MasterCard 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Consolidation of our customers can increase the bargaining power of our customers during new and

renewal contract negotiations.

• Uncertainty and volatility in our customers’ businesses makes our estimates of revenues, rebates and

incentives more difficult. As such, certain prepayments under customer business agreements may not be

realizable.

• Our customers may implement cost reduction initiatives that reduce or eliminate payment card

marketing or increase requests for greater incentives.

• Decreased spending by our customers for optional or enhanced services.

• Government intervention and/or investments in our customers may lead to the nationalization of those

banking institutions or otherwise alter their strategic direction away from our products.

• Tightening of credit availability could impact the ability of participating financial institutions to lend to

us under the terms of our credit facility. See “—Liquidity” for additional discussion of this committed,

unsecured, revolving credit facility.

• Our customers may default on their settlement obligations. See Note 21 (Settlement and Travelers

Cheque Risk Management) to the consolidated financial statements included in Item 8 of this Report for

further discussion of our settlement exposure.

In addition, our business is subject to regulation in many countries. Regulatory bodies may seek to impose

rules and price controls on certain aspects of our business and the payments industry. For example, see Note 20

(Legal and Regulatory Proceedings) to the consolidated financial statements included in Item 8 of this Report for

a discussion of global interchange proceedings.

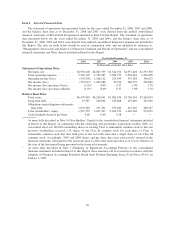

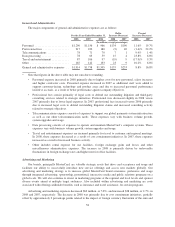

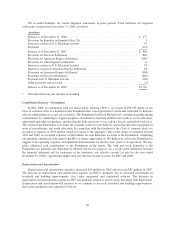

Revenues

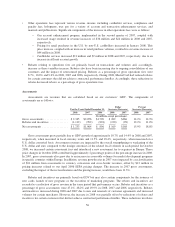

We generate revenues from the fees that we charge our customers for providing transaction processing and

other payment-related services (operations fees) and by charging assessments to our customers based on the

GDV of activity on the cards that carry our brands (assessments). GDV includes the aggregated dollar amount of

usage (purchases, cash disbursements, balance transfers and convenience checks) on MasterCard-branded cards.

Our pricing for transactions and services is complex. Each category of revenue has numerous fee components

depending on the types of transactions or services provided. We review our pricing and implement pricing

changes on an ongoing basis and expect pricing to continue to be a component of revenue growth in the future. In

addition, standard pricing varies among our regional businesses, and such pricing can be customized further for

our customers through incentive and rebate agreements. Our revenues are based upon transactional information

accumulated by our systems or reported by our customers.

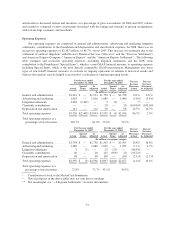

Operations fees are transaction-based and are also volume-based and are charged for facilitating the

processing and acceptance of payment transactions and information management among our customers.

MasterCard’s system for transaction processing involves four participants in addition to us: issuers (the

cardholders’ banks), acquirers (the merchants’ banks), merchants and cardholders. Operations fees are charged to

issuers, acquirers or their delegated processors for transaction processing services, specific programs to promote

MasterCard-branded card acceptance and additional services to assist our customers in managing their

businesses. The significant components of operations fees are as follows:

• Authorization occurs when a merchant requests approval for a cardholder’s transaction. We charge a fee

for routing the authorization for approval to and from the issuer or, in certain circumstances, such as

when the issuer’s systems are unavailable, for approval by us or others on behalf of the issuer in

accordance with the issuer’s instructions. Our rules, which vary across regions, establish the

circumstances under which merchants and acquirers must seek authorization of transactions. These fees

are primarily paid by issuers.

• Settlement refers to the process in which we determine the amounts due between issuers and acquirers

for payment transactions and associated fees. First, we clear a transaction by transferring the financial

52