments fluctuated with the timing and structure of pricing arrangements

with certain large customers and merchants.

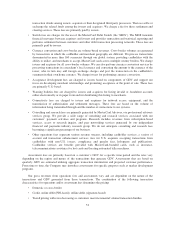

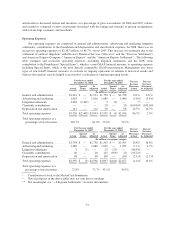

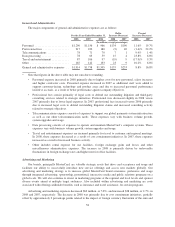

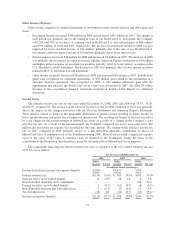

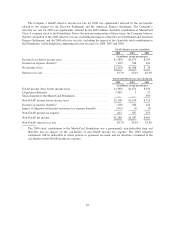

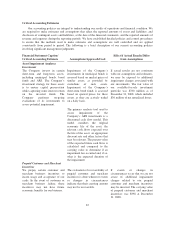

Operating Expenses

Our operating expenses are comprised of general and administrative, advertising and marketing, litigation

settlements, contributions to the Foundation and depreciation and amortization expenses. In 2008, there was an

increase in operating expenses of $2,567 million, or 86.7%, versus 2007. This increase was primarily due to the

settlement of antitrust litigations with Discover Financial Services (“Discover” and the “Discover Settlement”)

and American Express Company (“American Express” and the “American Express Settlement”). The following

table compares and reconciles operating expenses, excluding litigation settlements and the 2006 stock

contribution to the Foundation (“Special Items”), which is a non-GAAP financial measure, to operating expenses

including Special Items, which is the most directly comparable GAAP measurement. Management uses these

types of non-GAAP financial measures to evaluate its ongoing operations in relation to historical results and

believes this analysis may be helpful to an investor’s evaluation of ongoing operating results.

For the year ended

December 31, 2008

For the year ended

December 31, 2007 Percent

Increase

(Decrease)

Actual

Percent

Increase

(Decrease)

As AdjustedActual

Special

Items

As

Adjusted Actual

Special

Items

As

Adjusted

(In millions, except percentages)

General and administrative ......... $1,914 $ — $1,914 $1,758 $ — $1,758 8.8 % 8.8 %

Advertising and marketing .......... 1,018 — 1,018 1,080 — 1,080 (5.8)% (5.8)%

Litigation settlements .............. 2,483 (2,483) — 3 (3) — ** —

Charitable contributions ............ — — — 20 — 20 (100.0)% (100.0)%

Depreciation and amortization ....... 112 — 112 98 — 98 14.7% 14.7%

Total operating expenses ........... $5,526 $(2,483) $3,044 $2,959 $ (3) $2,956 86.7% 2.9%

Total operating expenses as a

percentage of total revenues ...... 110.7% 61.0% 72.8% 72.7%

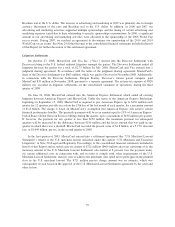

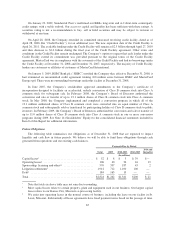

For the year ended

December 31, 2007

For the year ended

December 31, 2006 Percent

Increase

(Decrease)

Actual

Percent

Increase

(Decrease)

As AdjustedActual

Special

Items

As

Adjusted Actual

Special

Items

As

Adjusted

(In millions, except percentages)

General and administrative ......... $1,758 $ — $1,758 $1,505 $ — $1,505 16.8% 16.8%

Advertising and marketing .......... 1,080 — 1,080 1,052 — 1,052 2.7 % 2.7%

Litigation settlements .............. 3 (3) — 25 (25) — (86.4)% —

Charitable contributions ............ 20 — 20 415 (395)120 (95.2)% —

Depreciation and amortization ....... 98 — 98 100 — 100 (2.1)% (2.1)%

Total operating expenses ........... $2,959 $ (3) $2,956 $3,097 $(420) $2,677 (4.4)% 10.4%

Total operating expenses as a

percentage of total revenues ...... 72.8% 72.7% 93.1% 80.5%

1Contribution of stock to the MasterCard Foundation

* Note that figures in the above tables may not sum due to rounding.

** Not meaningful, see “—Litigation Settlements” for more information.

57